The energy industry is undergoing a period of unprecedented change. Energy companies are faced with a variety of issues that are reshaping traditional business models. Electric utilities must deal with stagnant growth, low natural gas prices, distributed generation, and emissions mandates. Both electric and gas utilities must address falling allowable returns, aging infrastructure, and rising operating costs. Merger and acquisition (M&A) has reemerged as a strategy to address these issues and relieve earnings pressures. In particular, M&A activity involving natural gas local distribution companies (LDCs) has increased over the past few years.

Since 2014, there have been seven significant transactions involving gas LDCs with a deal value of more than $45 billion.

Recent Transactions Involving Natural Gas Companies

|

Acquirer/Target |

Rationale |

Deal Value* |

Date Announced/ |

|

|

Dominion Resources/ Questar |

|

$4.4B |

Feb. 2016 |

4Q 2016 |

|

$12B |

Aug. 2015 |

Jul. 2016 |

|

|

$6.7B |

Oct. 2015 |

4Q 2016 |

|

|

Emera/ |

|

$10.4B |

Sep. 2015 |

1H 2016 |

|

Black Hills Corporation/ |

|

$1.9B |

1H 2016 |

|

|

WEC Energy/ |

|

$9.1B |

Jun. 2014 |

Jun. 2015 |

|

Spire/ |

|

$1.6B |

Sep. 2014 |

|

* Represents total transaction value, including assumed debt

Sources: SNL, PR Newswire, Financier Worldwide

While specific drivers for these deals depend on the acquiring company’s strategy and the nature of the transaction, they typically fall into the following categories:

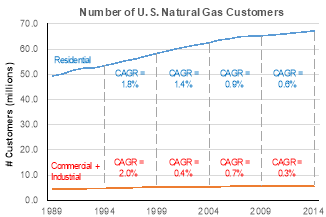

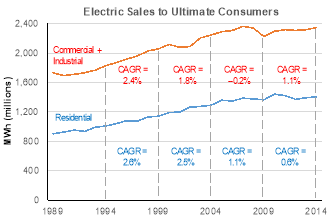

A desire for growth is one of the most common M&A drivers. Organic growth rates, in terms of gas customers and electric load, have decreased over the past several years. Between 2009 and 2014, gas customer growth was less than 1%, and growth in electric sales was similar.

Due to the slow growth rates in customers and load, M&A is becoming an alternate means to achieve earnings growth. For example, prospective buyers seeking utility-side growth may be attracted to companies with service territories in expanding markets or with capital investment opportunities. Growth in non-utility businesses can be realized through acquisitions of gas transmission or storage assets that provide long-term, predicable cash flows.

Geographic or business mix diversification is another key driver, as it mitigates risk related to earnings, customer base, local economies, cost recovery, and weather.

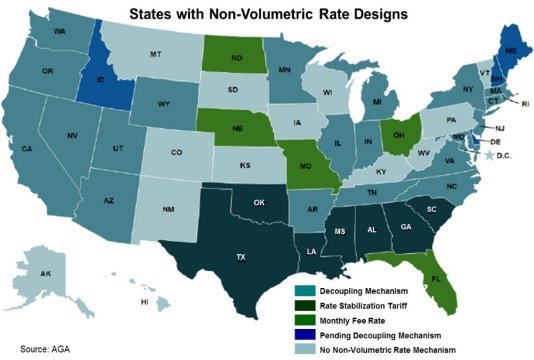

For utilities pursuing a regulated business growth strategy, geographic diversification can be especially important. State regulatory environments vary widely, and an acquisition can provide a presence in a more constructive ratemaking state. In a supportive jurisdiction, utilities can more easily develop rate mechanisms, such as non-volumetric designs, that reduce regulatory lag and increase rate base.

Synergies gained from increased scale, overlapping or adjacent service territories, and complementary expertise continue to be cited as rationale for M&A. These synergies are expected to lower operating costs. Lowering operating costs can mitigate impacts to rates for companies that desire additional capital investments.

For electric utilities, compliance with environmental regulations can be a factor. The EPA’s proposed Clean Power Plan (CPP); which places limits on air emissions from power plants, makes natural gas an attractive fuel due to its lower carbon footprint. Acquiring a company with an established natural gas infrastructure can support a shift to more gas-fired generation and help electric utilities and merchant operators meet air emission standards.

Given these factors, a key question is “what characteristics make a company an acquisition target?”

M&A activity is expected to continue due, in large part, to flat growth, low gas prices, and environmental mandates. While the recent U.S. Supreme Court stay of the CPP may slow the pace on some M&A activity, the other factors should be compelling enough for future deals to occur.

ScottMadden helps companies adapt to rapid change in the natural gas industry by providing strategic and operational improvements that deliver value and significant improvements. Our consultants have deep experience in assisting our clients with managing the gas business through a variety of services, including:

We have provided energy utility consulting support across major functions, including field operations, construction, maintenance, supply chain, customer service, gas supply, regulatory, and sales and marketing.

Sussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.