President Donald Trump, as expected, pulled the United States out of the Paris Climate Accord negotiated and agreed to in late 2015. Does it matter? Will doing so have ramifications for the U.S. coal and/or oil electric generation industries?

Key Details

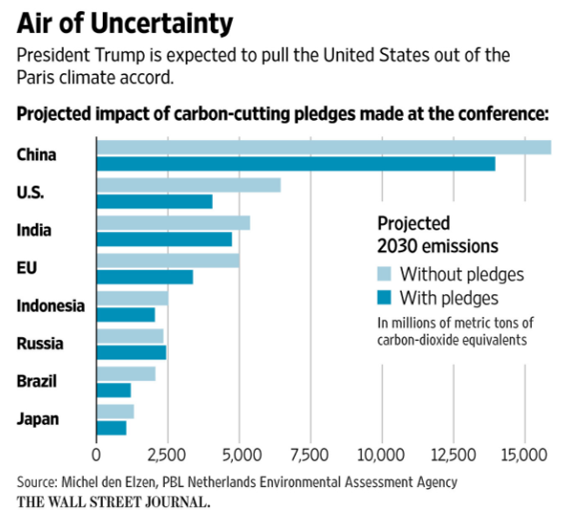

The landmark agreement was the world’s first comprehensive climate accord. It was struck by more than 190 nations in Paris with the goal of eliminating fossil fuels and carbon-emitting economic activity in the second half of the century. The accord stipulated that each country would positively address climate change by creating a voluntary plan within the context of its own domestic economic and political situations to reduce its greenhouse gas emissions (see diagram below) and channel more than $100 billion annually to poorer, developing nations to help finance their efforts. Those plans, however, were not legally enforceable—a condition some countries, including the United States, insisted upon—although the agreement did legally bind countries to create a common set of reporting standards and a review process to strengthen efforts to reduce greenhouse gas emissions in time.

Implications

Withdrawal from the Paris Accord will have little to no standalone impact on the U.S. coal and oil-based electric generation industry, mainly because its proposed regulations were voluntary and because the impacts of regulations and market environment had already left their marks.

The U.S. regulatory environment, over the past 10 years, has significantly affected the cost and competitiveness of coal and oil as fuel sources for electric generation. Key regulations include:

Adherence to these regulations was, unlike the Paris Accord, mandatory for the U.S. energy industry participants.

Energy industry market forces over the past decade have also had measurable consequences. The market forces include:

These forces, in addition to the regulations, have had serious ramifications. Some argue that collectively they made natural gas more financially appealing in the past decade for electric generation versus coal or oil. Going forward, both market forces and regulations will remain major factors with respect to the competitiveness of coal and oil for electric generation. But, in this instance, one regulation the coal and oil sectors can forget is the Paris Accord.

More Information

NPR.com: So, What Exactly Is in the Paris Accord?

CNN.com: UN Leader Asserts Leaving Paris Accord Will Harm U.S. Influence

CNBC.com: Here’s What Happens with U.S. Climate Accord Exit

ScottMadden: Fossil Power Generation Related EPA Rules 2009-2015

This report is part of ScottMadden’s Fossil Minute series. To view all featured Fossil Minutes, please click here.

Additional Contributing Author: David Mendez

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.