In February 2020, with bitcoin at $9,275, the business case for mining with nuclear power was a compelling value proposition. Now, at $47,300, that same proposition is much more compelling. When this value proposition is coupled with the mandate for non-carbon-emitting energy use in cryptocurrency mining, nuclear power is a strong partner.

ScottMadden’s original paper, “Bitcoin Mining and Nuclear Power: Uses for Surplus Power and Diversifying Revenue,” highlighted how nuclear power plants could diversify their revenue base by co-locating bitcoin mining with nuclear power plants. Our analysis showed that at a bitcoin price of $9,275, cryptocurrency mining could provide an opportunity to grow revenue and continue to provide safe, reliable carbon-free electricity.

With a bitcoin price of $47,300 as of August 26, 2021, along with the environmental, social, and governance (ESG) criticism facing the bitcoin mining industry, the combined opportunity for both nuclear and bitcoin mining has never been greater. Bitcoin mining with surplus or undervalued carbon-free nuclear power presents opportunities for both parties, and in our view, it creates a strong clean energy partnership.

To get an idea of the scale of a conceptual mining operation, take a plant producing 1 MW of surplus power. Diverting that power to a cryptocurrency mining farm could, depending on the hardware, power anywhere from 300 to 900 individual mining computers. A continuously operating 1 MW-sized mining operation with the most efficient miners, a power cost of .06$/kWh, and an initial investment of $1 million can conservatively generate a top-line revenue of $4.5 million per year and profits of $4 million. Our analysis predicts a small project with electrical and network upgrades could break even in approximately six months not accounting for cooling, repairs, or service technicians.

This conceptual project was analyzed at a bitcoin price of $45,000. A higher bitcoin price will increase profit for the same cost of goods sold (COGS). Also, as the operation scales and consumes more surplus power, revenue and profits are expected to grow at a faster rate than COGS. At today’s price, it might be more profitable for utilities to mine bitcoin than to supply electricity to the public grid.

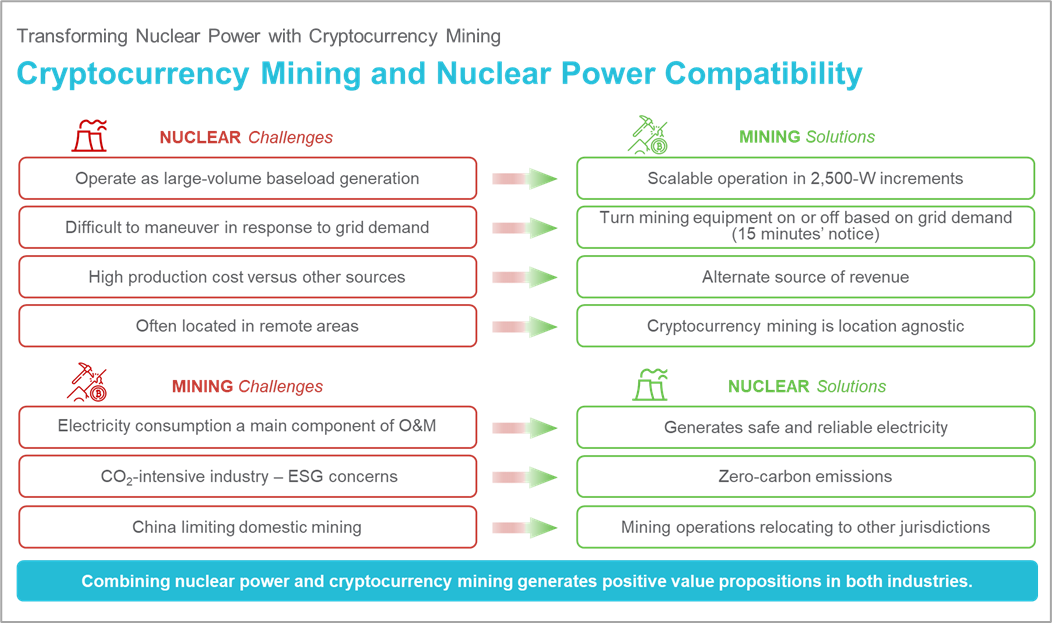

In our first paper, ScottMadden noted the complementary value propositions for the nuclear power industry and the cryptocurrency mining industry. Over the past year, these complementary value propositions have only strengthened.

Cryptocurrencies are gaining acceptance as a new asset class worldwide. Large public companies, like Square, Tesla, and MicroStrategy Inc., are purchasing cryptocurrency as a percentage of their corporate treasury. Other investors are interested in cryptocurrency to supplement cash holdings and to protect against inflation. Electric utilities that operate nuclear power plants and that are mining their own cryptocurrency could use it as a hedge against inflation on their own short-term treasury assets.

Nuclear power can become a major source of electrical power to the cryptocurrency mining industry. By doing so with reliable, carbon-free electricity, nuclear plants will help stabilize cryptocurrency’s network, support its growth, and further the adoption of cryptocurrency assets into the mainstream economy. The combination of excess and carbon-free, nuclear-generated electricity creates a unique value proposition for both industries. Not only will nuclear plants establish a new revenue source by mining cryptocurrency, but they will also help decarbonize an industry and make bitcoin even more attractive to a large number of institutional investors with ESG objectives.

The following points illustrate the complimentary value propositions that make the alliance between nuclear and cryptocurrency mining compelling beyond the economics:

| Cryptocurrency and nuclear power benefit each other. | ||

| Cryptocurrency will benefit from a non-carbon-emitting, stable, and cost-competitive power source. | ||

| Nuclear power plants will generate additional revenue and remain available to the grid. | ||

| The more stable and carbon-free cryptocurrency becomes, the more valuable current mining operations become. | ||

ScottMadden helps clients across a range of areas in nuclear generation. We have supported our clients with the following solutions with respect to co-locating bitcoin mining and power plants:

How We Can Help

Sources

https://beincrypto.com/learn/best-cryptocurrency-mining-hardware

Power Price $.06/kWh; Difficulty 15.5T; Pool Fee 2%; Recurring Cost $2,500/month; Block Reward 6.25BTC; Difficulty Change +2%/month

https://news.yahoo.com/yahoo-finance-presents-investor-entrepreneur-145345400.html

Additional Contributing Authors: Brian Szews

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.