When implementing a global payroll delivery model, it is critical that there is sufficient time spent determining the right delivery model for the organization (fully outsourced, partially outsourced, business process as a service, or in-house), designing the future state delivery model, creating the business case to support the change, and developing a comprehensive implementation plan (including a change management plan).

The first article of the four-part series delved into the global payroll solution landscape, covering the variations in vendors and solutions, the pros and cons of the vendor/solution options, and the decision-making process for selecting the right solution for an organization. This article focuses on pre-implementation transition planning, including the organization of the project team, understanding and accommodating country-specific requirements, and determining which harmonization approach is the best fit.

This article is the second of a four-part series that examines global payroll administration, covering the solution landscape (how to determine which global payroll solution is right for the organization) and key implementation aspects ranging from pre-implementation transition planning to keeping key stakeholders informed/involved to internal implementation management.

For more in this series, please see:

International Payroll Administration – Solutions for Improving Global Service Delivery

International Payroll Administration – Implementation Management

A global payroll implementation project team is the key vehicle for driving the implementation of the new process and system. To be successful, a team must possess operational expertise and local payroll knowledge. Furthermore, the team members must be skilled in facilitation, project management and execution, and global process governance.

The number of project team resources and team members’ required skill sets will vary based on a number of factors, including:

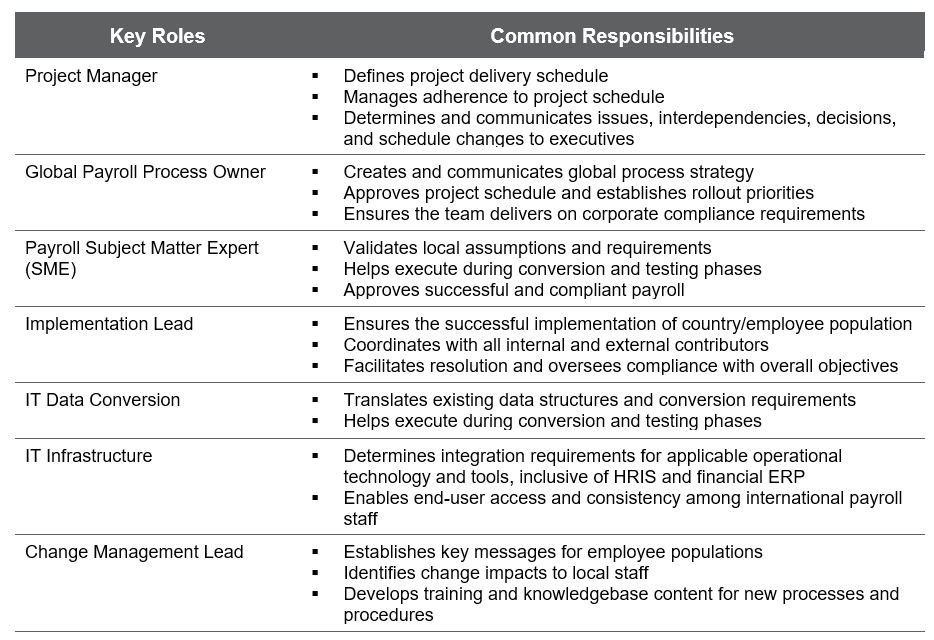

The number of project team members, as well as required team member skills, may fluctuate during the course of the project; however, there are key roles and responsibilities that are foundational to global payroll projects, as shown in Table 1 and described below.

Table 1: Key Project Roles and Responsibilities

This individual has global responsibility for the payroll process, including all related technologies. The global payroll process owner drives process consistency and effectiveness, as well as ensures timely decision making related to the process. If it is difficult to identify a single global payroll process owner, an organization may need to identify multiple process owners at a regional, country, or divisional level. However, using multiple process owners requires increased coordination to maintain global process consistency. With either approach—one global payroll process owner or multiple process owners—supporting infrastructure is required. This supporting infrastructure includes prescribed escalation pathways and an effective governance structure. This infrastructure ensures established standards can be consistently applied to bring quick resolution to local concerns, issues, or problems.

Subject matter experts (SMEs) bring payroll knowledge and expertise to the project, especially related to local process nuances and/or regulations. Country-specific requirements often have room for interpretation and are frequently changing. Local payroll process knowledge and expertise ensure the technical soundness of the solution and its fit to each country. In addition, SMEs promote the overall flow of the project. The ability of SMEs to facilitate and expedite local decision making greatly helps keep the project on track and will directly impact the project’s achievement of set milestones.

SMEs can be pulled from internal to the company, from a local payroll service provider, from an external advisor or consultant, or from any combination of these sources. The key is that the SMEs have in-depth knowledge of local payroll leading practices, rules, and regulations. In certain geographic areas, countries will have similar governmental and social programs. These geographies can often be covered with one “regional” payroll SME. For example, certain countries in the Asia-Pacific region, such as Philippines, Thailand, and Singapore, have similar administration requirements for retirement and benefits, the 13th month pay practices, and common allowances like meals and housing. Conversely, there are countries, such as Australia, with programs like superannuation that are unique and require specific local knowledge and expertise to ensure adherence to regulations and guide the implementation effort.

Implementation leads facilitate each country through the implementation of the new payroll process and are responsible for the diligent execution of the project plan and its tasks. The ideal implementation leads are able to quickly understand local process requirements, interpret problems, design solutions, facilitate resolution, and coordinate SMEs and other project resources. Implementation leads are frequently internal project resources or external consultants.

Many resources are needed to get through vital, high-volume phases such as data conversion, testing, and deployment. The implementation lead ensures that country-based and global project resources have been trained to support these activities. The implementation lead’s ability to establish clear backups and enable knowledge transfer ahead of specific project phases will minimize delays due to unforeseen circumstances and increase the likelihood of project success. The implementation lead should anticipate resources challenges and plan mitigation strategies with the project manager and global process owner.

Country-specific requirements are critical to understand for the overall success of the project. These requirements may include business readiness, statutory transition requirements, and cultural considerations. Common local factors that require attention during the pre-implementation planning phase include:

Below are examples of why providing attention to these local factors during the pre-implementation planning phase is critical to the success of the project.

As local factors are better understood, decisions around the phasing of the implementation should be made, while taking into consideration cultural and business objectives. For instance, countries or populations with manual processes and no existing service provider obligations should provide the most flexibility around implementation timing. These countries or populations can be considered for a fast-approaching pilot phase or used to fill gaps should a more complex country postpone. On the other end of the spectrum, more complex populations with multi-year service contracts in place may look appealing for deferral; however, corporate objectives such as standardization or controls may make these populations a prime choice. So, while smaller, less sophisticated countries might create a quick implementation win, the benefits of transitioning a larger operation may influence priority.

Harmonizing a company’s policies, processes, roles, and responsibilities will increase the length of a global payroll implementation effort; however, these efforts will yield significant operational benefits, reduce maintenance, increase control, and improve flexibility.

During the pre-implementation planning phase, organizations must determine if they will conduct up-front harmonization and, if so, the level of harmonization they wish to achieve. Harmonization decisions have a tremendous impact on scope, length, and cost of implementing a new payroll model. Therefore, the desire and willingness to harmonize need to be fully understood at the outset of the project.

Some companies do not have the up-front time to conduct a harmonization effort and rely on a lift-and-shift approach to expedite the transition. For these companies, if harmonization remains a goal, steps can be taken during the implementation of each country to capture information to support a future harmonization effort.

For companies that choose to proceed with harmonization, harmonization targets often include:

Challenges, including those listed below, should be anticipated and planned for during a harmonization effort.

A common question faced by transition teams is “should we lift-and-shift existing payroll intervals or harmonize everyone to monthly pay intervals?” Assuming there are no statutory or labor requirements inhibiting a change (e.g., from weekly or bi-weekly), harmonizing various international populations to a common schedule will create operational benefits but will also increase the preparation and socialization needed prior to the change.

Harmonizing pay elements or general ledger components can be disruptive to existing business processes, accounting, and reporting tasks. The required element remapping effort and localized change management will be significant and should be evaluated in order to decide whether to complete harmonization all at once or on a country-by-country basis.

A decision to harmonize these components at the outset can increase the pre-implementation planning phase by 6 to 12 months, delaying the start of transition to the new payroll model. Alternatively, an organization can define a future standard at the outset of the project and harmonize during the implementation on a country-by-country basis. This latter approach, however, lengthens each country’s implementation. Moreover, separating the standard and the harmonization frequently creates late-stage surprises when new information is discovered during a country implementation which was not uncovered during initial discovery.

When planning for the transition to a global payroll delivery model, selecting the right project team, understanding country-specific requirements, and determining the harmonization approach are all key areas of consideration. Due to unique business requirements and organization attributes, companies will all approach global payroll implementations somewhat differently; however, approaching the effort using a common methodology as laid out in this series can greatly increase the company’s success and help smooth possible implementation disruptions.

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.