Over the last decade, the proliferation of renewable generation has changed how owners and operators manage the economic and operational aspects of the grid from planning through the delivery of energy. While there are some common benefits and challenges to integrating renewables, not all renewables are created equal. Going forward, utility strategies will need to consider the important differences between utility-scale and distributed renewables and how best to integrate and effectively manage these resources to maximize benefit to customers and the grid. Should states with low-renewable penetration today try to shape their path? And if so, what tools or strategies can they use to arrive at the best outcomes?

Before going further, it is useful to define what we mean by utility-scale and distributed renewables. For the purposes of this analysis, we’ll use the following definitions and attributes:

| Utility-Scale Renewables | Distributed Renewables | |

| Definition | Large (typically > 1 MW) generating systems using renewable technologies | Smaller (typically < 1 MW) generating systems using renewable technologies |

| Attributes |

|

|

While these definitions could apply to a range of renewable technologies (e.g., solar, wind, hydro, geothermal, etc.), this analysis primarily considers wind and solar, as they comprise a significant portion of new capacity additions in recent years. Further, distributed renewables are almost entirely comprised of solar.

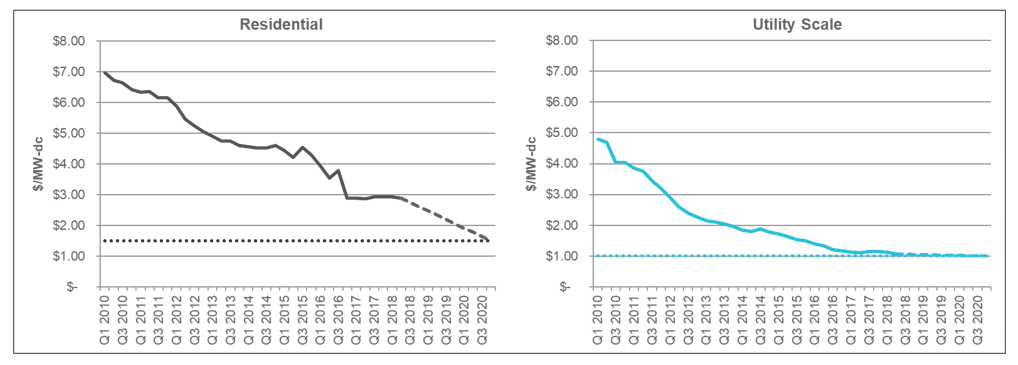

In addition to the size and point of interconnection, a key distinction between utility-scale and distributed renewable generation is the rate at which costs have declined in recent years. Given the difference in the sizes of a typical system, utility-scale renewables cost less than their distributed counterparts due to economies of scale. For solar, the Department of Energy’s SunShot initiative targeted approximately a 75% reduction from 2010 prices by 2020. For utility-scale solar, this target is $1.00/Watt-dc, and for residential (or distributed) systems, it is $1.50/Watt-dc. Since 2010, this initiative has successfully driven down prices of both types of systems; however, the rate of cost decreases for utility-scale has been faster, and only modest further reductions are needed to reach the 2020 target (see Figure 1).

Figure 1. Residential and Utility-Scale Solar Installed Cost, Actual and DOE SunShot Target

Wind has also seen significant cost reductions in recent years. In fact, according to Lazard’s latest Levelized Cost of Energy (LCoE) study, utility-scale onshore wind costs have decreased to the point where they are at or below the marginal cost of conventional generation.[1]

In parallel with the technology advances that are driving cost improvements, policy makers are taking steps to address concerns about climate change and the contribution of carbon-emitting, non-renewable generators. Through mechanisms like renewable portfolio standards (RPS), states are increasingly turning to renewable generation to meet greenhouse gas emission goals. Recent headlines tout commitments in California, Hawaii, New Jersey, New Mexico, and others to reach 100% clean electricity by mid-century.[2]

Both utility-scale and distributed renewables will help states achieve these lofty goals; however, by their nature, utility-scale systems will take bigger steps toward these targets. Additionally, the reduced administrative overhead (e.g., applications, interconnection studies, etc.) of a single utility-scale installation versus an equivalent multitude of distributed systems leads to faster achievement of clean energy policy goals of any significance.

As technology advances and policy mandates accelerate the deployment of renewables, operators will need to address the challenges associated with high penetration of renewables. The challenges with renewable generation relate to intermittency and uncertainty—when the wind doesn’t blow or the sun doesn’t shine, the generators stop producing power. This translates to challenges with forecasting, resource planning, dispatch scheduling, and maintaining grid stability and reliability. Distributed renewables can further compound these challenges by introducing a layer of complexity in managing and coordinating these activities across what could become thousands of distributed systems—if control is enabled at all.

To address these issues, operators should consider a range of technical, market, and process solutions, but the tools available vary based on the current levels and types of renewables on the system. A thorough understanding of the current state sets the stage for charting the most cost-effective path to meeting both demand for electricity and policy goals.

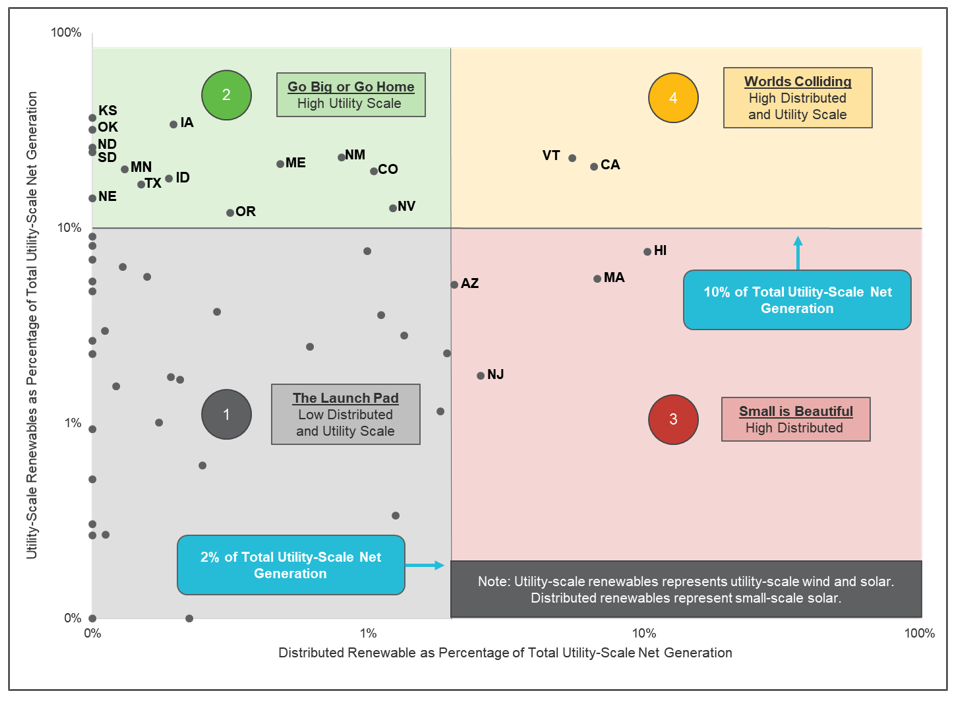

Understanding the current penetration of variable, renewable energy generation can provide valuable insights when developing renewable energy strategies for the future. ScottMadden analyzed EIA data to evaluate states currently operating with high penetrations of renewable energy. For the purpose of this analysis, we designate a state as having high-renewable penetrations if they meet one of the following criteria:

Our utility-scale renewable generation criterion focuses on utility-scale solar and wind resources because of their variable nature. Our distributed renewable generation criterion focuses on small-scale solar, because it is the most prominent distributed generation resource.

An obvious limitation of this approach is that it does account for energy imports or the wholesale markets managed by regional transmission operators. Nevertheless, we believe the state-level analysis provides an instructive view into the current penetrations of variable renewable generation.

The results (see Figure 2) are divided into four quadrants based on the current penetration of variable utility-scale and distributed renewable generation in each state.

Figure 2. Percentage of Variable Utility-Scale Renewable Generation vs. Percentage of Variable Distributed Renewable Generation by State, 2018

Key observations for each quadrant include:

The integration strategies pursued by electric utilities and grid operators will vary depending on their current state. Those in a low-penetration environment have an ability to shape the future, while those operating in a high-penetration environment, must leverage the existing renewable energy assets. The following section discusses strategies that stakeholders in each situation may pursue as they prepare for continued growth and higher penetrations of renewable energy.

If located within The Launch Pad quadrant, there is an ability to define a future state that contains high penetrations of renewable generation. Given this flexibility, our recommendation would be to drive toward the Go Big or Go Home quadrant in order to leverage the advantages of utility-scale renewables noted earlier. In particular, a critical strategy will be to:

If located within The Launch Pad quadrant, there is an ability to define a future state that contains high penetrations of renewable generation. Given this flexibility, our recommendation would be to drive toward the Go Big or Go Home quadrant in order to leverage the advantages of utility-scale renewables noted earlier. In particular, a critical strategy will be to:

The strategies are different for states that operate with high penetrations of utility-scale renewables (i.e., Go Big or Go Home and Worlds Colliding quadrants). In this situation, electric utilities will need to address the current renewable penetration and prepare for additional renewable capacity in the future. Keys to success will be redefining how renewables operate the grid while meeting customer interests. Specific strategies include:

The strategies are different for states that operate with high penetrations of utility-scale renewables (i.e., Go Big or Go Home and Worlds Colliding quadrants). In this situation, electric utilities will need to address the current renewable penetration and prepare for additional renewable capacity in the future. Keys to success will be redefining how renewables operate the grid while meeting customer interests. Specific strategies include:

States contending with high penetrations of distributed renewables (e.g., Small is Beautiful and Worlds Colliding quadrants) face significant operational hurdles. In addition to integrating variable resources, the resource may be dispersed across thousands of interconnection points rather than dozens of central generation stations. The customer experience and aggregation will be key strategies for long-term success. Specific strategies include:

States contending with high penetrations of distributed renewables (e.g., Small is Beautiful and Worlds Colliding quadrants) face significant operational hurdles. In addition to integrating variable resources, the resource may be dispersed across thousands of interconnection points rather than dozens of central generation stations. The customer experience and aggregation will be key strategies for long-term success. Specific strategies include:

The growth of renewables is shaped by many drivers, including state policy, resource availability, technology costs, geography, and customer preferences. As more states transition to high-renewable energy penetrations, utilities will need to be nuanced in their thinking about the best portfolio of products to offer their customers.

In this context, there are several criteria that could point toward leveraging utility-scale resources. First, and perhaps most importantly, thanks to their economies of scale, utility-scale resources are more cost-effective and have experienced accelerated cost reductions relative to distributed resources. Second, utility-scale resources are administratively easier to manage than an equivalent capacity of distributed resources. Finally, the market options to support utility-scale resources are more robust, mature, and easier to understand than the market options for distributed resources. For a utility that has yet to set a direction (e.g., those in The Launch Pad quadrant), these factors provide a compelling rationale to pursue a renewable energy strategy comprised predominantly of utility-scale renewables.

ScottMadden has helped our utility clients integrate both large scale renewables and DERs. We bring a depth of experience in renewables, clean energy, and grid operations that can help you develop and implement the appropriate renewable strategy for your company. Through years of regulatory experience, we can help you tell your story to the regulator and your key stakeholders, all enabling you to implement the right strategy for you.

To learn more about integrating renewables, please contact us.

[1] Lazard’s Levelized Cost of Energy Analysis, Version 12.0, published November 8, 2018, see https://www.lazard.com/perspective/levelized-cost-of-energy-and-levelized-cost-of-storage-2018/

[2] New Jersey Charts Path to 100% Clean Energy by 2050, with 3.5 GW Offshore Wind by 2030, see https://www.utilitydive.com/news/new-jersey-charts-path-to-100-clean-energy-by-2050-with-2-gw-storage-by-2/556649/

[3] Utility-scale renewable energy penetration of 10% was selected because integration complexity can increase even at this level. See MISO Renewable Integration Impact Assessment at https://www.misoenergy.org/planning/policy-studies/Renewable-integration-impact-assessment/

[4] Distributed renewable energy penetration of 2% was selected because this was historically an upper limit for net metering programs.

[5] See Xcel Energy Aims for Zero-Carbon Electricity by 2050 at https://www.xcelenergy.com/company/media_room/news_releases/xcel_energy_aims_for_zero-carbon_electricity_by_2050

View More

Sussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.