Nearly five years have passed since the issuance of Order No. 1000, a rule focused on transmission planning and cost allocation by transmission owning and operating public utilities. As the industry approaches this anniversary, it is time to revisit the original objectives of Order No. 1000 and assess to what extent they have been achieved.

Introduction

On July 21, 2011, the Federal Energy Regulatory Commission (FERC) issued Order No. 1000, its final rule on transmission planning and cost allocation by transmission owning and operating public utilities. Many elements of this rule were contentious and challenged in court by a number of parties. In August 2014, the U.S. Court of Appeals for the District of Columbia Circuit unanimously denied all appeals on the matter resolving any uncertainty about its legality. Transmission planning regions generally went through several iterations to reach final approval from FERC on their compliance filings for Order No. 1000 and are at various stages of implementing their processes.

The effectiveness of these processes will be tested in coming years, as the U.S. power system undergoes transformational changes driven primarily by changes in the generation resource mix toward renewables and natural gas and potential implementation of the Clean Power Plan. Given the long development times for building new transmission, highly coordinated and effective transmission planning

and construction will be critical to meeting future transmission needs in a timely and cost-effective manner.

With that in mind and as the industry approaches the five-year anniversary of the issuance of Order No. 1000, timing is appropriate to (1) revisit the original objectives of Order No. 1000 and (2) assess to what extent they have been achieved.

FERC Order No. 1000 Objectives

In Order No. 1000, FERC adopted sweeping changes to the transmission planning and cost-allocation rules established by Order No. 890. As noted by FERC, the key driver in issuing this set of rules is reliable transmission service at just and reasonable rates, consistent with Section 205 of the Federal Power Act. The final rule, along with statements from each of the FERC commissioners issued in conjunction with its release, established that the objectives of Order No. 1000 are to:

- Ensure that transmission planning processes at the regional level consider and evaluate, on a non-discriminatory basis, possible transmission alternatives and produce a transmission plan that can meet transmission needs more efficiently and cost effectively

- Ensure that the costs of transmission solutions chosen to meet regional transmission needs are allocated fairly to those who receive benefits from them

- Address interregional coordination and cost allocation to achieve the same objectives with respect to possible transmission solutions that may be located in neighboring transmission planning regions

To accomplish these objectives, FERC set forth four major components in Order No. 1000 applying to new transmission facilities:

- Regional transmission planning requirements

- Interregional transmission planning requirements

- Transmission cost-allocation principles (regional and interregional)

- Elimination of the federal right of first refusal (ROFR) for facilities subject to regional cost allocation

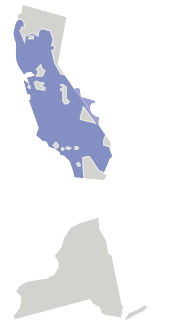

North American RTOs / ISOs

FERC ORDER NO. 1000 – ASSESSMENT OF OBJECTIVES

Objective 1 – Cost Effective and Efficient

The first objective of FERC Order No. 1000 is the establishment of processes that produce a transmission plan that can meet transmission needs more efficiently and cost effectively. The elimination of the ROFR was viewed as critical to opening up transmission planning to competitive processes. By doing so, FERC and many in the industry believed that introducing competition would lead to lower transmission costs and more innovative solutions.

With no transmission projects yet built and operating as the result of competitive processes, it will take time to assess the actual cost effectiveness of these processes. Still, as we near the five-year anniversary of the issuance of the order, it is useful to assess whether the industry has achieved competitive processes as originally intended. While opinions vary by stakeholder and region, we believe the answer to this question is a resounding “no.”

This is not to say that there have not been any indications of progress toward achieving competitive processes. Non-incumbents have been involved in competitive solicitations, even winning several, as noted in a March 2016 FERC report on transmission metrics. In addition, low-cost project bids—particularly those including cost containment mechanisms up to and including cost caps in some cases—have been successful in some competitive solicitations completed to date. This would seem to suggest that projects are becoming more cost effective; however, the projects have not yet been completed, so the final costs are not yet known.

Unfortunately, these positive developments are overshadowed by ongoing issues with the competitive processes. Noteworthy among these are the limited number of competitive opportunities, process inefficiencies, and a lack of transparency in evaluation and selection.

- Limited number of competitive opportunities: There have been a

limited number of competitive transmission solicitations to date: two in NYISO, one each in MISO and SPP, and none in ISO-NE. While PJM and CAISO have had eight and 10 solicitations, respectively, the last two CAISO planning cycles (2014–2015 and 2015–2016) had no competitive solicitations. NextEra Energy Transmission estimated in fall 2015, that roughly 5% of transmission spend had been done under competitive solicitations in the previous several years across the United States.

limited number of competitive transmission solicitations to date: two in NYISO, one each in MISO and SPP, and none in ISO-NE. While PJM and CAISO have had eight and 10 solicitations, respectively, the last two CAISO planning cycles (2014–2015 and 2015–2016) had no competitive solicitations. NextEra Energy Transmission estimated in fall 2015, that roughly 5% of transmission spend had been done under competitive solicitations in the previous several years across the United States.

- Process inefficiencies: While some transmission planning regions are behind others in terms of implementing competitive processes, some issues have already emerged. The Artificial Island project in PJM is perhaps the most notable example with challenges to the selection continuing even after the final project selection and approval by the board. PJM and other regions have already begun to apply lessons learned from this and other early competitive solicitations, yet challenges persist in and across regions as implementation continues. The result is continued hearings and litigation that is not only inefficient but results in increased proposal costs (up to $500,000 in some cases) and time for the project bidders. These issues also put at risk the timely selection, development, and operation of the transmission project.

- Lack of transparency: Incumbent utilities and independent transmission developers both have expressed frustration with a perceived lack of transparency in competitive processes. CAISO provides a selection report and lists the deciding factor(s) yet provides little, if any, additional information behind those factors. Cost is a deciding factor in many of the selections; however, no informatin is provided to compare costs across different proposals. PJM makes publically available the submitted proposals and reports cost and other key details, yet for many decisions provides limited information about why specific proposals were selected. It should be noted that transparency is more difficult in PJM than other regions. The solutions-focused nature of the PJM solicitation process leads to a wide range of project proposals, requiring more flexibility and engineering judgment in the evaluation and selection process.

Regulators in these and other regions have acknowledged the challenges of Order No. 1000 and the need to improve transparency to meet stakeholder expectations. Early indications are that SPP has applied lessons learned from other regions based on the level of transparency provided in the recommendation report for its first competitive solicitation.

These issues raise several questions regarding whether Order No. 1000 has resulted in competitive processes across the ISOs and RTOs that can facilitate the building of transmission efficiently and cost effectively, namely:

- Is there a level playing field? There are inherent challenges in creating a level playing field between incumbent utilities and non-incumbent competitors. Utilities with service territories can plan their systems and recover these costs as part of their cost of service, while non-incumbents do not have this mechanism available. Incumbents have additional inherent advantages for competitive processes in some cases, including existing rights of way, established relationships with regulators, and economies of scale for operations and maintenance of transmission assets. These factors will continue to limit the effectiveness of competitive processes even when issues related to process and transparency have been addressed.

- Are there quality risks when cost is a primary selection criterion? Low cost and cost containment have emerged as key selection criteria in the competitive solicitations completed to date. On the surface, this may suggest a trend toward cost effectiveness in planning and construction; however, a deeper look is warranted to assess the true cost to customers over the lifecycle of these assets.

First, we note that not all cost caps are created equal, as some are based only on engineering and construction costs, while others may include other lifecycle costs, such as operations and maintenance. There is also uncertainty across the industry regarding whether cost caps included in competitive proposals will be considered legally binding. In addition, the projects for which these caps have been proposed have not yet been completed, so it is not clear whether the developers will actually meet the cost cap or if they are incurring costs that will not be recoverable.

Second, as developers bid low costs (often with cost caps), there is the possibility of a “race to the bottom” in terms of quality. If developers are incented strictly to bring in low-cost bids (and in turn sacrifice quality of materials and labor), there may be long-term implications for grid reliability. This question becomes even more critical in light of the threshold requirements to become a qualified bidder in some regions.

Finally, we note the wide variance in proposed costs observed in regions where cost information is provided. This includes the first competitive solicitation in SPP, where 11 proposals were submitted with engineering and construction costs ranging from $7.4 million to $17.1 million. With such wide variation in cost estimates, it is critical for transmission planning regions to consider total lifecycle cost and quality standards in the evaluation and selection of competitive projects.

- If non-incumbents win a substantial number of projects across

different regions, would Order No. 1000 create additional complexity in operating and maintaining the grid? Though ERCOT is not subject to FERC jurisdiction, it is useful to look at its experience as a more mature market for competitive transmission. The Texas Competitive Renewable Energy Zone process awarded new transmission projects to 10 different developers, including three non-incumbents. This resulted in three new transmission control centers, one for each non-incumbent to develop the necessary infrastructure to support transmission operations. As the competitive processes mature in other regions, is it the right long-term answer for the grid to have multiple operators in one area? It is not yet clear whether the potentially more complex operations and maintenance of the grid will be justified based on the benefits of a competitive process to build, own, and operate transmission assets.

different regions, would Order No. 1000 create additional complexity in operating and maintaining the grid? Though ERCOT is not subject to FERC jurisdiction, it is useful to look at its experience as a more mature market for competitive transmission. The Texas Competitive Renewable Energy Zone process awarded new transmission projects to 10 different developers, including three non-incumbents. This resulted in three new transmission control centers, one for each non-incumbent to develop the necessary infrastructure to support transmission operations. As the competitive processes mature in other regions, is it the right long-term answer for the grid to have multiple operators in one area? It is not yet clear whether the potentially more complex operations and maintenance of the grid will be justified based on the benefits of a competitive process to build, own, and operate transmission assets.

Objective 2 – Cost Allocation Roughly Commensurate with Benefits

The second objective of Order No. 1000 focused on ensuring that the costs of transmission solutions chosen to meet regional transmission needs are allocated fairly to those who receive benefits from them. The principle behind this objective is the concept that cost allocation should be roughly commensurate with benefits, stemming in part from a 2009 court decision in

Illinois Commerce Commission vs. FERC.

The trouble is that FERC did not define “benefits” in Order No. 1000, instead leaving each transmission planning region to define benefits to serve as a basis for developing a cost-allocation methodology, ultimately reviewed and approved by FERC. In addition, the beneficiaries of system enhancements may change over time based on the evolution of the use of the grid (and different generation sources), creating additional complexity in cost allocation. Not surprisingly, this has led to divergent definitions of benefits across regions, with CAISO socializing the cost of all competitive transmission, while PJM has specific methods to quantify and allocate benefits of different types of projects. Each region has established thresholds for cost allocation (and competition) based on its view of how costs and benefits accrue to various stakeholders.

While cost allocation has certainly improved with Order No. 1000, issues persist. Two examples follow:

- Alignment of costs and benefits: MISO identifies and allocates cost to beneficiaries according to a basket of projects rather than individual projects. The cost for the basket of projects is allocated to states within MISO based on their share of overall MISO load. The issue arises for states such as Michigan, with a 10% renewable portfolio standard based entirely on Michigan-based assets, and Indiana, which has no renewable portfolio standard. Michigan pays approximately 20% of the overall cost of a basket of projects based on having 20% of overall load, but they may effectively be paying for transmission projects to integrate renewables in other states from which Michigan receives no public policy benefit.

- Socialization of costs: The Tehachapi Renewable Transmission Project is a competitive transmission project awarded by CAISO and currently under construction by Southern California Edison. The town of Chino Hills raised objections to the building of overhead transmission in their area as part of this project after poles had already been installed. A legal battle ensued, resulting in existing towers being removed and transmission assets in this area constructed underground, but the incremental cost of doing so was still socialized to all customers in the planning region.

It is worth noting that a similar problem related to the socialization of costs arose when Northeast Utilities constructed the Bethel Norwalk line in Connecticut, completed in 2006. Several towns requested undergrounding of portions of the line, which increased the total cost of the project, which was ultimately socialized across the footprint. While Order No. 1000 has begun to clarify the rules for transmission planning and cost allocation, some aspects of cost allocation will likely continue to frustrate stakeholders.

Objective 3 – Interregional Planning

When compared to implementation of the regional planning processes under Order No. 1000, interregional planning processes are in their infancy. The general view across the industry is that interregional planning processes are at best, stalled, and at worst, ineffective in identifying valuable projects. Some of this can be attributed to the level of effort that has been required of planners to implement transmission planning and cost allocation within their own regions, leaving limited time to focus on addressing issues with interregional processes.

Several of the issues that have limited the effectiveness of interregional planning include:

- Voltage level or project size restrictions: Some interregional planning

processes exclude upgrades below a specific project size or voltage level threshold, resulting in some beneficial projects not being considered. For instance, the MISO and SPP interregional planning process does not include projects under 345kV. MISO recently noted that of the 300 current interconnections between these two RTOs, only 12 are at or above 345kV.

processes exclude upgrades below a specific project size or voltage level threshold, resulting in some beneficial projects not being considered. For instance, the MISO and SPP interregional planning process does not include projects under 345kV. MISO recently noted that of the 300 current interconnections between these two RTOs, only 12 are at or above 345kV.

- Project type restrictions: Interregional planning processes allow only for the evaluation of projects that address an identical need in both regions. For example, an interregional project meeting a reliability need in MISO but not meeting a reliability need in PJM cannot be considered, even if providing some other benefit (e.g., public policy, market effectiveness) in PJM.

- Multiple benefit-to-cost ratios: As highlighted at a 2016 MISO stakeholder meeting, in some interregional planning processes, projects face a “triple hurdle” in that they have to meet an interregional benefit-to-cost ratio and meet internal benefit-to-cost standards of each of the two regions involved.

FERC itself has recognized the challenges and inefficiencies in interregional transmission planning and cost allocation. In May 2015, FERC Commissioner Philip Moeller noted, “In retrospect, I wish we had beefed up this interregional planning Order 1000. There are so many benefits to interregional transmission, but they are so hard to identify and to figure out how to get them built and how to get the cost allocation. But it’s where there are a lot of inefficiencies and I certainly hope this works.” He added, “If it doesn’t, the Commission may have to revisit it in a few years.” (

1016th Commission Meeting, FERC Transcript, May 14, 2015)

We expect interregional planning to receive more scrutiny in the coming years. Whether or not the planning regions can coordinate to improve the processes on their own, or if FERC will need to take further action to spur additional investment in interregional projects, remains to be seen.

The Path Forward

The industry is still in the early stages of Order No. 1000 implementation, and it will take some time before definitive judgments can be made about its effectiveness in meeting FERC’s stated objectives. That said, nearly five years have passed since the issuance of the order and significant challenges remain.

Very few stakeholders, on any side of the issues, argue that Order No. 1000 is an unqualified success in achieving its objectives. Ongoing issues within the industry regarding its implementation suggest that improvements are still needed and that competitive markets need to continue to evolve. To that end, several transmission planning regions are in the process of completing their initial competitive solicitations, and the results of these processes will be closely observed.

In particular, we note that SPP recently completed its first competitive solicitation, announcing the winning and alternate proposals in April 2016. Results of the first competitive process in MISO, and first two in NYISO, are likely to be announced later in the year. With competitive solicitation processes completed in these three planning regions, additional lessons learned may serve to enhance the competitive processes across the industry.

FERC has announced that it will be hosting a commissioner-led technical conference in June 2016. This event will focus on issues related to competitive transmission development processes, including but not limited to the use of cost containment provisions, the relationship of competitive transmission development to transmission incentives, and other ratemaking issues. Ideally this will lead to changes in the implementation of Order No. 1000, addressing some of the issues seen to date.

Given the confluence of technology, policy, regulatory, and market changes in the U.S. electricity sector and the long development time for transmission projects, time is of the essence to resolve the remaining issues in transmission planning, cost allocation, siting, and construction. It is critical to revisit the aspects of Order No. 1000 that have not met the intended goals in order to ensure the United States has the transmission infrastructure needed to meet the energy needs of the next 50 years.

Sources

- Transmission Planning and Cost Allocation by Transmission Owning and Operating Public Utilities; Final Rule, Federal Register, August 11, 2011

- CAISO, FERC, ISO-NE, MISO, NYISO, PJM, SPP websites

- Transmission Metrics: Initial Results, FERC Staff Report, March 2016

- “Competitive Transmission Update,” Presentation to Competitive Transmission Forum 2015, Christopher Sherman, New Hampshire Transmission, October 26, 2015

- Industry Expert Panel Recommendation Report, RFP-000001 (Walkemeyer – North Liberal 115kV), SPP, April 12, 2016

- A WIRES Report: Toward More Effective Transmission Planning, The Brattle Group, April 2015

- “FERC Order 1000: A Solution Looking for a Problem?” Presentation to Harvard Electricity Policy Group, Bruce Edelston, Energy Policy Group LLC, December 10, 2015

- 1016th Commission Meeting, FERC Transcript, May 14, 2015

- “MISO, Stakeholders: Reforms Needed, but ‘Seamless’ Seam an Illusion,” Amanda Durish Cook, RTOInsider.com, March 28, 2016