How do you strategize for post-merger integration before it happens? How do you ensure that you are able to accelerate the integration planning process?

Based on our experience, we believe that a successful shared services post-merger integration strategy should include four key aspects. This article takes a deep dive into the world of mergers and acquisitions and the strategy components needed for a successful integration process. In this white paper, you will learn about the steps needed to provide a clear road map to integration execution and eliminate the inclination to revisit certain directional decisions with each acquisition.

Your team has spent years flawlessly executing a comprehensive plan to implement shared services within your organization. You’ve done your research, and you’ve reorganized, standardized, optimized, and eliminated redundancy of services across your organization. Your team is well on its way to operating an organization focused on delivering high-quality transactional and advisory services to your enterprise with well-defined process ownership and delivery standards.

Your operational objectives are on target, and then it happens. Your company’s executive leadership team goes on a shopping spree, and before you know it, you are taking a step backward. You are back to having functional teams that are outside of your control, operating beyond the constructs of your shared services organization, using disparate systems and processes, and you have a new mess on your hands. Sound familiar?

In today’s business environment, mergers and acquisitions are a reality. Having a strategy for how to deal with post-merger integration before it happens is critical to the ongoing success of any shared services organization. A well-thought-out strategy will provide a clear road map for the integration and eliminate the tendency to revisit directional decisions. This will accelerate the integration planning process for your shared services organization.

A successful shared services post-merger integration strategy should include:

Well-run organizations work hard to establish global or regional standards. However, when an acquisition takes place, significant time is wasted addressing whether or not the acquired company should align these standards.

For example, if an organization has or is planning to have a single, global instance of an ERP solution, then allowing the acquired company to keep its ERP will conflict with the established strategic direction. Similarly, participation in a shared services model may be non-negotiable for legacy entities, yet conversations can ensue as to whether the acquired company should migrate to this model.

For this reason, advanced development of a comprehensive listing of non-negotiable items that support the parent company’s strategic or cultural objectives eliminates endless debate and negotiation during the integration planning process.

Some examples of common non-negotiable items include:

The knowledge of an intended acquisition is generally limited to a small group. Having shared services leadership as a part of this in-the-know group ensures the team has the opportunity for early discovery. With early access to the acquisition, the shared services team can assess the potential complexity of the integration and gain clarity on decisions made during and after the acquisition process.

The shared services leadership team can leverage the discovery phase to gain an understanding of the target company’s back-office operating model, locations, organizational structures, work scope, and technologies. More importantly, leadership can gauge how similar the target company’s business model is to the core businesses already supported by the shared services organization. The results of this assessment indicate if the acquired company can fit into the existing business process models or if new process models are required.

This early engagement also ensures that the shared services team is able to participate in and shape acquisition decisions. It is common for an executive team not to integrate an acquisition into existing operations. This is thought to foster the deal, protect the acquired company’s culture, and/or preserve their intellectual capital. This decision is often made without a focus on back-office processes, like accounting, finance, HR, and IT. It is important to have clear guidelines on what is to be incubated or not integrated. Should that incubation apply to processes supported by a shared services organization? Should it apply to the integration of employee payroll and benefits? Likely not. Failing to get clarity on these topics at the outset of due diligence can create downstream service delivery issues.

If the shared services organization is able to participate in due diligence, it can study the target company’s operations and plan for a successful integration.

ScottMadden believes the merger and acquisition process benefits from having corporate and shared services representation in the M&A governance and decision-making organization. Representatives can share what is achievable for corporate and shared services functions to support. This prevents later surprises and integration delays.

With any acquisition, there will be a variety of opinions on the level of integration, integration priorities, and preferred timing. Stakeholders may advocate for integration plans that meet their own needs without regard to the impact on other organizations. This can create chaos in a shared services organization.

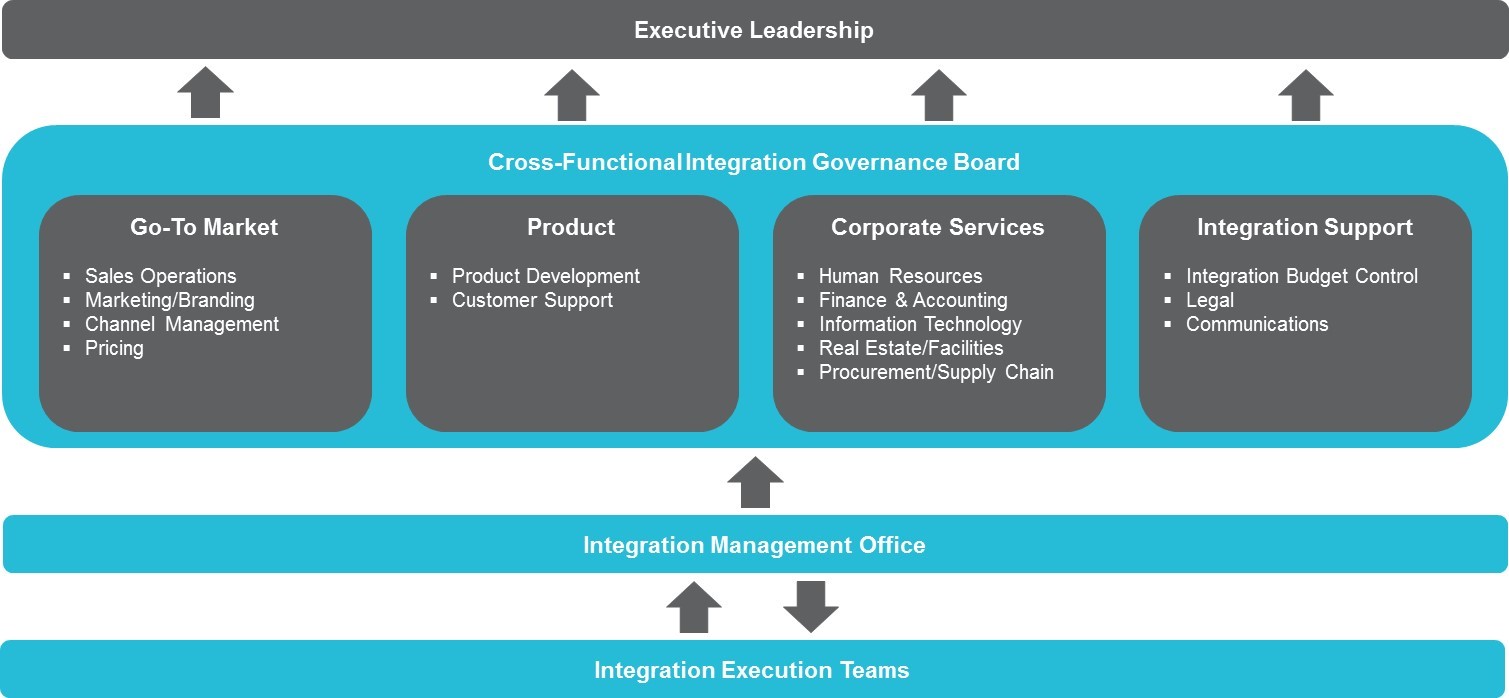

A strong governance model can prevent or limit unintended impacts. It can maintain alignment among stakeholders, avoid silo decision-making, and provide a formal process for issue escalation and resolution. An effective governance model has an integration board, comprised of cross-functional stakeholders with decision-making authority, and an integration management office to coordinate integration activities across functions. This structure facilitates alignment among organizations and drives issue resolution. Having representation from corporate and shared services organizations is integral to the success of a governance model.

The following illustration shows an example of a governance structure:

The integration governance board sets and champions the vision and objectives for the integration. Additionally, it resolves issues escalated by the integration teams. The board should convene on a regular basis during the acquisition and integration process. As a member of the integration governance board, shared services leadership can understand and influence decisions that impact its operations.

The integration management office has overall responsibility for project coordination and management, updates to the integration governance board and executive leadership team, and escalations of unresolved issues.

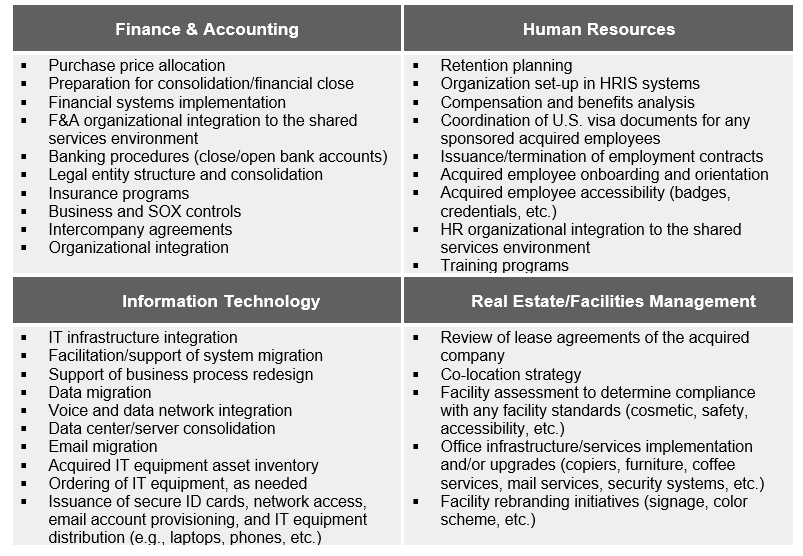

Formulating an integration playbook in advance of a merger or acquisition ensures that key activities and their ownership are clearly defined. An integration playbook includes tasks within the shared services environment, as well as tasks outside their scope, but whose integration direction and outcome have implications for the shared services organization.

While each acquisition is different, a playbook provides a starting point for developing a detailed integration plan. It is also an excellent checklist to drive integration decisions.

Playbooks can be very detailed. While not all tasks may be applicable to every acquisition, their inclusion in the playbook ensures that items are not missed or forgotten.

The following are examples of integration focus areas for corporate and shared services functions that should be considered for inclusion in a playbook. The list, however, is not all-inclusive as activities may vary from organization to organization.

The unfortunate truth for shared services practitioners is that business leaders making acquisition and integration decisions will seldom ask themselves, “How will this affect our shared services organization and the standard processes and procedures we have worked to create?” Therefore, pre-established non-negotiable items, early and proactive involvement of shared services leadership in the merger and acquisition process, a strong governance structure, and a well-thought-out execution plan or playbook will go a long way in facilitating a successful integration process. It will also ensure that the shared services organization leadership is a key player in the integration decision-making and implementation process.

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.