At your company, is it smooth sailing for Financial Planning and Analysis (FP&A), the group responsible for providing strategic, real-time business intelligence? Are you confident that FP&A enables business as usual and shapes business transformation effectively? Could FP&A be leaner and more efficient?

Corporate leadership and business units demand financial agility given the pressures of today’s rapidly morphing and volatile business landscape. To compete and innovate successfully, customers unprecedentedly require actionable, accurate analyses in near real time.

Over the past two decades, financial shared services gained from standardizing, consolidating, and automating general accounting activities. Now, a more mature financial shared services offers advanced capabilities, providing new FP&A options for service delivery. By employing shared services to support work, FP&A can capitalize on shared services’ features to improve performance and add value for customers. The next wave of financial shared services emerges on the horizon.

The Water Today

FP&A’s typical structure features both corporate centralization and business unit decentralization across the globe. Embedded among the business units, FP&A unavoidably performs processes and procedures specific to each business. Time-consuming administrative research and basic calculations burden staff, leave little time for strategic analytics, and underutilize FP&A’s deep financial knowledge and advanced degrees. Business intelligence tools, if existing, may connect to disparate and conflicting data sources, causing unnecessary data cleansing and poor accuracy. The waters appear choppy.

FP&A Now

FP&A Activities

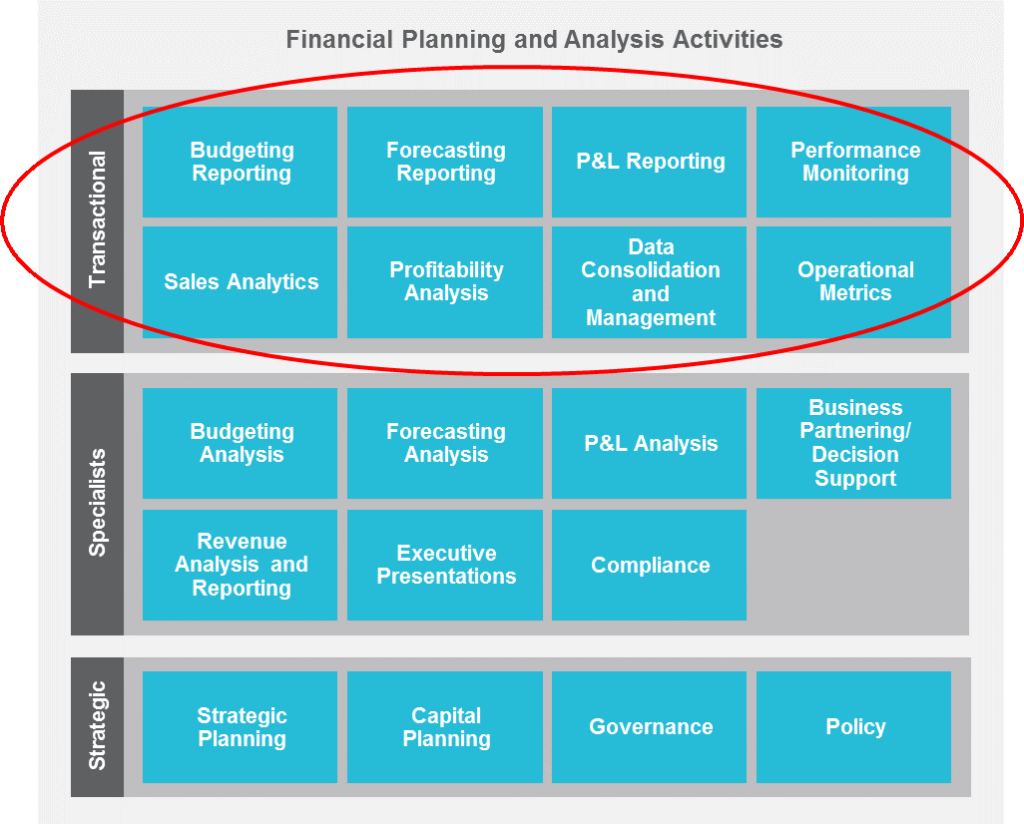

Traditionally, many executives do not consider FP&A activities as a viable option for shared services due to the customized, analytical, and judgement-based nature of the work. While not all FP&A activities should be supported by a shared services center, closer inspection reveals that perhaps some activities could be supported. Repetitive, data-intensive activities heavily reliant on global standards and centralized data appear as the most likely candidates to benefit from a consolidated environment (Figure 1). Business risks today, coupled with a long-term familiarity with shared services capabilities, challenge companies to evaluate new options for FP&A service delivery.

Figure 1. FP&A Activities that Could Be Supported by Shared Services

An opportunity exists to improve performance and provide even more value to FP&A’s corporate leadership and business unit customers through an enhanced shared services model. FP&A can meet unprecedented demand for real-time data analyses and strategic insights by changing some methods of service delivery. The next wave gains momentum as it approaches the horizon.

Shared Services Capabilities

Shared services offers distinct capabilities from which FP&A should take advantage:

Customer Benefits

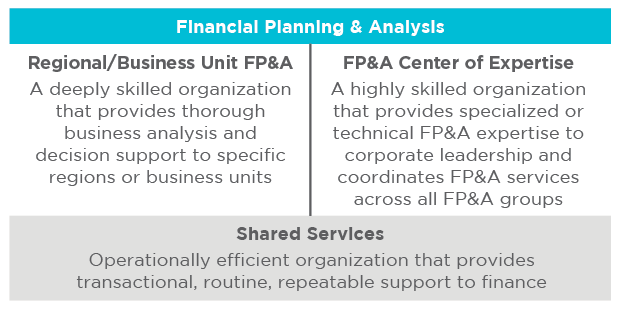

Not only will FP&A benefit from outcomes of shared services capabilities, its customers will benefit as well. Leading shared services attune to and routinely monitor internal customer needs. Service management tools inherent in a shared services organization, such as business intelligence applications, case management systems, knowledge-based tools, and customer relationship management applications, can be leveraged to improve service for FP&A customers. Changing the way FP&A delivers some services improves performance and creates additional value for corporate finance and the business units (Figure 2).

Figure 2. Creating Value for FP&A Customers

The next wave seems daunting to catch—business customers and senior finance executives are protective of local FP&A resources. They may resist centralizing FP&A work due to its perceived closeness to frontline operations. Moreover, many operational challenges loom. Don’t wipe out.

Main Considerations for Shared Services Support

Committing to support some FP&A activities through shared services raises many questions that need answering:

Figure 3. FP&A Service Delivery Model

Getting It Done Right

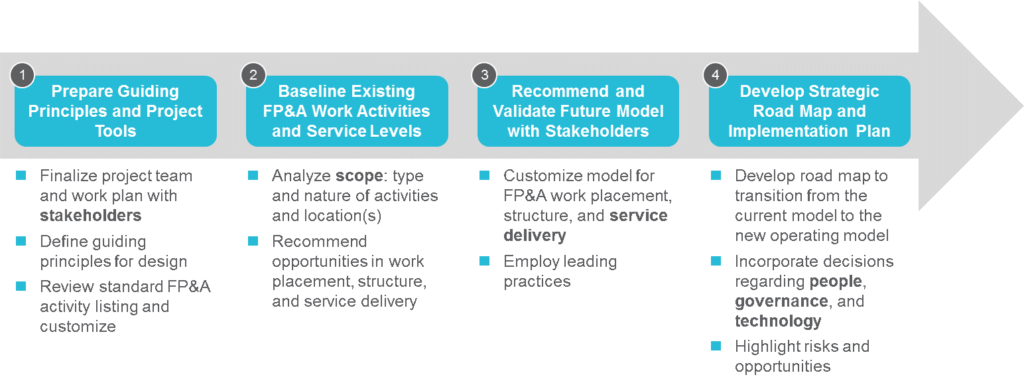

Companies trust ScottMadden to partner with them on these main considerations for expanding their business services to incorporate FP&A activities. ScottMadden developed a framework that ensures success with supporting certain FP&A activities through shared services (Figure 4).

Figure 4. ScottMadden FP&A Service Support Methodology

ScottMadden’s proven methodology instills confidence in a thorough implementation plan. We leverage our deep financial expertise and large multinational company experience to handle your financial service delivery successfully. Our collaborative and customized approach creates the right FP&A hybrid service delivery model for your company. But most importantly, our smaller, multicultural and multilingual teams work seamlessly and easily with your global employees. Team with us.

Conclusion

Early adopters challenged the status quo and proved that supporting some FP&A activities through shared services can achieve meaningful cost savings, while empowering frontline FP&A groups and improving overall performance. Trust ScottMadden to leverage the strengths of your existing operations and craft new custom solutions that improve the way you provide FP&A services to your business lines.

[1] “Financial Planning and Analysis: Influencing Corporate Performance with Stellar Processes, People, and Technology,” APQC 2015

[2] See Footnote 1

[3] “Free Resources from Transaction Processing by Upgrading FP&A Capabilities,” APQC 2015

[4] “FP&A: An Evergreen Challenge,” APQC 2015

[5] See Footnote 4

[6] See Footnote 1

[7] ScottMadden Financial Management Shared Services Benchmarking Survey, 2014

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.