The advancements in artificial intelligence (AI), combined with the tremendous popularity of messaging apps, have increased the use of virtual agents (VAs) as conversational tools in back-office functions. VAs are an important component of the digital transformation of supply chain and finance as they automate services and improve the accuracy of information exchange with internal and external customers.

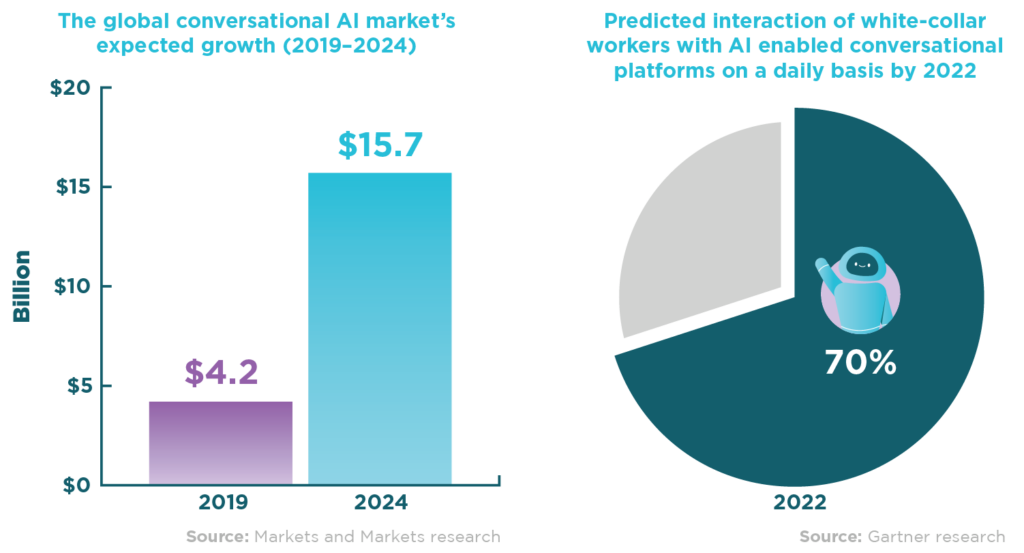

The ability for computers to take on cognitive capability (or human interactive traits) is advancing rapidly, and this capability is becoming increasingly embedded in business processes. According to the research firm Markets and Markets, the global conversational AI market is expected to grow from $4.2 billion in 2019 to $15.7 billion by 2024. Gartner predicts that 70% of white-collar workers will interact with AI-enabled conversational platforms on a daily basis by 2022.

VAs (also referred to as virtual reps, intelligent agents, or chat-bots) are customer relationship management software applications that attempt to mimic the interaction of online human service representatives. VAs are programmed to respond like human beings in both language (including accents) and communication (including the detection of emotion). They allow customers to execute routine transactions, such as purchasing catalog items, answering standard questions, and updating customer profiles. VA software that utilizes voice recognition is becoming better at deciphering the intent of customers and guiding them to their desired outcome, thus providing a level of personalized service.

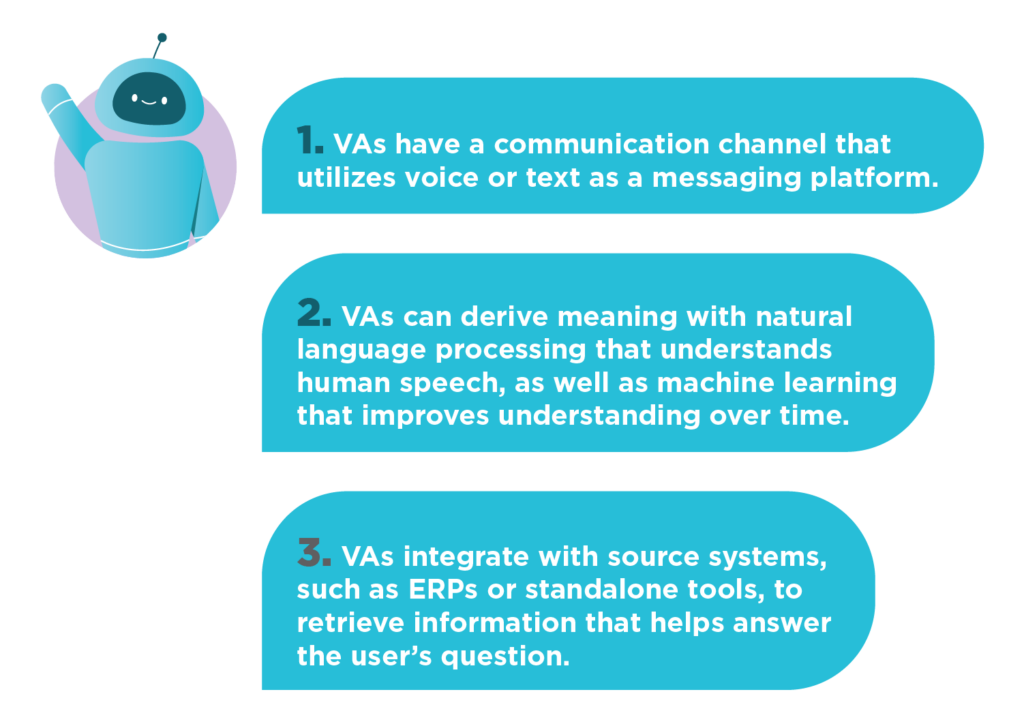

While VAs are available with varying capabilities and components, they are typically comprised of three basic elements:

Organizations are using VAs to improve returns on investment for customer call centers and technologies, to eliminate the need for global language capabilities, and to phase out traditional interactive voice response (IVR) technologies that frustrate customers with requests for multiple button pushes. Some examples include:

| Procure to Pay

A common scenario where VAs can improve supply chain management is providing guidance for routine purchases. In this case, a VA can assist an employee with the completion of a purchase requisition by prompting for information required by the request (e.g., prompts for dates, business justification, specifications, and other details). Also, the VA can guide the process by answering questions the employee has about completing the request. The real-time VA support helps ensure purchase requests are complete and accurate and provides a better user experience. VAs are also effective at addressing routine inquiries from procurement staff, business unit representatives, suppliers, and other customers. For example, VAs can provide real-time status updates on orders and shipments by retrieving information from systems and displaying answers via chat or voice response. As noted previously, VAs offer advantages over traditional telephone-based support models, which often have complex phone menus and lengthy wait times. The most common inquiry in accounts payable from suppliers is obtaining the status of an invoice. A VA on a direct access portal or phone service can provide invoice status to suppliers. In this setup, the VA greets the supplier and asks for the invoice number or other search parameters. Integration with an ERP or accounts payable system enables the VA to retrieve the relevant information and communicate the invoice status to the supplier (e.g., received, approved, under resolution, awaiting information, check sent, etc.). These calls commonly consume 30% to 50% of AP staff’s work. VAs can provide support in other areas as well, including assistance with updating supplier data, enrolling in various programs (e.g., dynamic discounting), and providing copies of documentation, to name a few. |

|

| Order to Cash

Companies are also realizing the benefits of VAs in order-to-cash processes. Past-due notifications are prime candidates for VAs. They can answer customers’ questions regarding past-due notices. They can also handle invoice disputes from customers using workflow to route short payments to the appropriate deduction management group for resolution. VAs can be programmed to note payment history in accounts so that short payments and other collections disputes are documented for future credit-making decisions. |

Businesses continue to be challenged by the need to reduce costs while meeting expectations of the on-demand economy. VAs can deliver scale and flexibility to allow companies better interaction with their customers and ensure more accurate information flow.

ScottMadden works with our clients on innovative concepts and state-of-the-art technology programs that enhance effectiveness, efficiency, and customer satisfaction. We can leverage a deep knowledge of shared services models and processes to support all phases of implementation, including strategy, process redesign, technology selection, and technology build.

For more information on how ScottMadden can assist in integrating VAs into your supply chain or finance operations, please contact us.

ScottMadden has been a recognized leader in corporate and shared services since the practice began decades ago. Our Corporate & Shared Services practice has completed more than 1,900 projects since the early 90s, including hundreds of large, multi-year implementations. Our clients span a variety of industries from energy to healthcare to higher education to retail. Examples of our projects include service delivery strategy and business case development, corporate service assessment and improvement, shared services design, shared services implementation, and shared services improvement.

Jason Davis is a director in ScottMadden’s Corporate & Shared Services practice.

Sussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.