Major Fortune 500 companies have been using shared services as an efficient, effective means of providing corporate support services to subordinate businesses since the 1980s. Major companies like British Petroleum, Ford, General Electric, and others have used the shared services model to reduce costs, improve service, improve compliance, and/or streamline processes with great success. A survey conducted by the Shared Services and Outsourcing Network (SSON) in conjunction with Hackett reports that at least 30 percent of companies enjoy greater than 20 percent cost savings by implementing this model. Some companies have reported much higher savings.

In a fully developed model, shared services are operated as a business unit providing services to other business units in a corporation. Chargeback models with service level agreements (SLAs) are used to fund operations. As the shared services organization matures, it is natural for leaders to consider spinning off the organization into its own entity—separate from the parent company—that then provides services to both the parent company and other external customers. In another scenario, companies have sold the shared services operation to outsourcing companies that then provide the same services back to the parent corporation. However, for both of these scenarios, independence does not necessarily infer complete financial separation from the parent company. Parent companies often strive to maintain substantial ownership to ensure stringent controls over data and services provided.

In this paper, we will examine the considerations, advantages, disadvantages, and risks of spinning off a shared services organization to provide services to its parent company.

Divesting or spinning off shared services operations can be very challenging for a company. So, why do some companies consider it? Typically, companies have streamlined and improved shared services operations to the point where further improvement, other than adding more customers, is extremely difficult. If the parent corporation is not planning on expanding operations, the only way to add more customers is to go to the external market. However, spinning off from a parent company can be quite a large project—there are financial, legal, and tax considerations, as well as the need for defining the strategic vision and determining the future culture for the new entity.

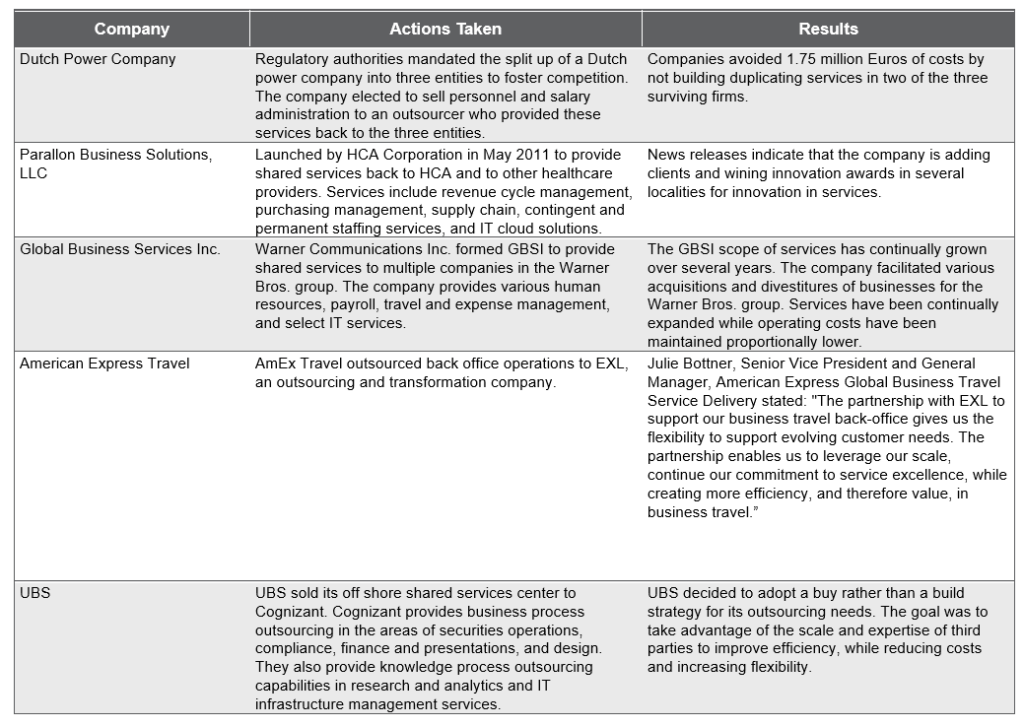

The two most prevalent scenarios seen are 1) companies spinning off shared services to provide services back to their business units or 2) companies that have sold shared services operations to business process outsourcers. The following are examples of both approaches:

organizational structures for an internal shared services organization and an independent shared services organization need not be significantly different. Independent shared services organizations must be able to provide the same services to its original parent that it provides to other companies. The key is having robust and proven infrastructure to operate as an independent business.

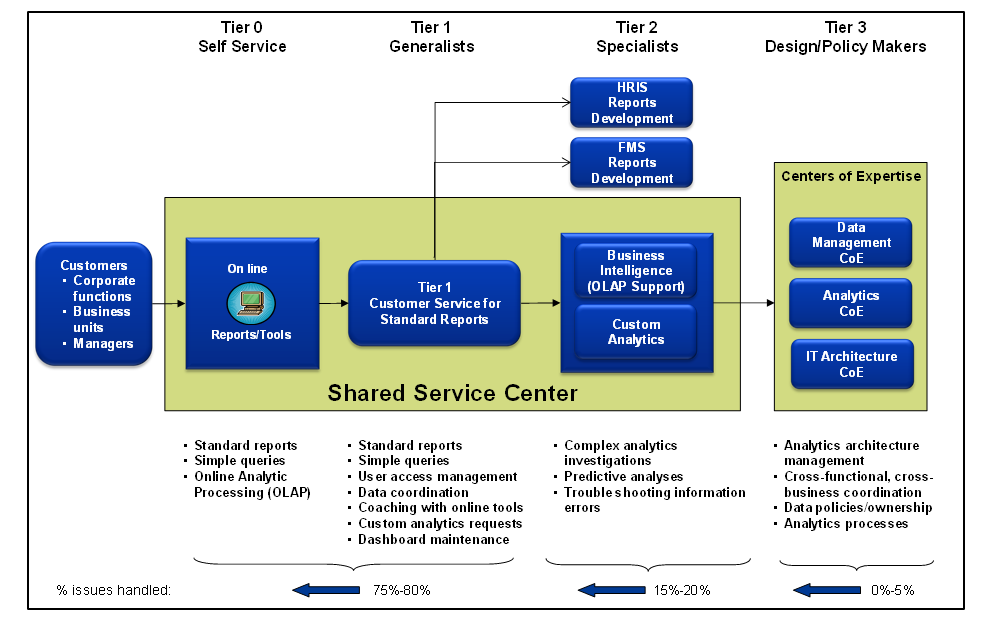

The following figures illustrate high-level differences in organizational structure. Figure 1, Classic Reporting and Service Model for Internal Shared Services, illustrates a common structure. Figure 2, Reporting and Service Model for Independent Shared Services Serving All Entities, illustrates the reporting and operating relationships when shared services are split off from the parent.

Figure 1: Classic Reporting and Service Model for Internal Shared Services

Figure 2: Reporting and Service Model for Independent Shared Services

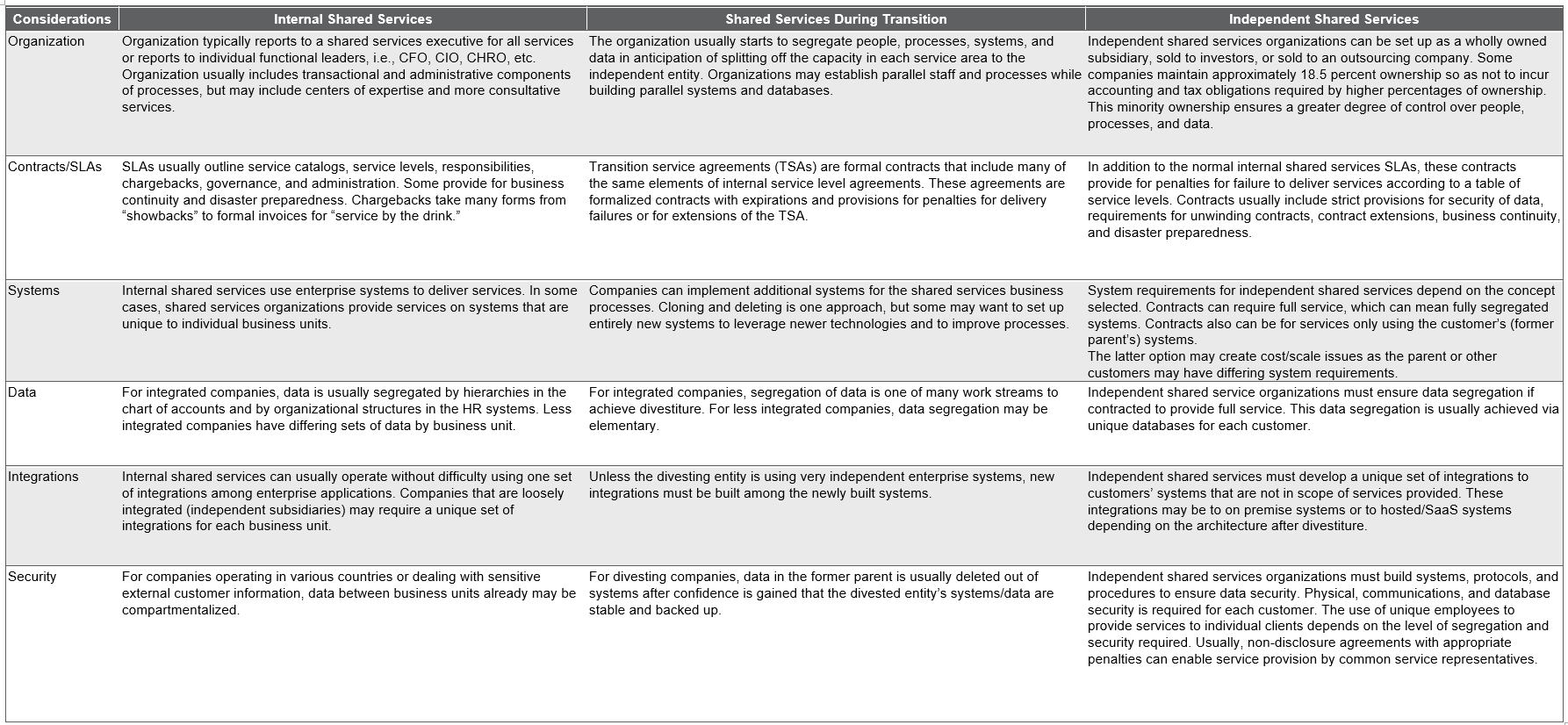

Internal and independent models have similar and differing characteristics and considerations for organization, contracts/ SLAs, systems, data, integrations, and security. These similarities and differences are discussed in the following table.

Divesting a shared services organization to form an independent operating entity can be a key driver to long-term success for the shared services operation. As an independent entity, the shared services organization must focus on being service and cost competitive with external providers. Ideally, the independent entity will benchmark itself against other potential providers to demonstrate the competitiveness of its services and costs. Areas that are not competitive are high priority for redesign or similar improvement.

In addition, as an independent operating entity, the shared services organization can gain the stature to drive adherence to policies and processes that is sometimes hard to achieve as an internal provider. This adherence is important when attempting to minimize costs and for producing comparable data and meaningful analytics.

In some instances, the formation of an independent shared services company allows the entity to provide services to other business units or operating entities in the corporation that might not accept services if the organization were not independent. This is especially true in holding company set-ups. In addition and as mentioned above, as an independent shared services organization, it is possible to offer services to other companies inside or outside of the original parent’s industry. While this is not commonplace, there are successful examples, especially in specialized industries, such as healthcare, or with unique services, such as safety.

Creating an independent shared services organization is not without its challenges. To be successful, the organization must have the internal infrastructure to operate as a standalone business. It must be able to market and sell its products and services, determine lifecycle costs, price products and services competitively, provide exceptional customer service, bill and collect for products and services rendered, as well as other basic operating functions. Because most new shared services operations do not have the majority of these elements in place at launch, the path to independent shared services typically occurs only after honing the model and operations over years as internal entities.

A key enabler for the successful divesting of a shared services organization is the development of formal contractual agreements with all legal entities to whom it will be providing services.

These shared services contractual agreements can vary from providing all systems and services to providing services using customer systems and data. It is wise to avoid complex arrangements as these can create disparities among customers’ systems and processes. These disparities can in turn increase the costs of providing services therefore adversely impacting the independent shared services organization’s profitability.

There are numerous successful examples of independent shared services entities. Typically, these cases are true for mature operations that have demonstrated their service and cost competitiveness with external providers of similar services; however, this is not a move to be taken lightly. Creating an independent shared services organization is challenging, especially if the organization’s processes and infrastructure are deeply entwined with its parent.

The more honed the organization’s operations and infrastructure, the more likely it will be successful.

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.