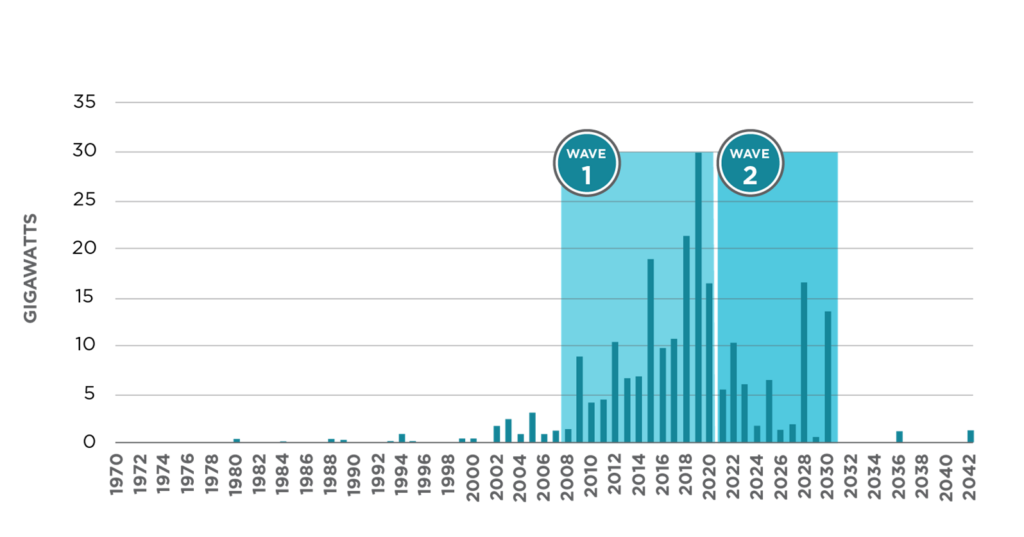

A second wave of coal plant closures is projected across the United States in the next five to ten years. The first wave began in the early 2000s and was driven solely by economic considerations. The coming second wave will be driven by similar economic considerations but will be buoyed by socio-political factors. Net-zero, renewable portfolio standards, and other clean energy emission goals and mandates, coupled with a new emphasis on environmental, social, and governance (ESG) initiatives, will accelerate the timing of coal plant retirements. ScottMadden projects the end of coal as an electric generation source in the United States sometime within this century.

Beginning in the early 2000s, one of the most significant trends in U.S. electric generation is the shift away from coal as a primary generation source. Previously, maxims like “coal is king” were unquestioned in generation related decision-making processes, but several factors disrupted the economics of coal generation and drove the closure of coal plants. These included the rise of commercial grade wind and solar renewables, the precipitous drop in natural gas prices brought on by fracking, and the cost of retrofitting existing coal plants to meet more stringent environmental standards. While never an easy decision, closing a coal unit that was losing money, or projected to lose money, was a relatively straightforward strategy to articulate to boards, investors, customers, and other stakeholders.

While economics continue to play a role in today’s decisions to retire coal plants, the second wave of coal plant retirements is being ushered in by increasing societal pressure to reduce carbon emissions. This whitepaper explores ScottMadden’s view of the six primary drivers of the second wave. Our analysis is based on ScottMadden’s experience working with both large and small electric generation companies across North America, as they make strategic decisions about changes to their generation profiles.

Figure 1: U.S. Coal Plant Retirements, Actual and Projected 1970–2042[1]

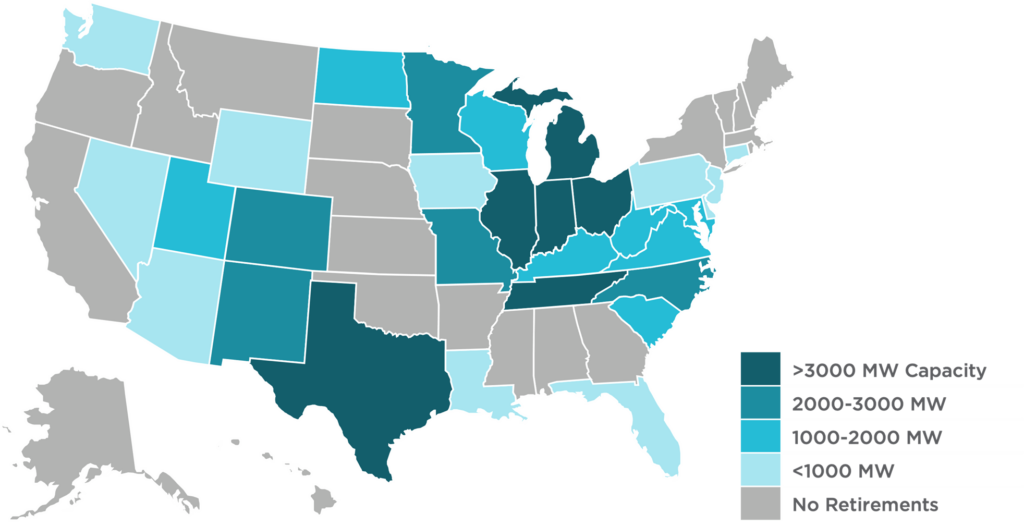

The United States has been home to nearly 500 grid-connected coal plants, representing more than 1,200 units. By 2020, however, less than 600 units continued to operate in the United States, representing an approximate capacity of 230 GWs with an average age of 45 years. Today, roughly a third of that capacity (73 GWs) is set to retire by 2045.[2]

Figure 2: Planned Coal Generating Plant Retirements by State between 2022 and 2045[3]

While the United States saw a 17% uptick in generation from coal in 2021, the recent surge is attributable to high natural gas prices, as oil and natural gas producers curbed production in response to the ongoing COVID-19 pandemic.[4] The surge in coal generation is no doubt temporary (see sidebar) as natural gas production returns to pre-pandemic levels, more coal retirements continue to be announced, and renewable generation continues to be built.

Historically, the age of a coal plant has been the best determinant of whether it will continue to operate. Since 2015, however, the emissions rate of a coal plant may have become a better indicator of that plant’s remaining life.[5] Figure 3 provides a comparison of the average unit retired in 2015 versus the average unit retired in 2018.

Not everyone is abandoning coal quite yet, as natural gas prices have increased, motivating some recent gas-to-coal switching in some markets. While many mining companies were exiting the thermal coal market, some are responding to this recent uptick in demand by maintaining or growing investment in the sector. This is evidenced by Glencore Plc’s recent re-commitment to coal, at least through 2050. Glencore has promised to run down its coal assets by then, a plan approved by 94% of its shareholders, rather than divest the coal unit as urged by Bluebell Capital Partners.* This approach helped Glencore post record earnings in 2021, and coal is expected to be an even bigger contributor to Glencore’s profitability in 2022.**

This example may suggest that coal will be here longer than many think, driven by near-term investment opportunities and/or near-term energy security. This may be at odds with utilities and jurisdictions that have set net-zero targets.

*Financial Times: Glencore defends coal rundown strategy as right for the world, https://www.ft.com/content/81696e63-38c5-4454-8a03-8a92fdc4ca5a

**Miningmx: Nagle stands behind Glencore coal strategy with fuel set to drive EBITDA in 2022, https://www.miningmx.com/news/markets/48759-nagle-stands-behind-glencore-coal-strategy-as-fuel-set-to-drive-ebitda-in-2022/

Figure 3: Comparison of Average U.S. Units Retired in 2015 vs. 2018[6]

There are six primary drivers of this wave of U.S. coal plant closures. The first three relate to economics and financial decisions, while the last three are more socio-political in nature.

On day one of his presidency, Joe Biden rejoined the Paris Agreement, and since taking office in January 2021, the Biden Administration has made addressing climate change a central element of both foreign and domestic policy. Biden has created two new positions in the Office of the President with John Kerry serving as Special Presidential Envoy for Climate and Gina McCarthy heading the White House Office of Domestic Climate Policy. Kerry is the first-ever principal to sit on the National Security Council entirely dedicated to climate change, and McCarthy, frequently described as the “Climate Czar,” coordinates domestic climate policy across agencies and departments.

The strategic process to build, operate, and retire generation units is complex. These are big decisions that require input and analysis from many stakeholders. To date, the decision to close coal units in the near-term has been driven primarily by economics. While never an easy decision, the process is straightforward for any executive when analyzing an asset that is costing more to operate than it earns.

Going forward, ScottMadden predicts that while closures will continue to include economic drivers, public perception, RPS requirements, and an international focus on climate change will increasingly drive decision making and cause a second wave of coal unit closures, dramatically shifting generation away from coal to natural gas and renewables.

This article is part of a series titled Coal’s Accelerated Burn covering coal unit closures.

Additionally, we suggest the following article written by Dorsey & Whitney’s Development and Infrastructure Industry Group:

ScottMadden has assisted many generation companies to effectively analyze, plan, and execute plant decommissioning projects. We approach decommissioning work with a deep respect for the stakeholders and leverage our significant experience to support your initiatives. Our experience includes:

For more information on how ScottMadden can assist you with plant decommissioning and other fossil generation initiatives, please contact us.

[1] S&P Global Market Intelligence, ScottMadden analysis

[2] EIA: Planned U.S. Electric Generating Unit Retirements, https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_6_06

[3] EIA: 2020 Form EIA-860 Data – Schedule 3, ‘Generator Data’ (Proposed Units Only) https://www.eia.gov/electricity/data/eia860/xls/eia8602020.zip

[4] Washington Post: U.S. emissions surged in 2021, putting the nation further off track from its climate targets, https://www.washingtonpost.com/climate-environment/2022/01/10/us-emissions-surged-2021-putting-nation-further-off-track-its-climate-targets/

[5] Scientific America: And Now the Really Big Coal Plants Begin to Close, https://www.scientificamerican.com/article/and-now-the-really-big-coal-plants-begin-to-close/

[6] EIA: More U.S. coal-fired power plants are decommissioning as retirements continue, https://www.eia.gov/todayinenergy/detail.php?id=40212

[7] EIA: Annual Energy Outlook 2022 with projections to 2050, http://www.eia.gov/forecasts/aeo/

[8] EIA: Detailed generator-specific information about existing and planned generators, https://www.eia.gov/electricity/data/eia860/

[9] Lawrence Berkeley National Laboratory: U.S. Renewables Portfolio Standards 2021 Status Update: Early Release, https://eta-publications.lbl.gov/sites/default/files/rps_status_update-2021_early_release.pdf

[10] Reuters: U.N. Climate Change Report Sounds ‘Code Red for Humanity,’ https://www.reuters.com/business/environment/un-sounds-clarion-call-over-irreversible-climate-impacts-by-humans-2021-08-09/

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.