With the transportation sector accounting for the largest portion of greenhouse gas (GHG) emissions in the United States,[1] meeting state, local, and corporate GHG emissions targets will require businesses operating fleets to proactively adopt electric vehicles (EV). With this in mind, companies are beginning to pursue electrification, including halting procurement of internal combustion engine (ICE) vehicles and planning for the considerable charging infrastructure, business model impacts, and personnel changes required to operate an electric fleet.

Electric utilities, both as operators of vehicle fleets and providers of electricity, are uniquely positioned to take advantage of fleet electrification opportunities. As providers of electricity with the obligation to serve their customers, utilities must plan to support commercial customers in their electrification efforts. As fleet owners, many utilities have already set goals to electrify some portion of their own fleets, from light-duty passenger vehicles to bucket trucks and other heavy-duty vehicles. However, like commercial fleet operators, substantial planning must go into these transitions to ensure utilities can continue to serve their customers and meet operational commitments.

This paper focuses on fleet electrification goals emerging in the industry, the potential benefits to utilities from electrifying their own fleets, and considerations utilities should evaluate prior to and during their fleet electrification process. Given vehicle replacement cycles and ambitious decarbonization targets set by states and utilities across the country, fleet managers across industries must begin planning immediately to successfully transition their vehicles to electric. This is particularly true for utilities, who stand to benefit from electrification in the following ways:

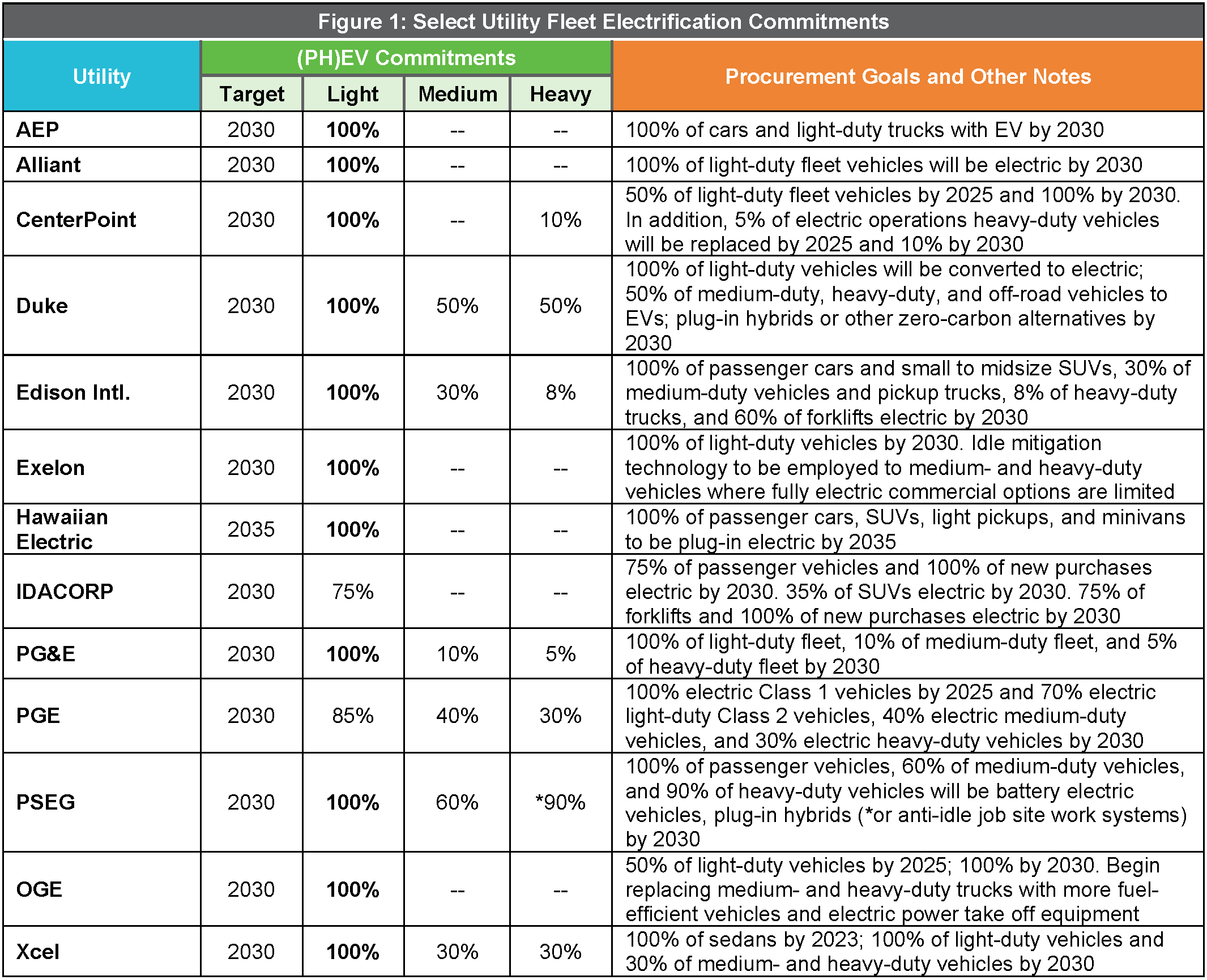

Utilities across the country are taking active roles in electrifying their fleets. ScottMadden’s analysis of the 33 largest investor-owned utilities indicates that most have announced fleet-electrification goals of some kind. Two-thirds have published fleet-electrification targets with the majority setting 2030 as their internal deadline to convert some portion of their fleet to electric, and ten utilities have committed to electrifying 100% of their light-duty fleets by this time. Light-duty vehicles are by far the most common class of vehicle to electrify with only eight utilities in our analysis having stated any goal for medium- and/or heavy-duty vehicles.

The emphasis on light-duty electrification is driven by the availability of light-duty EV models and their ability to meet passenger vehicle needs. Light-duty EVs are currently more cost-competitive with their ICE counterparts than medium- and heavy-duty EVs. However, as prices for medium- and heavy-duty EVs fall and product offerings expand, utilities will have more options and opportunities for electrifying all classes of fleet vehicles. Utilities may also have opportunities to work directly with medium- and heavy-duty EV manufacturers to develop vehicles to meet their needs. As an example, Con Edison recently announced a partnership with Lion Electric to deliver a custom electric truck.[2]

The size of a fleet is a critical consideration in electrification and varies significantly across utilities. Fleet size can depend on factors, such as assets, customer counts, and service territory size. Our estimates show that fleets of the largest 33 utilities are approximately 150,000 vehicles, including light-, medium-, and heavy-duty.

Figure 1 provides a summary of utility fleet electrification commitments.

Utilities are electrifying their fleets for a variety of reasons. Among the most common is combatting climate change and reducing emissions from their vehicles—more than half of the 33 largest utilities cited this as a motivation to electrify, based on ScottMadden’s analysis.

Another compelling reason for utilities to electrify their fleets is the opportunity to “lead by example” and set a standard for customers. Utilities can encourage other stakeholders to electrify by doing so themselves. In addition, by electrifying their fleets, utilities can gain practical knowledge that can then be used in working with customers to electrify their fleets. As utilities progress toward fleet electrification, carefully identifying the driving motivations and goals is a critical step in this process.

In undertaking fleet electrification, utilities should pursue four primary activities to support planning, leadership alignment, and implementation.

Before embarking on electrifying your fleet, it is important to be able to clearly articulate your goals and to have leadership buy-in. For example, the primary goal of some utilities may be to drive down operational and fuel costs through their electrification efforts. For others, the primary goal might be to meet corporate sustainability goals and establish themselves as leaders in the industry. Both goals are important benefits of electrification, but they may lead to different approaches to cost, timing, and defining what a successful transition looks like.

Even if the decision to electrify is not purely motivated by cost savings, a business case will help utility fleet managers set expectations, quantify costs and benefits, and identify potential risks and mitigating actions. A business case allows fleet managers to communicate to leadership important information about expected costs and benefits of the transition as well as potential risks and trade-offs.

Throughout implementation, fleet managers can monitor the underlying business case assumptions and make adjustments based on interim results. Inputs, such as operating and maintenance costs, procurement budgets, and program incentives, among others, will affect the business case. For example, vehicle purchase prices are likely to change during the course of a multi-year implementation, and fleet managers may need to adjust business case assumptions accordingly in order to meet the strategic objectives of the project.

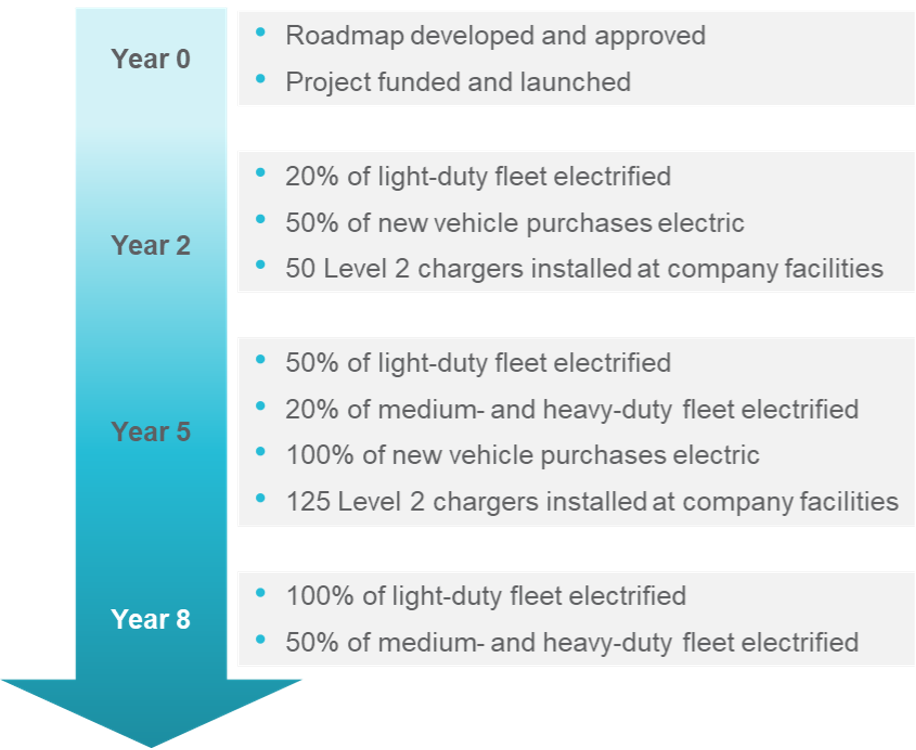

The transition to an electric fleet represents a significant change in fleet operations and may take many years to complete. Creating a roadmap to outline interim goals and milestones should be an initial priority for the transition team. The roadmap should be informed by industry benchmarking, forecasts of market and technology trends, and product availability timelines, which provide valuable context upon which to base recommendations. The roadmap should also consider initial costs and budgets, infrastructure needs, and the specific duty cycles of the fleet’s vehicles. For instance, one multi-state utility has discussed beginning its fleet electrification efforts with light-duty vehicles located at its nuclear sites to take advantage of on-site generation and conducive duty cycles.

Developing a roadmap allows the transition team to communicate the electrification process, align expectations, and solicit feedback from stakeholders to increase buy-in. A roadmap also provides a forum to think through the transition and anticipate roadblocks and challenges, as opposed to reacting to them as they happen. The roadmap should include electrification targets, such as numbers and types of vehicles and high-level milestones, which allow the transition team to track and celebrate intermediate progress. Sample milestones are shown in Figure 2 and include goals for vehicle procurement, charger procurement, and electrification by vehicle class.

Figure 2: Illustrative Electrification Milestones

During the transition process, fleet operations managers must meet expected service levels among internal and external customers. Vehicle availability and readiness expectations will need to be met for electric and legacy ICE vehicles. As a result, the impact of the transition to electrification on utility operations must be understood and planned for in advance to ensure expectations are met.

Crucial actions of this phase include:

Fleet managers and utility executives must also be mindful of the impact fleet electrification will have on the people and processes that allow the utility’s fleet to operate. EVs function differently than their ICE counterparts and require different skills, capabilities, and expertise. Fleet electrification will therefore require dedicated operator training, new and updated processes, and potentially new teams and organizations.

Socializing the roadmap with stakeholders is critical. Executives will seek assurance that safety and customer service will not be interrupted during the transition and will expect sustainability or other goals to be met. External stakeholders may pressure utilities to accelerate their electrification efforts to drive the EV market and serve as an example to other fleets.

Stakeholder management is as critical as the preparation of the business case and execution of the plan. Electric fleets are a new opportunity for all stakeholders and will require cooperation and communication. Engaging other interested parties and providing frequent updates will contribute to a more successful fleet transition.

Three external stakeholders that can serve as partners and advocates during the transition process include:

As owners and operators of vehicle fleets as well as providers of electricity, utilities have a unique opportunity to take advantage of fleet electrification. Through their own electrification efforts, utilities can serve as industry leaders providing an example for others to follow. In addition, by drawing on the experience and lessons learned from electrifying their own fleets, utilities can effectively advise their customers and serve as a partner in their electrification efforts.

However, fleet electrification is not without its challenges. Detailed planning, including defining goals and developing a business case, roadmap, and key milestones, is essential to successfully transition to EVs. Managing change and engaging stakeholders is also a critical differentiator for successful electrification efforts. When done properly, utilities can benefit from reduced maintenance and operational costs, achievement of corporate and government sustainability goals, and serving as an example for their customers to follow.

ScottMadden works with utilities to plan for the integration of EVs into their business and operations, including the development of EV-charging programs, EV organizations, distribution planning and new business processes, customer outreach programs, and charging incentives. ScottMadden helps clients explore every aspect of the transition to EVs. We work with utilities and service providers to build tailored solutions designed to manage the significant changes associated with transitioning to EVs. In addition, ScottMadden has advised EV original equipment manufacturers and commercial fleets in the development of EV-charging strategies. Our deep acumen in energy and grid transformation helps fleet operators achieve safe, efficient, and profitable transitions.

To learn more about what actions your company should take to facilitate the electrification of your fleet or to begin your own fleet electrification or advisory program, contact us today. If you’re not sure where to start, contact us to receive our free electrification checklist for assessing your fleet’s electrification readiness.

Additional Contributing Author: Jim House

[1] www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions

[2] https://www.coned.com/en/about-us/media-center/news/20210324/utility-bucket-truck-makes-clean-energy-breakthrough

[3] https://www.nescaum.org/documents/multistate-truck-zev-governors-mou-20200714.pdf

[4] https://www.mwenergy.com/news/view/midwest-energy-joins-electric-vehicle-charging-collaboration

[5] https://electrek.co/2021/03/02/six-us-utilities-form-electric-highway-coalition-in-southeast-midwest/

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.