A major integrated electric utility embarked on a strategic planning exercise to take a fresh look at operational benchmark metrics and industry peers. The leadership team retained ScottMadden as an independent advisor to conduct the analysis to ensure it would be fair, objective, and defensible to its board of directors and regulators.

The company was facing a common challenge—staying competitive and dedicating its time, effort, and capital to the most important initiatives. Leaders had recently participated in a handful of ad hoc benchmarking surveys on specific support services, and they had a good handle on tracking and reporting metrics internally. However, they were still missing a full suite of metrics to help them understand enterprise performance from top to bottom. Utility benchmarking is a valuable tool for those seeking to achieve and sustain top performance, and this company needed access to hard-to-get data specific to its organization.

The company’s leaders chose ScottMadden to take it a step further in its continuous improvement journey due to our:

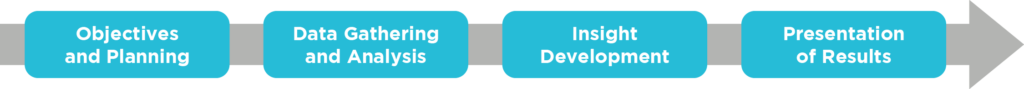

To obtain a clear assessment of the utility’s performance, ScottMadden used a four-step approach: Objectives and Planning, Data Gathering and Analysis, Insight Development, and Finalization and Presentation of Results.

Figure 1: Approach Model

We began by ensuring alignment on the objectives, timing, metrics, and benchmark panel. We outlined a detailed project plan, scheduled meetings for key touchpoints, and coordinated a recurring progress update call.

From there, we worked collaboratively with the utility to select a suite of 52 unique performance metrics representing all areas of the utility’s enterprise. These included core electric utility functions, like generation, transmission, and distribution, as well as corporate support functions, such as finance, HR, IT, and supply chain.

Our team worked with the client to develop an external basis of comparison by identifying peer groups that made sense for each area of the business. We selected Canadian and U.S. peer groups for each benchmark to provide a sound basis for comparison (multiple peer panels). Our analysis compared the client’s performance with the industry median and top-quartile scores using performance data for all metrics.

As an added benefit of this ScottMadden process, company leaders were able to gain insights on relevant industry trends, such as the cost associated with integrating more wind generation.

ScottMadden delivered a formal, customized benchmarking report in a short period of time that could be submitted to the company’s board of directors and its regulators. The report:

ScottMadden worked closely with the various functional stakeholders to ensure they understood metric definitions, calculations, and the connectivity between their department’s performance and metric results.

For additional details on how leaders of electric and gas utilities are enhancing their planning processes, contact us. We would be happy to discuss your current strategy and provide further information about our most popular benchmarking solutions from enterprise benchmarking and targeted department/functional deep dives to generation fleet analysis, gas LDC benchmarking, and other customized analyses.

View More

Sussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.