Faced with macro challenges that threaten the traditional utility business model—stagnant demand, the emergence of distributed resources, decarbonization, unpredictable energy markets, increased regulatory pressures, and lingering impacts of COVID-19—utility leaders are under pressure to simultaneously reduce cost and improve performance.

Managing these disruptions requires a rigorous planning process. Too often, however, we see responses to these issues treated as one-off projects or high-level strategy that is disconnected from day-to-day operations. Common symptoms of a broken planning process include:

In the worst cases, managers view planning as an annual waste of time. Plans stay on the shelf once completed and provide little transparency into how the business is truly run.

ScottMadden has worked with many of our utility clients to solve these challenges with gap-based business planning. We have seen organizations use this approach to translate strategy into actionable plans and achieve desired outcomes, from nuclear fleet turnarounds to top-quartile reliability performance to least-cost corporate support services. The gap closure planning process allows an organization to identify and understand the factors that contribute to gaps between current and desired performance and focuses management on defining initiatives that address these gaps. Equally important, it provides transparency into “bang for the buck” (i.e., what the enterprise expects to achieve in return for spending). Closing the gap between where a department is and where it wants to set the stage for effective business planning.

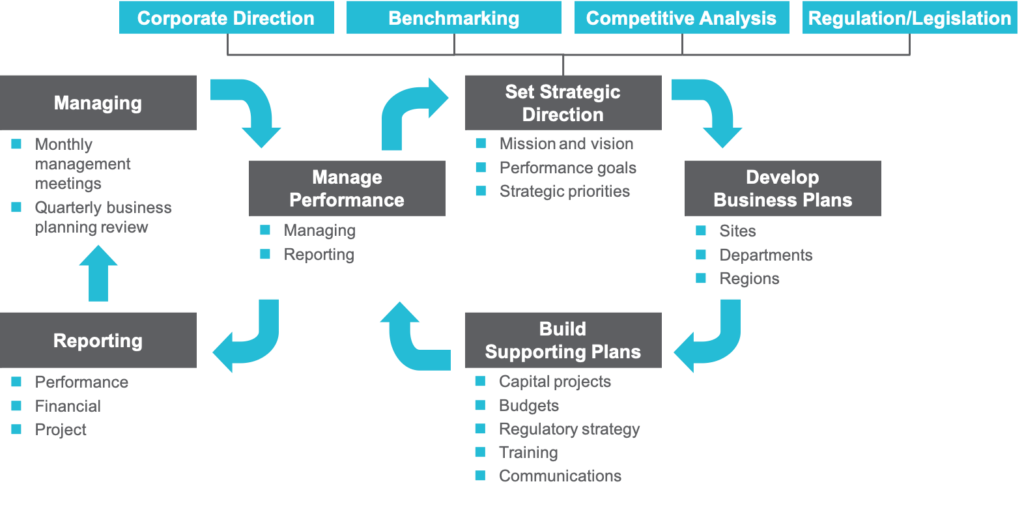

We commonly describe this process as a cycle or “a wheel” that is iterative and continuous with annual planning activities and monthly/quarterly reviews. Each time an organization repeats the cycle, it develops a more refined understanding of what data truly measures performance against goals, what actions or projects will have the greatest impact on those measures, and what accountabilities need to be in place to ensure follow-through on plans.

One question we are frequently asked is where to start or how to “get the wheel spinning.” Our experience is that the entry point is less important than dedication to the overall process. Whether the initial focus is on picking the right metrics, building robust plans, or habitually holding managers accountable for performance, the other steps in the cycle naturally follow so long as there is a commitment to the process and visible sponsorship from key leaders.

Following are the three common entry points to starting this process, common challenges faced, and how we have helped our clients overcome those challenges.

In any organization, leadership must set a clear strategic direction for where the enterprise needs to go and why. An effective strategy includes specific performance aspirations across key focus areas, such as safety, reliability, human performance, and financial management.

Where many organizations struggle is translating the vision into concrete and actionable goals. The business planning process achieves this through annual strategic planning sessions, in which senior leadership consolidates multiple inputs into a clear strategic direction that serves as the basis for that year’s planning process. Outputs of these sessions should include performance goals for the year and measures of success against those goals. All business plan initiatives should tie back to this strategy in a measurable way.

With today’s focus on decarbonization, customer centricity, and new utility business models, translating strategy into measurable results is not intuitive. In recent years, ScottMadden has worked with many of our utility clients to identify new performance indicators for measuring the effectiveness of their strategies or how new strategies will impact existing measures. Grounding new strategies in concrete data and a well-defined planning process helps to filter out platitudes, manage competing priorities, and achieve intended results.

Once a clear vision and meaningful metrics have been established, the next step is to identify gaps in performance and set targets for improvement. A common approach to target-setting is to use benchmarks.

Benchmarking allows an organization to understand current performance through rigorous, fact-based comparisons, and it can be a critical input in identifying gaps and opportunities for improvement.

While certain functions and metrics lend themselves well to benchmarking, a common challenge is a lack of available data. ScottMadden recently supported a physical security organization that was interested in incorporating metrics into its business planning process, but it found that reliable data on operating models, cost effectiveness, and key performance indicators did not exist. We helped the client assemble a peer group of utilities and solicited data on these dimensions on a give-to-get basis. The small group of peers was able to debate and eventually align on what information was most useful to managing their function, and they agreed to share it on an annual basis. As an added bonus, the participating companies gained access to other leaders in the industry who were facing similar challenges and eager to share lessons learned and best practices.

Just as important as the front-end planning process, the back-end monitoring, control, and accountability can ultimately determine the effectiveness of a business planning program. Performance management keeps the business moving in the right direction through consistent monitoring of progress, objective discussions about results, and faster recognition of what is working and adjustment to what is not.

The key here, again, is visible sponsorship and participation by senior leadership to demonstrate that performance against the plan matters, and managers will be held accountable to their commitments. The organization must be rigorous in tracking and reporting on actual performance of business plan metrics and initiatives and regularly review results in management review meetings. When performance falls short of expectations, senior leaders must step in promptly to address the challenges. Without programmatic performance management reviews and significant senior leadership involvement, business plans will quickly lose their relevance and value.

ScottMadden recently worked with an organization that was struggling to align on priorities with its HR department. Our client, the chief operating officer, established a monthly management review meeting in which all support functions would report on key initiatives and performance indicators. Initially, the COO and HR VP could not agree even on what metrics to track, but the meeting provided a regular forum to debate the veracity and usefulness of the data. Over time, through ongoing dialogue, the two sides aligned on key results that mattered, including metrics in areas where performance was lacking, such as time to hire and hiring manager satisfaction, and together they were able to work toward demonstrable improvements.

High-performing utility leaders have found gap-based business planning valuable for several reasons:

This practical and logical approach has helped leaders achieve and sustain top-tier results, and it will do the same for your organization. To access more resources and learn more about the process and what is working well with organizations similar to yours across the United States and in Canada, please contact us.

Sussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.