The first two articles in this series, “Solutions for Improving Global Service Delivery” and “Transition Planning for a Global Payroll Solution,” provided an understanding of the worldwide payroll solution landscape and how to prepare for your transition to a global payroll model. The third article in the series, “Stakeholder Management for Implementing a Global Payroll Solution,” focused on effective stakeholder management. The final area of focus in our series is implementation management.

At ScottMadden, we have helped clients navigate the multidimensional and multicultural road toward a standardized, yet globalized, payroll solution. In this article, we will explore key questions—such as how to manage a global payroll implementation, how to work in a virtual team, and how to recognize and overcome change management obstacles—that are vital for executing some of the most difficult international payroll tasks.

This article is the fourth of a four-part series focused on the best practices in international payroll administration and implementation management.

For more in this series, please see:

International Payroll Administration – Solutions for Improving Global Service Delivery

International Payroll Administration – Transition Planning for a Global Payroll Solution

First, let’s consider best practices for a global payroll implementation.

Evaluating Current State

Evaluating Current StateAn important first step to ensure the implementation delivers on business drivers is to understand and critically evaluate current payroll operations against changes intended by the new solution. Assessing the current state should include evaluating:

As the country profile takes shape, you should work with the vendor or in-country provider to identify potential compliance issues. The local payroll manager is often the internal expert and the most informed and experienced person to consult. However, local processes have often inherited “standard company practices,” and local resources may not have the experience or support required to ensure compliance with all regulations. Highly nuanced regulations, like emissions taxes on company-paid cars and nationalized benefits, are challenging for even seasoned payroll resources.

As the country profile takes shape, you should work with the vendor or in-country provider to identify potential compliance issues. The local payroll manager is often the internal expert and the most informed and experienced person to consult. However, local processes have often inherited “standard company practices,” and local resources may not have the experience or support required to ensure compliance with all regulations. Highly nuanced regulations, like emissions taxes on company-paid cars and nationalized benefits, are challenging for even seasoned payroll resources.

To validate technical and regulatory components of payroll, you should engage HR and finance leaders, local counsel, and the in-country provider or vendor. If gaps or uncertainty emerge, you and your team will need to coordinate with these various stakeholders to address appropriate policy or delivery changes as part of the design and stabilization.

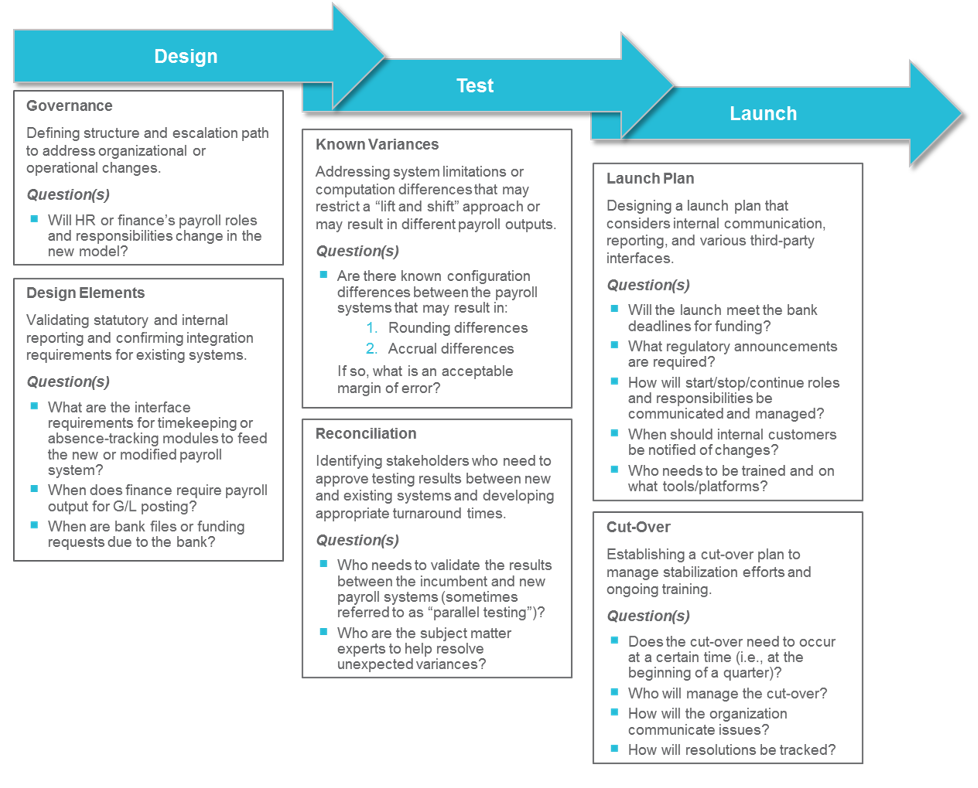

After establishing a country profile, the implementation moves into the design, testing, and launch phases. While these phases will be highly dependent on the organization’s current operations and the future state model, we can outline some general stage gates and considerations when developing a plan. Examples of such topics in a global payroll implementation are outlined in Exhibit 1.

Exhibit 1: Implementation Phases and Key Questions

Across each phase, the project team will need to consider staffing and required expertise to build and implement its tailored global payroll model. Skillsets will vary depending on the scope of the implementation. But in all implementation scenarios, the team will consist of a blend of external and internal resources to meet the global technical and logistical variances.

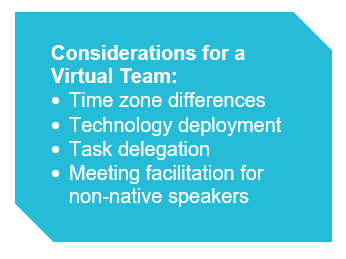

The team and stakeholders—spanning from the local or regional subject matter experts to the global process leaders—will most likely be spread across different offices, regions, and continents. To be efficient, an international implementation of this kind will require a virtual team setting. Below are some considerations for an effective remote working team.

The team and stakeholders—spanning from the local or regional subject matter experts to the global process leaders—will most likely be spread across different offices, regions, and continents. To be efficient, an international implementation of this kind will require a virtual team setting. Below are some considerations for an effective remote working team.

While advances in technology have eased virtual collaboration, virtual teams still require a different approach, not only to time zone and language barriers, but also to project management techniques and tools that better accommodate a global focus. Cultural awareness is a significant attribute for success and such sensitivities can be hard to maintain in a virtual setting. Cultural awareness has broad implications in a global implementation project; it includes considering and respecting everything from country-specific regulatory landscapes to cultural norms that may drive implementation timelines, conflict resolution, and team interaction.

Team members have many effective ways to stay connected, but not every communication channel is created equally. Consider the content or objective of the collaboration and assess which channel is most appropriate. For example, a contentious or complex issue should be handled by phone or video conference; whereas, a quick question may be best handled by instant message or email. Establish expectations for the team by clearly defining communication methods and frequency from the outset.

In addition to establishing communication protocols, you must be aware of and responsive to language barriers. Although team members may speak fluently in a second language, there is still the risk of meaning or intent being lost or misinterpreted. To that end, consider sending materials in advance of a call and providing a written recap after a call. This provides team members with time to digest, translate, and prepare to take action.

From the start, a global project manager must plan and formalize team members’ roles and task ownerships. While role and responsibility assignment is an important first step in any project, detailed task assignments and hand-off practices become even more critical in a virtual environment. These elements are important to reduce overlap or duplication of work when, for example, team members in the United States are starting their workday as their colleagues in Asia Pacific are heading home.

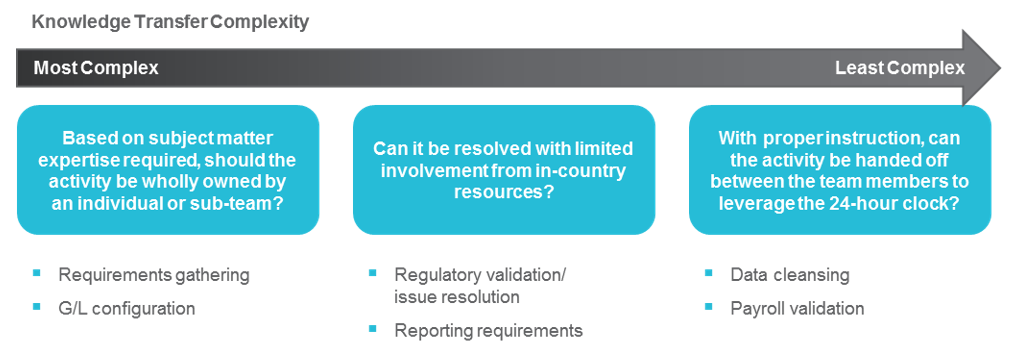

The project manager should carefully evaluate the complexity of activities to determine how best to allocate and exchange tasks. Exhibit 2 articulates a few key questions that a project manager should consider when assigning activities.

Exhibit 2: Task Assignment Considerations

The answers to these questions will help in assigning work and setting reasonable deadlines. When working across time zones, the team will need a project plan that addresses the natural lag created between when work gets done and when it can be reviewed, advanced in the process, and approved.

Time zones are not the only practical consideration to plan for when creating project deadlines and deliverables. Some further questions that the project manager should address:

Decision-making processes are deeply rooted in cultural norms, so be aware of how defined protocols might challenge different team members. They can range from the “quick decision and modify later” approaches familiar in the United States to the hierarchical approaches seen in many European countries to the highly consensus-driven approaches seen in some Asian business cultures. With many cultural norms at play, setting clear expectations for how issues will be resolved or escalated within the team or organization is critical. Be open to different decision-making approaches and avoid decision methodologies that alienate team members rather than solve common obstacles.

Every implementation presents unique challenges. One of the biggest challenges facing a global payroll implementation team at a corporate level may be demonstrating to a previously autonomous business the value of an enterprise-driven program. For example, local stakeholders, who handle the end-to-end payroll process or have made substantial customization to meet local needs, may see the implementation as happening “to them” instead of “with them.” Whether it is enterprise compliance goals, reporting standardization, or general ledger harmonization, the objectives and impact need to be articulated across the organization in a consistent manner. Furthermore, the implementation team should be prepared to address local resistance.

You and your team need to listen to and address business pain points; but to find the right solution, it is important to analyze and drill down to the root cause of the resistance. At a base level, it is only natural to face hesitation to changing what is familiar. For instance, the business may not feel that its payroll process is broken and thus not understand the effort of changing it. To break out of complacency, the implementation team should spend sufficient time training on the new model and bridging gaps between “the way it’s done today” and “the way it will be done tomorrow.” When the team is assessing resistance, it should weigh the impact of the issue and determine:

The team as a whole should agree on what will stop the process, and the local team especially needs to feel a sense of ownership and control when cutting over to the new system or model. Again, payroll is a sensitive topic and the local management team will bear the brunt of the criticism if employees receive incorrect paychecks. Before going live, the local team should have an opportunity to review the high-level outcomes from design (e.g., what does the new model look like?) and results of testing (e.g., were there significant differences in payroll calculations?). Although the local constituents will probably be heavily involved throughout the implementation, it is important for them to have a final chance to voice concerns and give the green light to proceed.

Global payroll implementations are complex, especially when the project requires virtual engagement from team members around the globe. Our goal at ScottMadden is to help you manage through the complexity, so you can fully realize the benefits of a global payroll solution.

Through our experience, we have identified three key factors to help you successfully manage your implementation: 1. Understand the business requirements, compliance needs, and plan objectives needed to drive your implementation; 2. Consider and address the virtual team environment; and 3. Embrace the global and local change management needs. Getting to the bottom of each will be critical to successfully managing your implementation and the various challenges included.

This four-part series takes a dive into the implementation of a global payroll solution. It provides you guidance on many challenges by covering the solution landscape, transition planning, stakeholder management, and international implementation management. For additional information on how to get international payroll administration right, please contact us.

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.