CHALLENGE

A generation and transmission (G&T) electric co-op was receiving inquiries from its credit ratings agencies about its Environmental, Social, and Governance (ESG) efforts—with the most interest on the “E” as its ratings agencies indicated environmental performance has the greatest potential impact on long-term access to capital. Additionally, over the past several years, there was increasing member interest in environmental issues—specifically carbon emissions. Though the co-op had established and published carbon-emissions reduction targets and has long emphasized and established policies to ensure sound governance practices, its leaders recognized the topic of ESG is not going away; “so it is important for us to ground ourselves in the ESG issues most material to our stakeholders.”

Examples of Materiality Issues Included in Materiality Assessment

- Environmental: Carbon Emissions, Coal Ash Management, Water Management”, Wildfire Mitigation

- Social: Diversity/Equity/Inclusion, Emergency and Disaster Response, Occupational Health and Safety, Talent Attraction and Retention

- Governance: Board Independence, Business Ethics and Integrity, Compliance, Data Privacy/Cybersecurity

Identified Stakeholder Groups

- Board Members (represented customers)

- Co-op Leadership and Employees Proxies (representative from HR)

- Credit Rating Agencies

- Industry/Trade Groups

- Government and Elected Officials

PROCESS

ScottMadden conducted this materiality assessment using a multiphase approach. We began by working with co-op leadership and its board members to scope the exercise by agreeing to relevant ESG issues and aligning on stakeholder groups to be included in the assessment. We then captured inputs from stakeholders through various methods of engagement from research to surveys to interviews. The results from the assessment as well as an overview of potential next steps were summarized in a final report.

RESULTS

- Identified the ESG issues most material to each stakeholder group as well as the perceived ability of the co-op to significantly influence; results were mapped on a materiality matrix

- Summarized key observations and available applicable methodologies and positions of credit ratings agencies, ESG ratings firms, industry trade groups, and government entities relating to ESG issues and trends

- Provided leading ESG practices for organizations starting on their ESG journey, including common metrics and initiatives to address material ESG issues identified

- The co-op’s leadership team indicated the results from the assessment and the process—particularly the discussions among senior leaders and the board—would be invaluable when developing a broader ESG strategy, potential new metrics to track, and what should be communicated in future external ESG reports

Stakeholder Detail: Board Members

The directors represent the interests of the residential, commercial, and industrial customers at each of the distribution cooperatives that purchase power from the G&T co-op. Based on the interviews conducted, directors appear to recognize that governments, customers, and the culture are shifting on ESG factors, particularly with regard to Environmental factors like carbon emissions, and that there is need to pay attention to the topic.

- Governance was identified as the most important ESG category, followed by Social, then Environmental, though the gap between each ESG category was small

- The Governance and Social categories were ranked more important than as ranked by the employee group

- Reliability and resilience, affordable energy, business ethics and integrity, data privacy and cybersecurity, and operational safety were ranked as the most important ESG issues

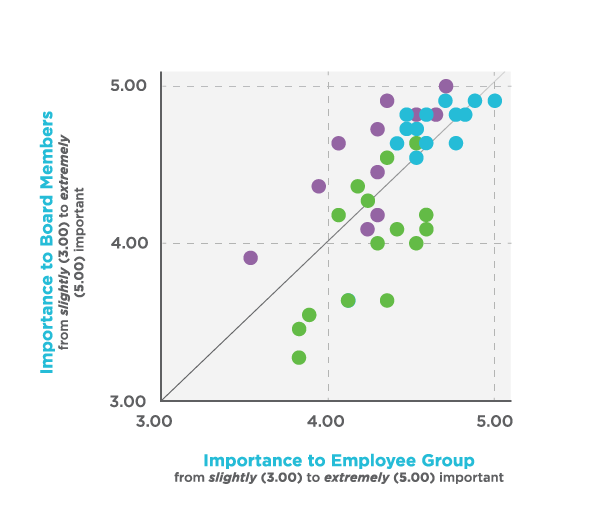

Employee Group vs. Board Member Importance

Environmental: 11 of the 16 issues received higher

importance mean scores from the employee group (4.22) than from board members (3.96)

Social: 10 of the 13 issues received higher importance mean scores from board members (4.55) than from the employee group (4.32)

Governance: 12 of the 15 issues received higher importance mean scores from board members (4.74) than from the employee group (4.56)

KEYS TO SUCCESS

- Due to numerous factors, people often have assumptions or preconceived notions about the purpose of ESG efforts

or the factors driving its adoption. Therefore, it is vital senior leaders and board members are properly educated on

the evolving ESG ecosystem and the purpose and rationale of a materiality assessment

- To ensure the client was comfortable with ScottMadden’s materiality assessment process, we ensured the project

plan and approach was clear, transparent, and grounded in data (i.e., there can be debate around the results of the

assessment, but there cannot be debate about the process used to obtain the results)

- As ESG issues and potential stakeholders are not limited to a particular area of an organization (i.e., finance, legal, marketing, operations, etc.), it is essential that leaders from across the organization participate in the process

View More