For several years, an energy imbalance market (EIM) has been in place in the western United States. Driven by changes in California’s generation mix and renewable portfolio standard, as well as greenhouse gas reduction targets, the Western EIM has become an attractive service for market participants. The California Independent System Operator (CAISO) designed this new market where non-ISO members could participate and share renewable energy, as well as integrate more renewable energy into the region.

For potential participants in the western market, the evolution of energy markets presents new opportunities, especially in supply cost optimization, renewables-generation integration, and transmission planning. Entities in the west, which are considering joining EIMs, will see an increased focus on building organizational capabilities for managing market participation to optimize benefits.

As the fall 2019 ScottMadden Energy Industry Update (EIU) and associated webcast replay highlight, there are a few key financial and operational benefits of participating in an imbalance market. You are now able to access lower and cheaper costs of resources, as well as more environmentally friendly resources. The operational benefit is that you are better able to balance your grid because you have access to a wider pool of resources.

The west now has two ISOs offering imbalance market services. Many western utilities plan to join the Western EIM, while a number are still weighing their options. Deciding which imbalance market to participate in is a decision that requires some evaluation criteria, based on market scope and products, governance, and other considerations.

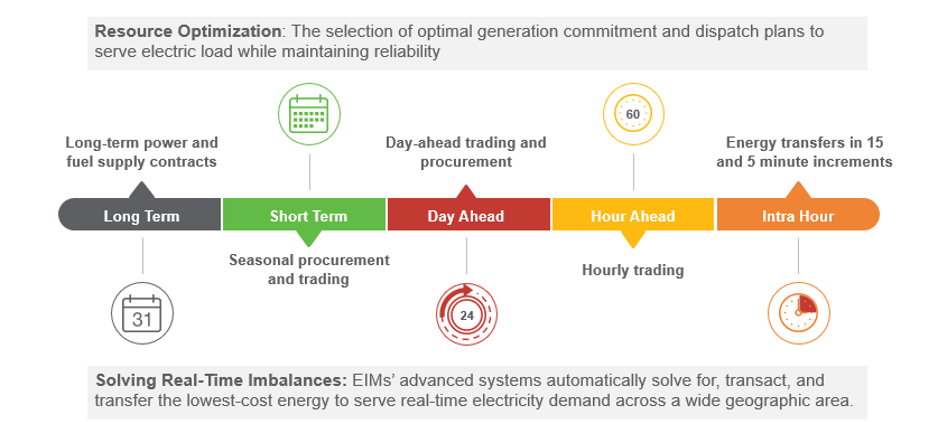

The mission of a resource optimization function at an electric utility is to coordinate the use of its own resources and engage the market to minimize the cost of generation to meet customer load. Additionally, utilities maximize the value of unused generation and capacity by using their trading function. This is done on the trading floor over various time horizons (see chart below). The EIM makes the last piece of the puzzle possible using the real-time automated exchange of electricity, because it is not possible to use phone calls or trading platforms using manual inputs within a 15-minute time frame.

A unique aspect of an imbalance market is that it delivers a broad range of benefits to participants and their stakeholders. It is uncommon to find an initiative at an electric utility that meets with general acclaim from diverse interests, such as investors, customers, environmental groups, and regulators.

There are benefits for every stakeholder in terms of finances, environment, organization, and operations.

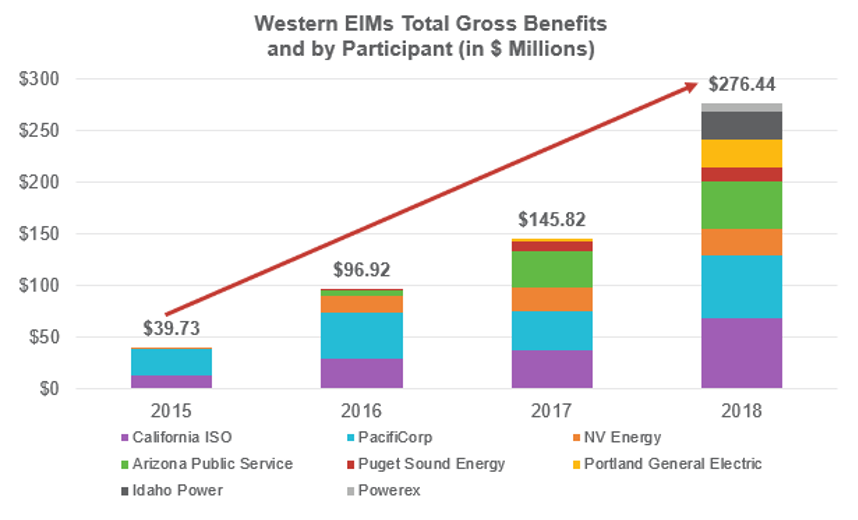

As demonstrated by the chart below, the benefits from EIM participation are driven by a number of factors, including:

There is growing interest in the Western EIM as evidenced by the latest announcements. In recent months, four organizations have announced they are joining the Western EIM, including Bonneville Power Administration (fall 2021), Tacoma Power (2022), Avista (April 2022), and Tucson Electric Power (April 2022).

Bonneville Power Administration’s interest in joining the Western EIM is a huge development, as it will unlock the Pacific Northwest region’s participation from a transmission use standpoint and because it will bring a number of closely aligned entities to the table. The Pacific Northwest is rich in hydro-electric power, which is one of the most valuable resources in a market like the EIM due to its upward and downward flexibility.

In June 2019, SPP announced to western utilities its proposal to bring cost savings and grid modernization to the west. The SPP’s WEIS will launch in 2021 with the following three committed western entities—Western Area Power Administration, Tri-State, and Basin Electric Power Cooperative. SPP will administer WEIS on a contract basis, meaning utilities do not have to be a member of SPP’s regional transmission organization (RTO) to participate. SPP plans to operate the WEIS under a Western Joint Dispatch Agreement that, among other things, guarantees participants a say in the market’s ongoing evolution.

WEIS is one of several components of SPP’s Western Energy Services family of contract-based products:

Entities that might have an interest in this market may have a transmission connection with SPP, operations and interests aligned with SPP, or past work experience with SPP.

Western utilities now have a choice for imbalance markets. Some considerations in choosing an imbalance market include governance structure, cost and ease of participation, diversity of resources, market structure and rules, and ease of entry and exit.

Governance structure determines how the market service evolves over time, who makes the rules, and how issues are addressed. |

Cost of participation is related to the implementation costs for technology, including how compensation for transmission assets are handled. |

A participant’s resource mix (especially when compared to other entities it is connected to) can make a big difference in the financial benefits from this market. |

Both of the imbalance markets have well-defined exit rules, while SPP and CAISO make entry easy. A participant should also consider the internal changes to be made (systems, cost recovery, regulatory issues) to join such a market. |

While joining either of these imbalance markets is a reversible step, it is not one that entities should take lightly for several reasons: 1. There is a significant amount of organizational changes needed to successfully participate and reap the benefits of these markets. 2. Operational changes and financial outlays are needed to join a market. There is a significant increase on the management of regulatory matters prior to joining and especially after joining. |

Expanding the market footprint by attracting non-RTO members to participate in such offerings as an EIM not only improves the integration and use of renewables, but it also adds an important operational tool for CAISO and SPP.

Western organized markets will continue to evolve to include new members and newly developed market services from CAISO and SPP. Entities should monitor regulatory impacts and changes in the underlying assumptions made when joining a market.

For participants in the western market, this evolution of energy markets presents new opportunities along with an increased focus on building organizational capabilities for managing market participation and forging regulatory relationships to maximize benefits.

Imbalance markets may represent a toehold for other reliability coordination services and markets or roles for CAISO and SPP. Each has left the door open for expansion into day-ahead markets, where larger dollar and energy volumes are transacted.

To learn more about opportunities and benefits of the western EIM, as well as key considerations for potential market participants, you can access this video or download the Fall 2019 Energy Industry Update webcast recording and presentation.

View More

Sussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.