Introduction

As clean energy standards and net-zero CO2 emission commitments accelerate across the United States, utilities and other stakeholders are focusing on the transmission challenges associated with achieving these aggressive goals. Indeed, a robust long-haul high-voltage transmission backbone is the linchpin in our energy transition. Integrating large amounts of renewables (on the order of $11 trillion by 2050 per the latest analysis from BNEF) will require significant additional investments in Transmission . But identifying the right transmission investments in the right locations at the right scale can deliver benefits far exceeding the cost of such investments.

Despite the requirement for significant build-out of transmission capacity, recent trends to support a future with a high penetration of renewables suggest that the investment in Transmission during the renaissance of the 2000s and 2010s has not been sustained. Many transmission projects proceeding today are smaller in scale and scope and more local in the nature of issues addressed—suggesting a disconnect between today’s transmission grid and the macro grid of the future, which will be needed to achieve clean energy goals.

In this report, we discuss several challenges to transmission development in detail, and we offer a few examples of successes and possible viable options. The United States is transforming its energy system to address the climate crisis, and a modern, robust electric grid will be critical to ensuring the future energy system’s safety, affordability, and reliability. Investments in Transmission will be critical to enabling the increasingly ambitious clean energy goals of utilities, states, and cities.

Brief (Recent) History of Transmission Development Planning in the United States

States: Owners of Transmission Siting Authority

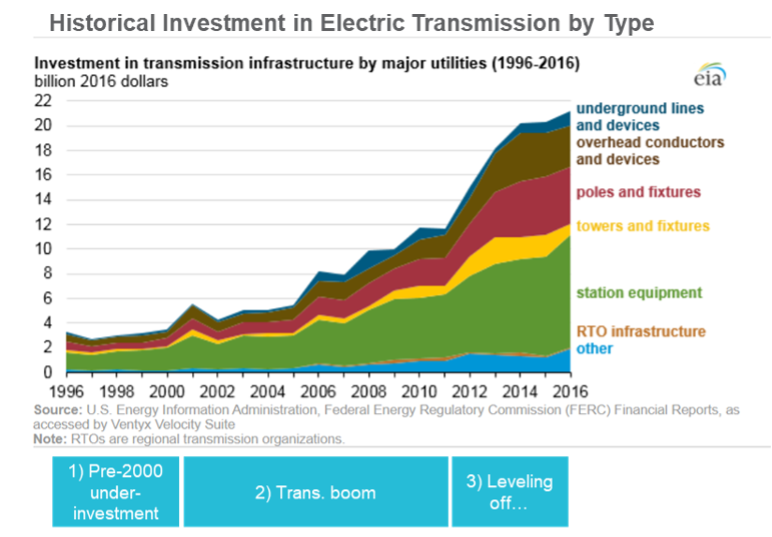

- Siting of transmission infrastructure has always been the domain of the states, but many industry stakeholders began voicing concerns in the early 2000s about state-siting challenges and comparatively lower returns for Transmission (among other factors) contributing to underinvestment in the transmission grid.

FERC Empowered: Section 216 of the Energy Policy Act of 2005 (EPAct 2005)

- FERC was granted new authorities in Section 216 of EPAct 2005 and issued a series of Orders in the mid-2000s that had the combined effect of encouraging investment in and attracting capital to Transmission over the first decade and a half of this century.

- Following FERC Order 679, and supported by higher return on equity (ROE) levels, we observed a boom in transmission investment (i.e., a five to six times increase relative to the pre-2000 level).

FERC Steps Back: Federal Backstop Authority

- Although Section 216 of EPAct 2005 contemplated developing a backstop siting authority for FERC, which would allow it to approve siting if a state “withheld approval” of any application pending a decision for more than a year, this authority has been challenged, effectively neutralizing it.

Today: Leveling Off Over the Past Two to Three Years

- While the number of projects has continued to rise over the past few years, the total dollar value of projects has gone down, highlighting the trend of utilities pursuing smaller and more local projects.

Burning Platform: Accelerating Clean Energy Commitments

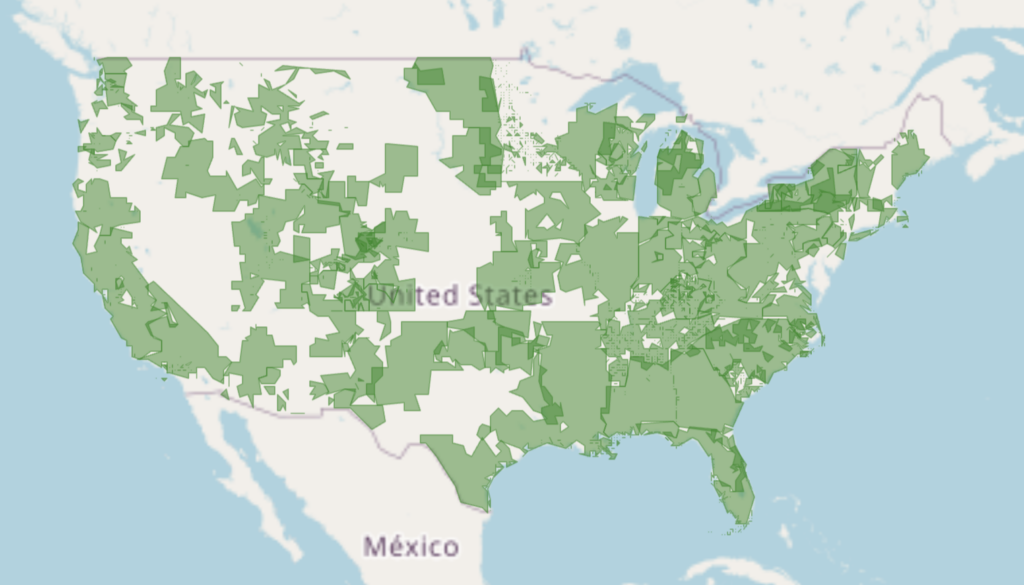

Utility clean energy commitments: Clean energy commitments continue to spread, with more utilities announcing new targets weekly. In the last three months alone, several major utilities have been added to this list, expanding to 59 the number of utilities that have announced carbon or emission reduction goals, representing 68% of all U.S. customer accounts and more than 40% of U.S. retail electricity sales.

- FirstEnergy Corporation (November 2020)

- Black Hills Corporation (November 2020)

- National Grid plc (October 2020)

- Entergy Corporation (September 2020)

- Ameren Corporation (September 2020)

Utility Service Territories with Announced Carbon or Emission-Reduction Goals

State renewable portfolio standards (RPS): The number of states with clean energy generation standards has increased markedly in the last 18 months, and many of those goals cannot be achieved with in-state renewable resources alone:

- As RPSs become ambitious and the development of renewables is mixed and geographically diverse, RPS supply-demand imbalances are potential indicators of increased needs for import and export capacity across regions.

Benefits of a larger grid footprint: A larger grid footprint or balancing area (B.A.) not only allows for the integration of various generation technologies, but it also increases overall reliability and resilience. A number of studies have pointed to the benefits of increased interregional Transmission to accommodate higher penetrations of renewable resources:

- A study of the Western Interconnection found that increasing B.A. coordination with more Transmission connecting larger geographic areas helped diversify the variability of both load and resources and created cost savings due to reserve sharing.

- More recently, the National Renewable Energy Laboratory (NREL) is nearing publication of its Interconnection Seams Study, which identifies opportunities for increased integration among the U.S. interconnections as providing opportunities for cost savings and possibly resilience by bringing low-cost resources, including remote renewables, to market.

Headwinds: Limiting Constraints on New Transmission Development Plans

Developing a transmission development plan is already challenging and time-consuming, and the evidence suggests that current policy frameworks are not enabling its development. Few interregional projects are being initiated through existing planning processes. Transmission development plans are instead being canceled or delayed, and renewable projects are dropping out of the queue due to a lack of transmission access and/or prohibitively expensive transmission requirements accruing to renewable developers.

- More than $4 billion in transmission investments were canceled or delayed in 2018 due to local or environmental opposition.

- FERC reports that 2,433 miles of Transmission have a “high probability of completion” by February 2021, compared to a total queue of 6,272 miles.

- The number of renewable projects withdrawn from interconnection queues because of grid congestion and lack of transmission access is growing. The Sustainable FERC Project’s recent analysis of MISO’s queue is telling.

- From 2016 through October 15, 2020, developers withdrew 278 wind, solar, and battery storage or hybrid solar-storage projects from the queue. These 278 clean energy projects had reached advanced stages of the interconnection process, representing nearly 35,000 MWs of capacity.

- Clean energy developers are pulling their plans from the queue, as they must pay for grid upgrade costs that are too high for a single project to bear. In MISO West, for example, high-voltage grid upgrade costs assigned to developers have raised the total cost of some projects by more than 60%.

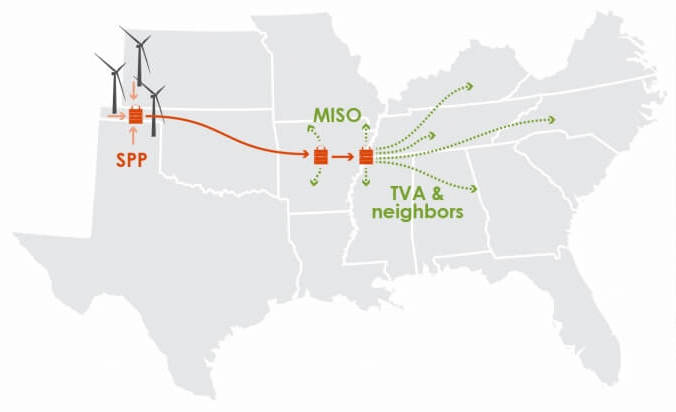

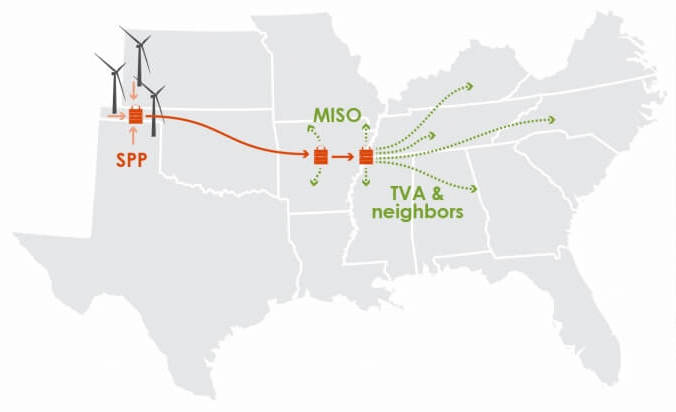

Case Study: Plains and Eastern Clean Line Project

- Clean Line Energy Partners proposed a 700-mile, $2.2- billion, 3.5 GWs high-voltage D.C. line to extend from the Oklahoma and Texas panhandles eastward across Arkansas and into Tennessee. The Plains and Eastern project would have transmitted low-cost wind power eastward. The project was proposed in 2010.

- The DOE partnered with Clean Line on the project in March 2016, specifically in using federal powers of eminent domain to obtain rights of way for the line’s route. The Trump administration, in January 2018, included the Line on its priority list for infrastructure projects.

- However, many local interests, especially in Arkansas, opposed the project.

- The DOE withdrew from its partnership in 2018, hampering further development. Clean Line has sold the Oklahoma portion of the project to NextEra Energy.

|

|

The Particular Challenge of Siting and Permitting

Siting and permitting are often cited as the most challenging aspects of developing long-haul high-voltage transmission projects.

Local Opposition

- In a white paper from the early 2000s, The National Council on Electricity Policy states the following: “Siting within a single state can be a difficult challenge: concerns about land use impacts, property values, technical considerations, jurisdiction, and the appropriate allocation of costs and benefits can delay or derail a proposed project. These issues are multiplied by the number of states the Line traverses on an interstate basis.”

- Indeed, large-capacity interregional projects are subject to federal, state, and local siting and permitting requirements before the construction of facilities can commence. Some intervenors in these processes are unsatisfied with any project for any reason, even those that might improve regional access to lower-emitting resources. Objections range from aesthetic or environmental impacts to lack of local benefits from a project to hostility to eminent domain.

- Recent evidence suggests these challenges are as daunting today as they were 20 years ago. In addition, interstate oil and gas pipeline projects have seen significant pushback in recent years, suggesting that interstate infrastructure may face challenges.

Multiple Approvals

- State authorizations for transmission development largely hinge on the determination of need, and state regulators often focus on in-state costs and benefits in approving projects; some are required to do so under state law. Determination of those costs and benefits may be subject to varying legal interpretations and modeling assumptions. There is a compounding effect with larger, longer proposed lines as increasing numbers of state governments, regulatory authorities, and individual landowners become involved. In recent years, some large projects aimed at moving large-scale renewable resources between regions have been slowed or stopped due to state or local action.

FERC’s Backstop Siting Authority

- As discussed earlier, FERC’s backstop siting authority has not been exercised. This authority could be invoked only if a proposed line was in a Department of Energy (DOE)-designated “corridor” facing transmission congestion “that adversely affects consumers.” However, this authority has been challenged—both in what constitutes “withheld approval” as well as corridor designation—effectively neutralizing it. The DOE continues to assess congestion periodically, but it has yet to identify or reaffirm any corridors.

- As evidenced by the recent cancellation of several large interstate pipeline projects, notably the Atlantic Coast Pipeline, project development is still challenging, even when FERC’s siting and eminent domain authorities are employed.

The Particular Challenge of Interregional Planning

Improved interregional planning processes will be key to getting clean, renewable energy from the areas where resources are abundant to the areas where the energy is consumed. There are a number of reasons why these improvements have been so difficult to achieve.

Balkanization

- The historically balkanized North American grid makes planning across regions difficult. Regions can have vastly different industry structures, with some dominated by vertically integrated utility systems that seek to optimize transmission investment while serving customers with their own generation resources. Other regions, specifically regional transmission owners (RTOs) and independent system operators (ISOs), have planning processes that yield periodic, multi-year transmission expansion plans with significant stakeholder involvement.

Historical Focus on Regional Transmission Development

- Through a series of orders issued in the early 2000s, FERC’s initial focus was on providing transparent and non-discriminatory access to the transmission system and encouraging transmission owners to join ISOs and RTOs. Transmission development planning processes were adapted accordingly within each region to identify projects to address the needs within each region. Planning across regions has always been more challenging, and interregional planning has not received the same amount of focus and attention as intraregional projects.

Interregional Planning Approach

- Interregional planning is not integrated multi-regional or interconnection-wide planning. It is coordination focused on stitching together regional transmission plans into “roll-up reports,” which identify any potential interregional transfer, system overload, or other issues that could impact reliability, supplementing regional reliability assessments. These efforts also inform periodic studies of interregional seams. The horizon for these reviews is five to ten years. While these coordination efforts consider long-term changes in the resource mix, they are not focused on optimizing the cost-effectiveness of public policy requirements or the deliverability of those resources. Planning for those priorities is left to the regions.

Shortcomings of Current Interregional Planning Construct

- Interregional transmission planning is in its infancy and remains incomplete. Order 1000 was intended to resolve a number of transmission development issues, including improving interregional planning. But challenges remain to achieve the investment in large-scale Transmission envisioned by FERC when it promulgated that order. The general view across the industry is that interregional planning processes are, at best, stalled and, at worst, ineffective in identifying valuable projects. As recently noted by AWEA, “FERC Order 1000 was a well-intentioned attempt to fix two of the main obstacles holding back transmission investment, barriers to planning and paying for regional and interregional Transmission. However, unintended consequences and lackluster implementation, particularly for interregional Transmission, have left all sides unhappy.”

Potential Paths Forward for Transmission Development Planning

Given the urgency with which the United States needs new transmission development and the complexity of the challenges, potential solutions may take a number of different forms in different stages from project identification to project implementation and operation.

Planning reforms: While FERC Order 1000 included provisions for improved interregional planning, the evidence to date suggests that utilities have shifted focus to smaller regional projects vs. long-haul interregional transmission projects. Some regions are attempting to remedy this:

- MISO’s Long-Range Transmission Planning Initiative

- MISO announced in August 2020 an initiative to enhance its planning process to incorporate the ongoing and significant shift in the generation portfolios of its members, as well as the significant grid and stability issues resulting from those shifts, which will require additional investments in Transmission. The last such planning effort from MISO led to the development of a portfolio of Multi-Value Projects, and MISO expects the initial results to be published in early 2021.

- Southwest Power Pool (SPP) Transmission Planning Process Review

- In September 2020, SPP created a new group to re-engineer its transmission development planning in response to growing concerns about the amount of continued transmission investment amid rapid industry changes. The Strategic and Creative Re-Engineering of Integrated Planning Team, or SCRIPT, will evaluate all transmission development planning and options to strategically re-engineer processes and provide high-level recommendations for improvements.

- MISO/SPP Seams Coordination

- SPP and MISO announced in September 2020 a year-long study to identify power grid upgrades that could alleviate long-standing interconnection challenges along the MISO/SPP seam. The joint study, slated to be formally launched in December 2021, is designed to identify mutually beneficial transmission projects and process improvements.

Market reforms: Market rules are evolving in RTOs and ISOs, as penetration of variable renewable resources increases. There are opportunities to improve alignment with and incorporation of state-level policies and goals.

- ERCOT Fast Frequency Responsive (FFR) reserve product – As renewable energy penetration increases and system inertia levels drop, primary frequency response has become a serious concern in ERCOT. The FFR product was introduced in order to help arrest frequency decline in the event of a large-generator outage.

- CAISO Imbalance Reserves (Up and Down) – In the context of enhancing its day-ahead market to accommodate real-time uncertainty and volatility, CAISO has proposed a new enhancement that will potentially allow for a larger fleet of resources to meet the difference between cleared demand and the system forecast.

Potential legislation: While the prospect of passing any substantive energy legislation is uncertain, it has been 15 years since the passage of EPAct 2005, and there may be an opportunity for new legislation in the new Congress.

- CLEAN Future Act

- The Climate Leadership and Environmental Action for our Nation’s (CLEAN) Future Act introduced in January 2020 included: the establishment of a federal clean energy target of 100% by 2050; several requirements of FERC, including initiating a rulemaking to increase the effectiveness of interregional transmission planning; and the establishment of funds for projects that improve the resiliency, performance, and efficiency of the electricity grid, among other things. Comments were provided in response to the draft bill, but its prospects remain uncertain.

- Potential Infrastructure Bill

- Some lawmakers and other stakeholders believe there may be an opportunity to find bipartisan common ground in order to pass an infrastructure bill during the Biden administration.

- As Americans for a Clean Energy Grid (ACEG), Rewiring America, and others have recently articulated that developing a new transmission infrastructure will have significant economic development potential, including as many as 25 million new jobs, particularly in rural areas of the United States. That message may resonate in the current economic climate.

- Investment Tax Credit (ITC) for Transmission

- S. Senator Martin Heinrich (D-NM), a Energy and Natural Resources Committee member, has advocated for creating an ITC for regionally significant transmission projects. Tax incentives have been effective at incentivizing support for renewables, and the expectation is that an ITC for Transmission would have a similar result.

- Legislation to Address Siting and Permitting

- Some have suggested that Democrats are currently crafting legislation to address challenges with transmission siting and permitting, which could be introduced soon.

Executive/agency action: some actions can be taken immediately without the consent of Congress.

- FERC and the DOE have existing statutory authorities to take action immediately to encourage the development of Transmission by revisiting their authorities under EPAct 2005.

- In a recent paper from the Center on Global Energy Policy at Columbia University titled “Building a New Grid without New Legislation: A Path to Revitalizing Federal Transmission Authorities,” the authors challenge the orthodoxy that new long-distance high-voltage transmission projects require new legislation.

- Among the 20 recommendations for policymakers, the paper describes how the DOE could designate new transmission corridors and partner with private transmission developers and how FERC can refine and clarify its role in permitting.

- FERC also has a proposed rulemaking on outstanding transmission ROEs, as well as a notice of inquiry on transmission incentives pending action, both of which could be advanced to increase the investment in Transmission.

Conclusion

There is no question about the fundamental need for additional investment in transmission development to support the growth of additional renewable energy resources in the United States. A robust long-haul high-voltage transmission backbone is the linchpin in our energy transition, and it is critical to ensuring the future energy system’s safety, affordability, and reliability. Integrating large amounts of renewables will require significant additional investments in Transmission, but the right investments in the right locations, at the right scale, will deliver benefits far exceeding their cost.

Despite the many challenges and complexities described here, there is cause for optimism. First, there is a significant focus on Transmission’s role in achieving clean energy objectives. In addition to the potential transmission planning outlined in this paper, the incoming Biden administration’s emphasis on infrastructure investment as a potential lever for economic stimulus may provide additional tailwinds.

We Can Help Plan your Transmission Development

Our consultants will help develop the right strategy, better tell your story to regulators and key stakeholders, and implement effective tactics to reach your vision. ScottMadden has helped our utility clients with capital asset planning, regulatory strategy, competitive transmission process development, and project management. We bring a depth of experience in T&D, grid operations, policy, and strategic planning that can help you develop a comprehensive, detailed plan tailored to your company’s needs and support the execution on your plan. We have supported 20 of the top 20 and hundreds of other large and small enterprises in the energy industry. Our industry-leading clients trust us with their most important challenges. To learn more about capital project planning, competitive transmission process development, or regulatory strategy, contact us.

Sources

- ACEG, Macrogrids in the Mainstream: An International Survey of Plans and Progress (Nov. 2020)

- ACEG, Consumer, Employment, and Environmental Benefits of Electricity Transmission Expansion in the Eastern U.S. (Oct. 2020)

- The Business Network for Offshore Wind, Offshore Wind White Paper (Oct. 2020)

- Columbia University Center on Global Energy Policy, Building a New Grid without New Legislation: A Path to Revitalizing Federal Transmission Authorities (Dec. 2020)

- FERC, Report on Barriers and Opportunities for High Voltage Transmission (June 2020)

- Institute for Sustainable Energy (Boston Univ.), The Value of Diversifying Uncertain Renewable Generation through the Transmission System (Sep. 2020)

- MISO, Long Range Transmission Planning – Preparing for the Evolving Future Grid (Aug. 2020)

- Rewiring America, Mobilizing for a Zero Carbon America: Jobs, Jobs, Jobs, and More Jobs (June 2020)

- S&P, Electric Grid Expansion May Require Congressional Action, Energy Experts Say (Oct. 2020)

View More