Transformative shifts in customer expectations, advances in technology, and changes to the generation mix are driving utilities to reassess how they plan and operate their smart grid and whether they have the appropriate set of tools and technologies to do so. Complicating matters, state lawmakers, governors, and regulators are layering policy objectives on top of these trends, often with mandates for the procurement or integration of clean or distributed energy resources (DER). Spurred by this combination of drivers, often labeled “grid modernization,” utilities are wrestling with key questions, such as:

Transformative shifts in customer expectations, advances in technology, and changes to the generation mix are driving utilities to reassess how they plan and operate their smart grid and whether they have the appropriate set of tools and technologies to do so. Complicating matters, state lawmakers, governors, and regulators are layering policy objectives on top of these trends, often with mandates for the procurement or integration of clean or distributed energy resources (DER). Spurred by this combination of drivers, often labeled “grid modernization,” utilities are wrestling with key questions, such as:

Answers to these questions are non-trivial, but if the responses are well-executed, they can establish a foundation for the continued growth and capability of a utility’s transmission and distribution (T&D) infrastructure. In our experience, there are four keys to success for developing and gaining regulatory approval for a grid modernization plan:

With such big picture questions to tackle, grid modernization can be a sweeping topic. To avoid “boiling the ocean,” it is important to establish up front what is hoped to be achieved in developing a grid modernization plan. Engaging stakeholders to understand their needs is an important early step in establishing grid modernization objectives. These high-level objectives could include traditional aims, like improved reliability and safety, or could also focus on the integration of clean and distributed sources of energy. The objectives should be both sufficiently ambitious and customer-oriented. This means that they cannot be met with current capabilities and will deliver clear customer benefits upon achieving the objectives. Once the gaps in capabilities and alignment between objectives and customer benefits are known, utilities can determine which investments fill the gaps. Early stage investments may focus on the foundational infrastructure needed to provide a host of capabilities, such as advanced metering infrastructure (AMI), telecommunication infrastructure, or data analytics platforms, which can be applied to a number of different applications. Ultimately, the intent is to provide benefits in a layered manner with successive investments leveraging those that precede them. By doing so, the utility will be in a position to clearly articulate how proposed investments will provide benefits to customers in both the near and long term.

|

|

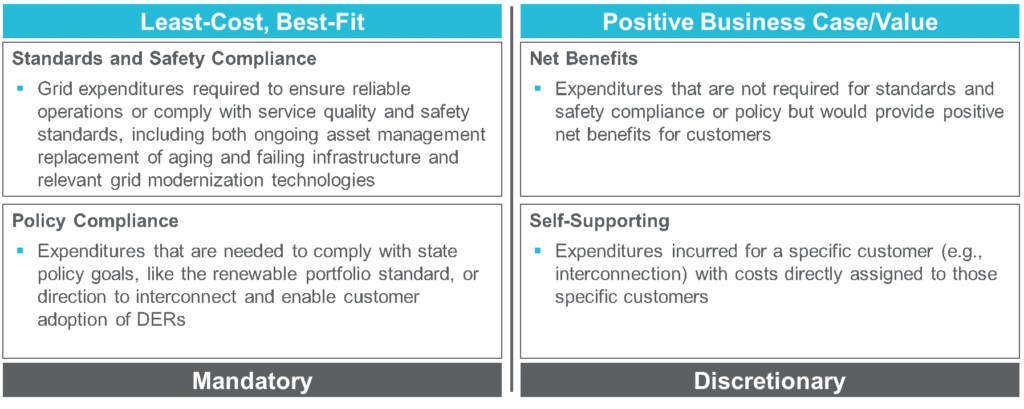

Once a set of proposed investments is identified and clearly linked to the objectives and customer benefits, the next step is to demonstrate the prudency of the investment. Historically, utilities have used a set of design standards necessary to ensure safe and reliable service and then selected the least-cost, best-fit investment that met those standards. In some cases, this approach can be used for grid modernization investments as well; though in others, a net benefit to customers must be achieved for the investment to be considered prudent. The Department of Energy’s DSPx framework (shown below) attempts to clarify the distinction between these types of investments, and it has been used in Hawaiian Electric Company’s (HECO) grid modernization filing. Categorizing grid modernization investments into these groupings with the accompanying rationale establishes the hurdle individual investments must pass for inclusion in the portfolio.

Figure 1: Cost-Benefit Framework – Adapted from HECO’s Grid Modernization Filing[1]

As a transformative industry trend, grid modernization impacts not only many groups within a utility, but also a wide range of external stakeholders. Starting with an internal utility focus, a natural group to lead a grid modernization initiative is T&D operations and planning groups; however, the effort should also include other teams. Groups like IT, customer operations, research and development, rate design, regulatory strategy, public affairs will likely be impacted by a grid modernization plan and should contribute their perspectives. This can be accomplished by using cross-functional working teams, an executive steering committee comprised of these groups, or ideally both. Expanding the focus beyond the utility, there are many interested parties in grid modernization efforts, such as DER developers, utility regulators, city and state policy makers, clean energy advocates, and more. This outreach process is often a required component of regulatory-driven grid modernization proceedings, but it should be considered even when it’s not mandatory. Sharing early versions of grid modernization plans, soliciting and incorporating feedback, and engaging in a dialogue with these parties can reveal challenges with plans early and in an iterative manner, rather than encountering road blocks at the end of a long and resource-intensive planning process.

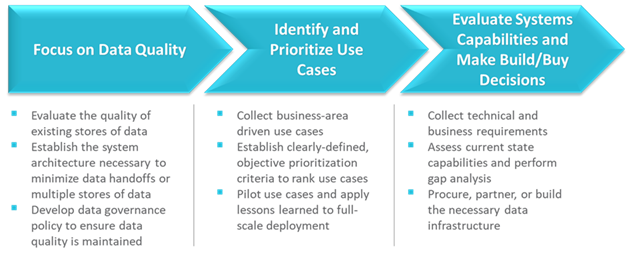

An important and often overlooked aspect of a grid modernization initiative is to define an approach for handling the influx of grid data generated by the investments—consider AMI, which typically replaces the monthly meter readings collected through analog infrastructure with up to 105,000 digital readings per year. Transmitting and storing this data is a necessary part of the data strategy, but it is insufficient to utilize the data to the benefit of the utility and the customer. Unlocking the value of the data comes through identifying innovative new uses of the data. Initially, this should focus on harnessing the creativity of the grid modernization initiative team, but it should quickly progress to prioritizing these ideas. Multiple aspects will inform this prioritization, including business and customer value, maturity of the use case in the industry, quality of the data, among others. A three-step process to approach a grid modernization data strategy helps to address the basics first and then builds value from that foundation.

Figure 2: Three Step Data Strategy Approach

Evolving customer expectations, the availability of new technologies, and increasingly favorable economics and incentives to adopt DERs all contribute to the need for many utilities to adopt some version of a grid modernization plan. Beyond these high-level trends, utilities will have to consider their unique circumstances, which include their current levels of grid automation, relevant policy, stakeholder input, and the stated (or unstated) preferences of their customers. Grid modernization represents a significant opportunity to invest in the latest technologies to deliver customer and grid benefits. However, recent headwinds from regulators in some states have shown that a utility’s grid modernization proposals are by no means guaranteed approval. That is why the keys to success described above are more important than ever.

ScottMadden has helped our utility clients develop and implement grid modernization road maps. We bring a depth of experience in T&D, grid operations, policy, and strategic planning that can help you develop a strategy and detailed plan tailored to your company. Through years of experience, we can help you tell your story to the regulator and key stakeholders, enabling you to implement the right strategy for you. To learn more about grid modernization or get started on your own grid modernization road map, contact us.

[1] Modernizing Hawaii’s Grid For Our Customers, Hawaiian Electric Companies, August 29, 2017, p. 42

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.