In what is now a sustained period of flat load growth, improving the top line has proven to be a challenge for many electric utilities. Without significant asset growth—a traditional driver of utility revenues—the future is not improving much.

What if there was an asset that many utilities already possessed that had excess capacity and could be sustainably monetized? So, what is this underutilized asset? Optical fiber networks. For example, several utilities with fiber network assets constructed for operations have found ways to extract additional value from these assets:

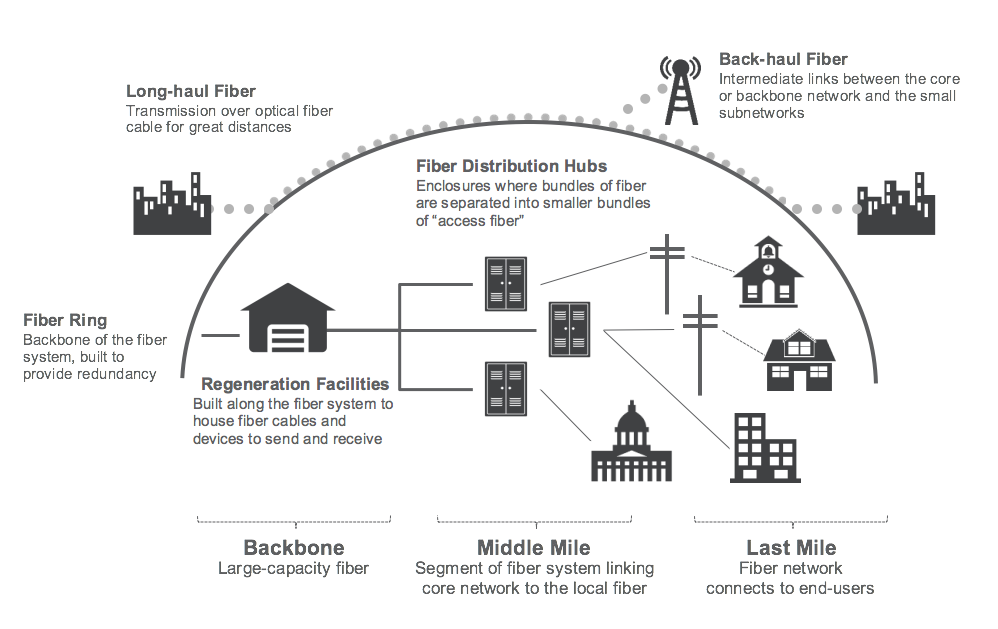

For electric utilities, the opportunity is enhanced because their fiber network is frequently installed high on their transmission towers using optical ground wire, which enjoys a measurable reliability advantage over ground-based networks.

Approaches

Fundamentally, there are two approaches for capitalizing on the value of fiber networks:

Bandwidth availability, whether to the customer premise or on the fiber network, offers economic development opportunities, frequently in areas that might be underserved by existing internet providers.

Pros and Cons

The build-own-operate approach capitalizes on achieving economies of scale in deploying fiber infrastructure. Utilities already service their own fiber infrastructure, thus incremental costs to support third parties is likely minimal.

Alternatively, monetizing prior investments in a fiber network through a build-operate-transfer model may provide liquidity for utilities to take advantage of other business opportunities. Depending on route demand, third parties may be willing to purchase a portion or all of a utility’s fiber investment.

Both paths unlock value and cash flow outside the traditional business model, and both help diversify the utility’s business portfolio.

In the search for top-line growth, every opportunity matters, especially when existing assets can generate new revenue streams at very low costs.

ScottMadden’s Take

In the early 20th century, utilities changed the world by bringing electrification to communities that encouraged economic development and raised the standard of living. Today, some think they have a similar opportunity with broadband.

Our experienced team of energy practitioners is at the forefront of developing innovative business models and operational processes. We can help you assess your opportunity and implement a business solution tailored to your situation. For more information about our experience with utilities, please click here.

Additional Contributing Authors: Rachel Babcock, Rizwan Aslam

View MoreSussex Economic Advisors is now part of ScottMadden. We invite you to learn more about our expanded firm. Please use the Contact Us form to request additional information.