The outcomes of a business case can mean a make-or-break decision for moving forward with shared services. It is critical that you create a business case to understand your costs and savings opportunities and be able to demonstrate the benefits of this significant change to your organization. Additionally, the business case creates the baseline from which to measure your progress once you go live with the new model.

ScottMadden recently updated our analysis of shared services business cases we helped develop for our clients in the areas of finance and accounting (F&A), human resources (HR), and multifunction shared services. These business cases spanned a wide range of industries, including:

We looked for typical returns and staff reductions, as well as ranges for implementation costs and significant savings opportunities. The latest results of this analysis are presented in this report.

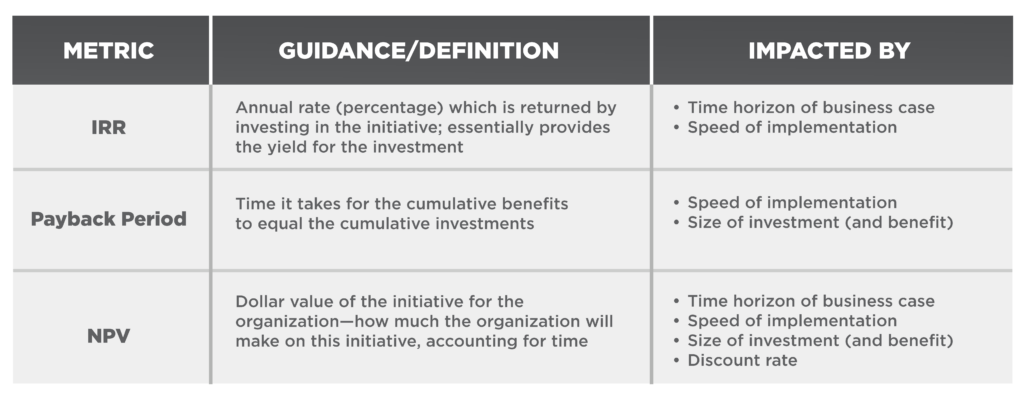

Business cases will typically have several financial metrics that are used as reference points for comparison to other cases or internal projects, as well as performance “takeaways” for the business. We focus primarily on internal rate of return (IRR) and payback period in this summary, as comparing net present value (NPV) across organizations can be more challenging.

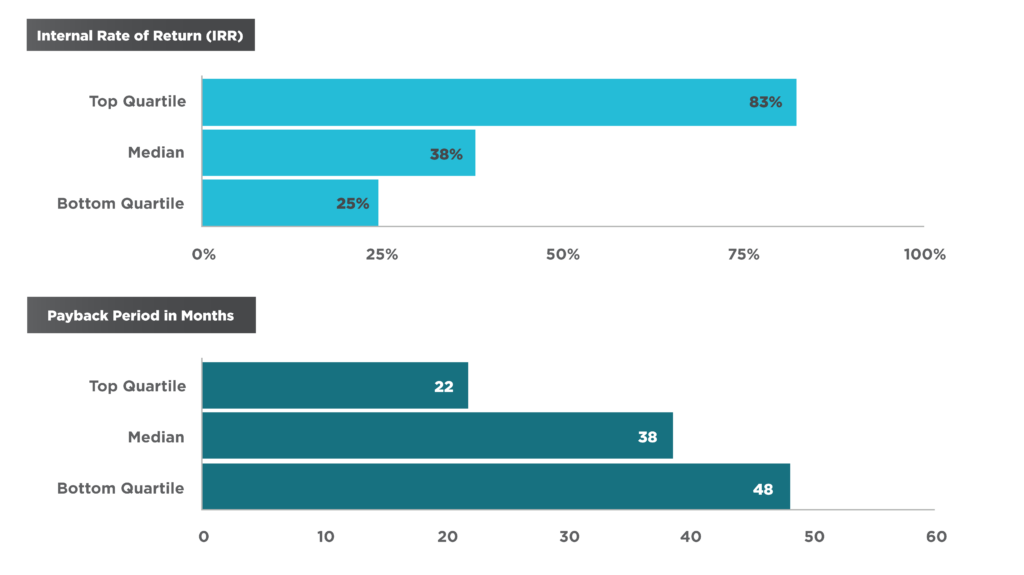

Across shared services business cases, we found that the median IRR is 38%, and the median payback period was about three years. Our data indicated that some companies can achieve higher returns and pay off investments more quickly, but even the bottom quartile results showed positive outcomes for the business.

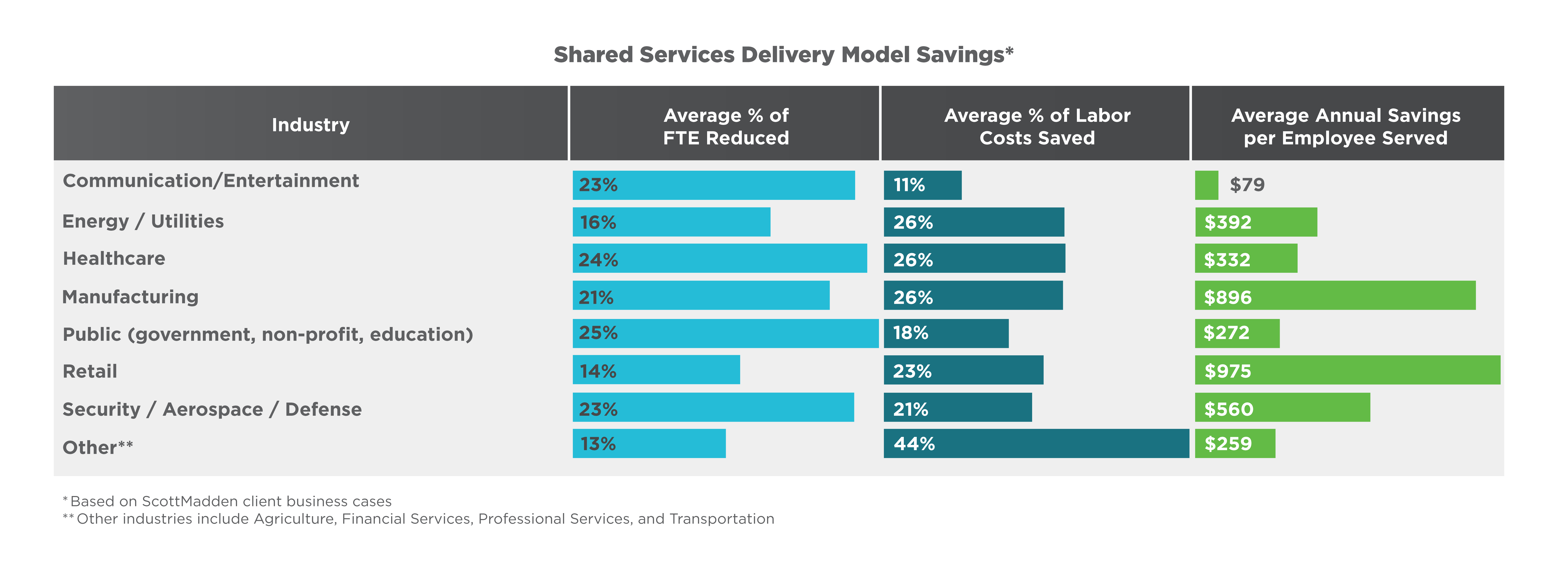

While the results varied, our data indicated that the industries showing the most potential for cost reduction with a shared services model included the public sector (government, non-profit, education), retail, manufacturing, and healthcare. Business cases developed for clients in these industries resulted in a higher average annual savings per employee served with a shared services model. In the public sector, the average percentage of labor costs saved relative to full-time equivalent (FTE) reduction was much lower. This may be caused by the fact that many eliminated positions in this sector were lower cost positions performing administrative or transactional work. When looking at FTE reductions, the life sciences and pharmaceutical industry also showed vast potential.

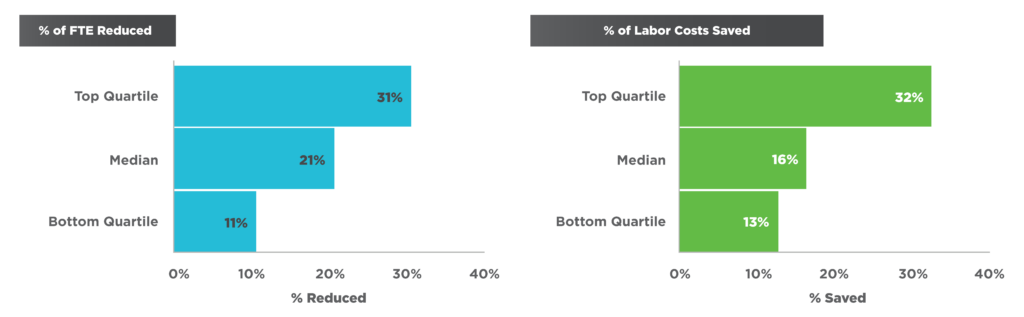

In our experience, labor savings almost always exceeded non-labor savings and represented the biggest opportunity for return when moving to a shared services model. We looked at labor savings in terms of both the percent of headcount reduced and the percent of labor costs saved.

A lower savings percentage for labor costs versus headcount was understandable given that many of the positions that were typically eliminated were lower cost positions performing administrative or transactional work.

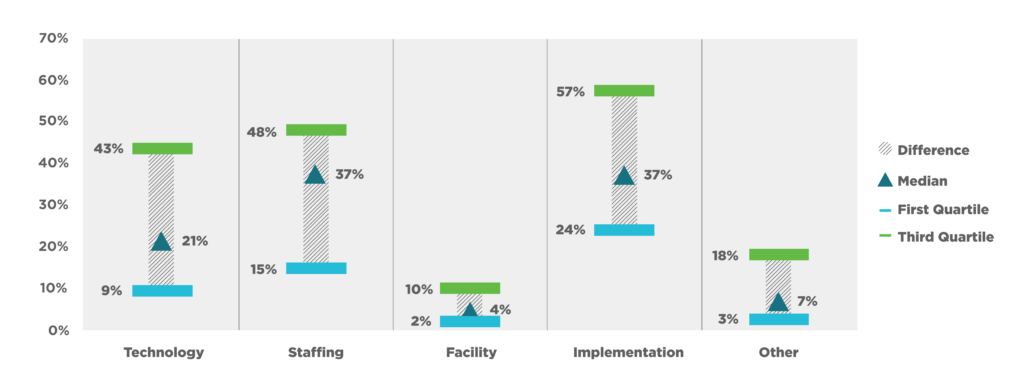

We examined various categories of implementation costs across the business cases to determine typical ranges and understand the most significant costs. These categories included technology, staffing, facility, implementation, and other.

Implementation and staffing represented the largest component of implementation costs, followed by technology and facility. Implementation included costs for internal and external resources supporting the implementation, including fully or partially dedicated headcount, consulting support, and other vendor support. Staffing included costs for severance, retention, relocation, recruiting, and hiring.

The ranges shown between the first and third quartiles indicated high variability in implementation, staffing, and technology.

A variety of additional implementation costs existed for some of the business cases, including marketing, communications, and other administrative costs.

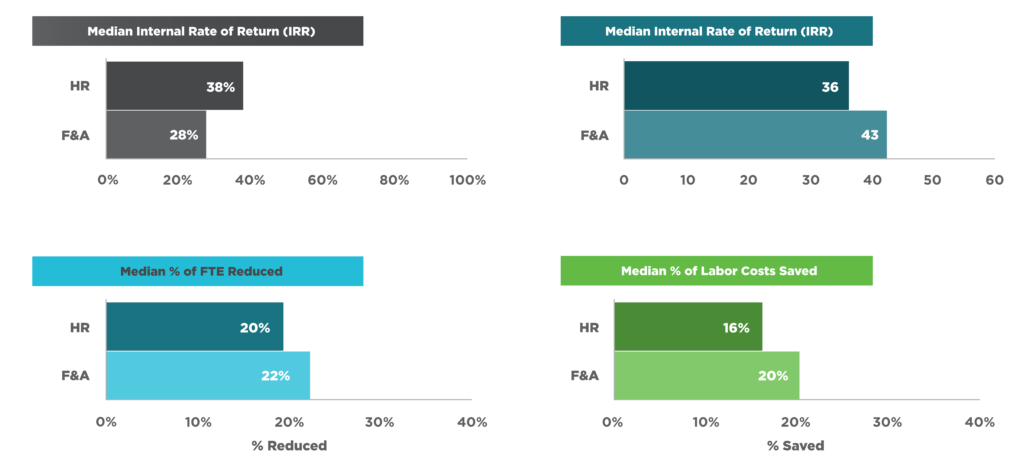

To determine differences in savings opportunities across functional areas, we examined shared services business case metrics for HR compared to finance and accounting (F&A). These two functions represented the most common areas in the business case analysis. Overall, we saw little difference in the results between business cases for HR and F&A functions, indicating a shared services model can provide similar benefits regardless of the functional scope.

The HR business cases showed a slightly higher median IRR and shorter payback period, while F&A cases showed a slightly higher median percent of headcount reduced, as well as a higher median percent of labor costs saved.

If you are developing a business case for shared services, keeping in mind a few lessons can help ensure it is successful.

In summary, the returns available through a shared services model represent a significant cost-savings opportunity for companies. Labor savings resulting from the new model show the most significant cost-savings opportunity. These savings are typically achieved through better alignment of staff resources to work performed and increased leverage of technology to automate processes. Implementation costs vary across organizations, but they typically include technology, staffing, facilities, implementation support, and others (e.g., marketing, communications, and administrative costs). Conducting a thorough business case analysis is critical for gaining support for a shared services model and ultimately impacts the success of the organization.

To learn more about ScottMadden’s approach for shared services and business case development, contact us.

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.