Prior to the 1990s, investor-owned utilities (IOUs) were largely vertically integrated, housing each utility function—generation, transmission, and distribution—under one roof. This structure, and the large, centralized nature of generation resources at the time, gave rise to a planning process that involved forecasting customers’ demand, building generation to support that demand, and then planning for the necessary transmission and distribution to support energy delivery.

Utility restructuring, starting in the early 1990s, saw many states break apart vertically integrated utilities, separating the generation and wires functions. Retail and wholesale deregulation, utility disaggregation, and wholesale market participation have differed by state and region, leaving a patchwork of approaches to managing the interfaces across these asset types.

From the late 1990s to the mid-2000s, planning for this system, whether fully integrated or disaggregated, was relatively straightforward. The largest change in a generation was gas overtaking coal as a fuel source, and demand grew at a relatively steady rate. For the most part, the activities of each utility function could be modeled based on historical trends, and the need for alignment was generally limited.

The current trends of (i) integration of increasing amounts of renewables, (ii) electrification, and (iii) interdependence of the power and natural gas systems mean that regardless of a utility’s current structure, greater coordination across these functions is needed.

The energy transition has turned long-held assumptions about planning and the behavior of the electric and gas systems on their head. As policies seeking to limit greenhouse gas emissions and spur technological innovation have begun to transform the industry, these changes are having cross-cutting and complex effects on all utility functions.

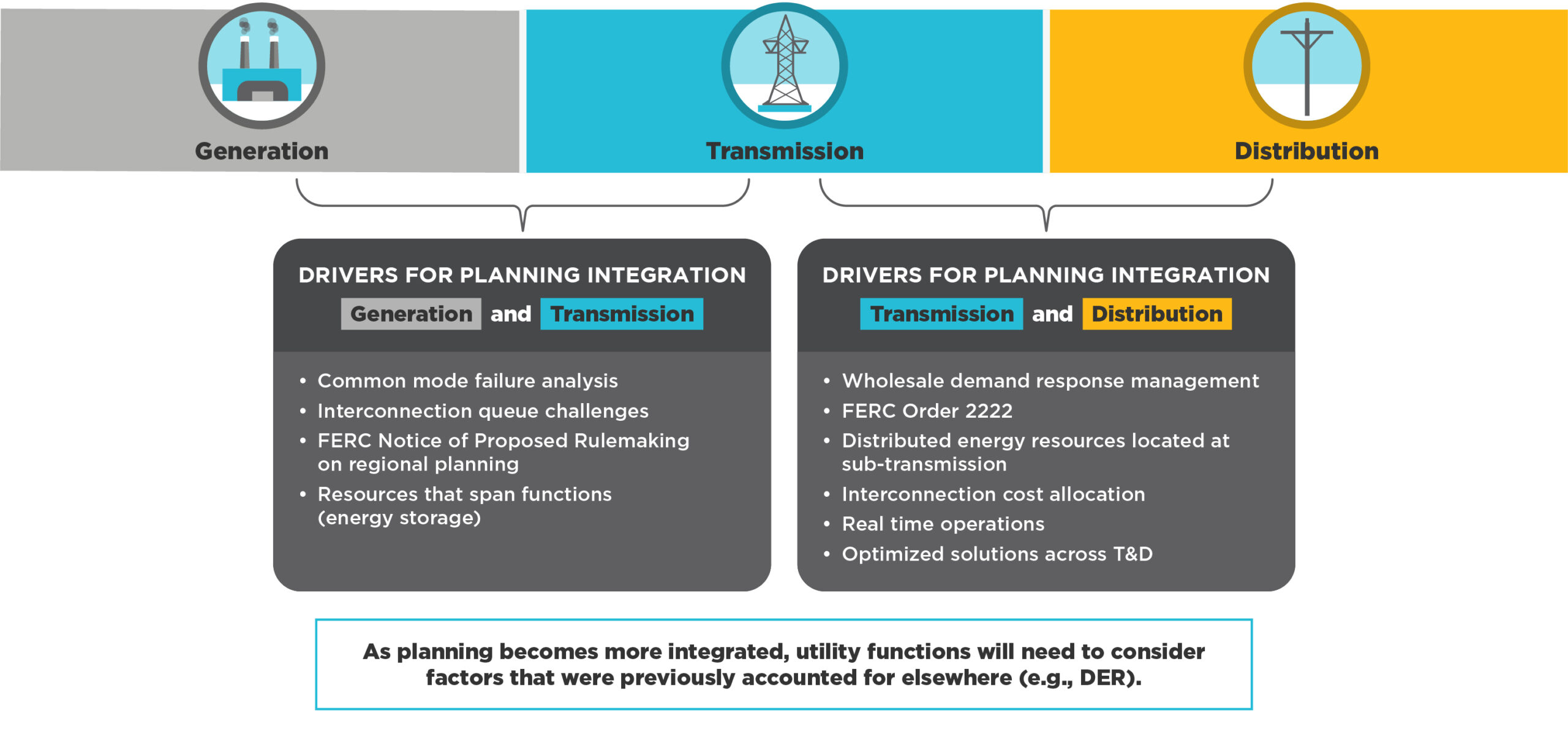

Planning within each function—generation, transmission, and distribution—has grown more complex. And the need to coordinate across these functions has also grown as the underlying assumptions that we held for a generation (steady load growth, central station generation), are changing dramatically.

In generation and transmission, intermittent renewables, which now dominate interconnection queues, operate based on weather and are having significant impacts on resource adequacy. Their smaller size and disparate locations are challenging interconnection processes across the country. Much ink has been spilled describing the backlog in today’s interconnection queues, which largely stems from planning processes that were built to suit a different generation mix.

At the distribution level, the proliferation of distributed energy resources (or DERs) will require upgrades to distribution grids, such as the ability to accept two-way flow, and data collection and analysis capabilities to support demand response. Further, the continued adoption of electric vehicles may result in rapidly increasing electricity demand and the creation of new demand centers as charging infrastructure expands.

Both demand and load on the distribution system are impacting the transmission system in ways not captured in traditional load forecasting. Demand response has the potential to make the load more flexible, such that under certain circumstances, it can serve as a resource. Aggregation of DERs, including demand response, and bidding these resources into wholesale markets introduces yet another level of complexity.

In addition to factors driving change within and among electric planning functions, there is a need for enhanced coordination between electric and gas planning processes. The challenge of wholesale electric/gas interdependence has been well-known for more than a decade; most recently highlighted by winter storms Uri and Elliott. At the gas retail level, there is an emerging need to better align demand forecast assumptions, especially as they are impacted by electrification and the projected impacts on demand on both systems.

The interdependencies across the elements of the electric system and with natural gas point to the need for greater coordination and alignment across planning processes.

Industry groups have been investigating the potential benefits of integrated system planning. In 2018, the National Association of Regulatory Utility Commissioners and the National Association of State Energy Officials created a task force to assess the need for planning integration. They dubbed the process Comprehensive Electricity Planning (CEP) and in their 2021 findings report, outlined the following objectives for a successful CEP approach:

The Electric Power Research Institute (EPRI) has launched the “Integrated Resilience and Strategic Planning Framework” which is focused on developing the tools and processes needed to plan the electric system to meet decarbonization, electrification, resiliency, and other objectives. As part of this work, EPRI recently conducted a pilot demonstration of an integrated study process in New York.

Notable examples of utilities that have begun to integrate aspects of planning include:

The extent of integration differs in each case, but common drivers include the belief that traditional planning falls short in the face of accelerating industry change and the goal of optimizing investment across systems. There is also increasing recognition of the potential for non-traditional resources and the need to properly account for their value.

The discussion of integrated system planning gives rise to myriad questions as utilities consider the adequacy of their existing processes. For example:

These considerations give rise to the gating question for utilities: What should the planning process be capable of in this evolving environment?

The answer to this question leads to another: What is the state of existing planning processes and where are they aligned to or divergent from this vision?

The answers to these questions will inform the degree to which process, organization, or data and system changes are needed. In many cases, all three will have to change.

Utilities will need to determine if existing planning tools (systems) can support their vision for integrated planning. Integration of data across these functions could provide value but will be challenging, as each currently relies on different data, different systems, and plans over different time horizons.

Organizations and people will have a steep learning curve. People will be critical to aligning planning processes, and utilities will need to both recruit and train individuals capable of performing these functions.

The pace of electrification will require more dynamic load forecasting to accommodate change. There is a substantial push for electrification in many industries, notably transportation, which has been shown to drive peaks in demand and has the potential to create large, new loads in a short time frame. Forecasting, likewise, will need to become more dynamic and inform processes that have traditionally only been done on an annual basis.

The industry is transforming and the need for utility planning to likewise evolve is becoming evident. As we balance our traditional goals of ensuring reliability and affordability with clean energy objectives, the need for a holistic, integrated view of our asset portfolios is critical.

ScottMadden is actively working with our clients to evolve utility planning and enable the clean energy transition.

View More

Sussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.