While bonus depreciation is not a new concept, the extension of bonus depreciation provisions as part of the $1.1 trillion tax extender bill passed in December 2015 was unexpected by some. Electric and gas utilities have since been weighing options and determining how to make the most of this development in lieu of their unique financial situations—with short decision timelines and potential impacts on cash flow, rate base, and earnings in the billions of dollars for the industry as a whole.

While bonus depreciation is not a new concept, the extension of bonus depreciation provisions as part of the $1.1 trillion tax extender bill passed in December 2015 was unexpected by some. Electric and gas utilities have since been weighing options and determining how to make the most of this development in lieu of their unique financial situations—with short decision timelines and potential impacts on cash flow, rate base, and earnings in the billions of dollars for the industry as a whole. The purpose of this document is to provide an overview of the issue of bonus depreciation and to illustrate a few potential impacts and implications that utilities may want to consider as they determine how to proceed.

Background

The Modified Accelerated Cost Recovery System (MACRS), established in 1986, is a method of depreciation in which a business’ investments in certain tangible property are expensed, for tax purposes, over a specified time period through annual deductions. A business can typically deduct the costs of acquiring an asset more rapidly under MACRS than under economic depreciation rules, which require that these assets are expensed using a “straight-line” method.

MACRS is the method of depreciation used for most property, though assets vary by class, which determines the depreciable life, or cost recovery period, of the property. Class depreciation timeframes vary between three and 50 years, depending on the type of property.

- Renewable Projects – Various renewable energy technologies qualify for a five-year cost recovery period, including solar and wind energy property, geothermal assets, fuel cells, and combined heat and power technologies. Certain biomass property is eligible for a seven-year cost recovery period under MACRS

- Traditional Projects – Investments in conventional utility plants (generation, transmission, distribution, and general plant) may be depreciated over longer periods of time. Examples include:

- 15-year recovery period for nuclear power plants

- Seven-year recovery period for natural gas gathering lines

See Appendix A for an example of a MACRS depreciation table for assets of different useful lives.

See Appendix B for a list of depreciable asset lives for electric and gas utility services.

Brief History of Bonus Depreciation

Introduction

Bonus depreciation—also referred to as “bonus first-year depreciation” or “accelerated first-year depreciation”—has generally been available since September 11, 2001 (the provision expired in between 2005 and 2007), and has ranged from 30% to 100% over the years.

See Appendix C for a full history of bonus depreciation rates in the United States.

2008 Downturn

Congress took action to further incentivize capital investment by accelerating the depreciation schedule economy-wide. The

Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 allowed companies to claim a 100% depreciation bonus on qualifying capital equipment purchased and placed in service by December 31, 2011.

2013 “Fiscal Cliff”

Congress included an extension of 50% bonus depreciation in early 2013 in the so-called “fiscal cliff” deal, which was scheduled to expire at the end of 2013. Under 50% bonus depreciation, in the first year of service, companies could elect to depreciate 50% of the basis, while the remaining 50% is depreciated under the normal MACRS recovery period.

2014

At the end of 2014, Congress passed a retroactive extension such that companies that placed qualifying equipment in service through December 31, 2014 were eligible for 50% bonus depreciation.

December 2015 (Most Recent Development)

Congress passed the

Protecting Americans from Tax Hikes Act (PATH) of 2015, which included a five-year extension of bonus depreciation, extending bonus depreciation to property acquired and placed into service from 2015 through 2019 (with an additional year for certain property with a longer production period), including a phase-out structured as follows:

- 2015-2017 – 50% bonus depreciation

- 2018 – 40% bonus depreciation

- 2019 – 30% bonus depreciation

- 2020 and beyond – 0% bonus depreciation

How Bonus Depreciation Works

Solar Project Example with ITC

Qualifying solar energy equipment is eligible for a cost-recovery period of five years under MACRS. For equipment on which an

Investment Tax Credit (ITC) or a

1603 Treasury Program grant is claimed, the owner must reduce the project’s depreciable basis by one-half the value of the 30% ITC.

- MACRS Depreciation on a $1M Solar Project[1] – Assume you have a solar project valued at $1M. The taxable basis is reduced by half of the 30% Investment Tax Credit, so it is 85% of $1M, or $850,000. Prior to “bonus depreciation,” this would typically be depreciated according to the following five-year schedule:

Economic and Financial Impacts for Utilities

General Theory

Bonus depreciation theoretically increases the amount of capital expenditures and/or accelerates projects planned for later years, thus boosting economic growth and creating jobs. Because it rewards

new investments, its core benefit is to allow companies to take more depreciation at the beginning of an asset’s life, to increase the net present value of capital purchases (more linked

here from The Tax Foundation).

Short-Term Tax and Cash Flow Benefits, Potential Drag on Earnings

Bonus depreciation results in substantial present value tax savings and incremental cash flow availability for businesses that already had plans to purchase or construct qualified property.

- The trade-off is offsetting deferred tax liabilities that lower rate base and reduce most utilities’ ability to generate earnings growth

- As one industry analyst (Evercore ISI) observed in a recent note to investors, “[It] expects to see the impact of bonus depreciation increasing cash flow but lowering EPS growth for [its] coverage universe by a bit less than 1% on average over the ’16-’19 time period, with the impact more front-end loaded due to bonus deprecation starting at 50% in ’15-’17 and declining to 40% in ’18 and 30% in ’19”[2]

- The expected impacts vary by company and regulatory jurisdiction, and they depend on each company’s near-term outlook for capital expenditures and current tax position[3]

- Companies with more near-term (eligible) capital expenditures and current taxes are more exposed from a GAAP and tax accounting perspective

- Utilities in jurisdictions which treat bonus depreciation as accumulated deferred income taxes that lower rate base in future rate cases could see impeded future growth, but those in jurisdictions which treat bonus depreciation as a kind of “cost-free” source of permanent financing (i.e., not treated as an offset to rate base) could see a reduction in the overall authorized rate of return

Long-Term Regulatory Tax Liabilities, Cash Reduction, and Uncertain Effects on Rate Base

In the long term, and in the later years of an asset’s life (for capital eligible for bonus depreciation), the tax and the cash flow advantages reverse as the timing difference between book depreciation and tax depreciation are reconciled and bonus depreciation unwinds.

- Tax “normalization” for the purpose of regulatory accounting smooths for any timing differences between tax and book bases by creating a deferred tax liability that is used to offset higher taxes in later years, ensuring that current customers do not pay lower taxes at the expense of future customers that might otherwise have higher taxes in the future

- To offset the higher tax burden in the long-term as bonus depreciation expires, other tools at the disposal of some utilities include net operating losses, carry forwards, and production and investment tax credits which can be used to offset future taxes

- As cash flow declines as bonus depreciation expires, utilities will likely compensate by issuing a combination of debt and equity. If debt limits are constrained by regulatory requirements, utilities will be required to issue more equity to address cash needs

- As utilities manage the uncertain rate base implications in their jurisdictions as bonus depreciation expires, continued capital spending will continue to be a key tool

Illustrative Implications and Considerations

Example 1 – Purchase of a $100K Asset without Bonus Depreciation

Implications of adding a $100K asset (20-year life)

before bonus depreciation (no tax deferral) are outlined below:

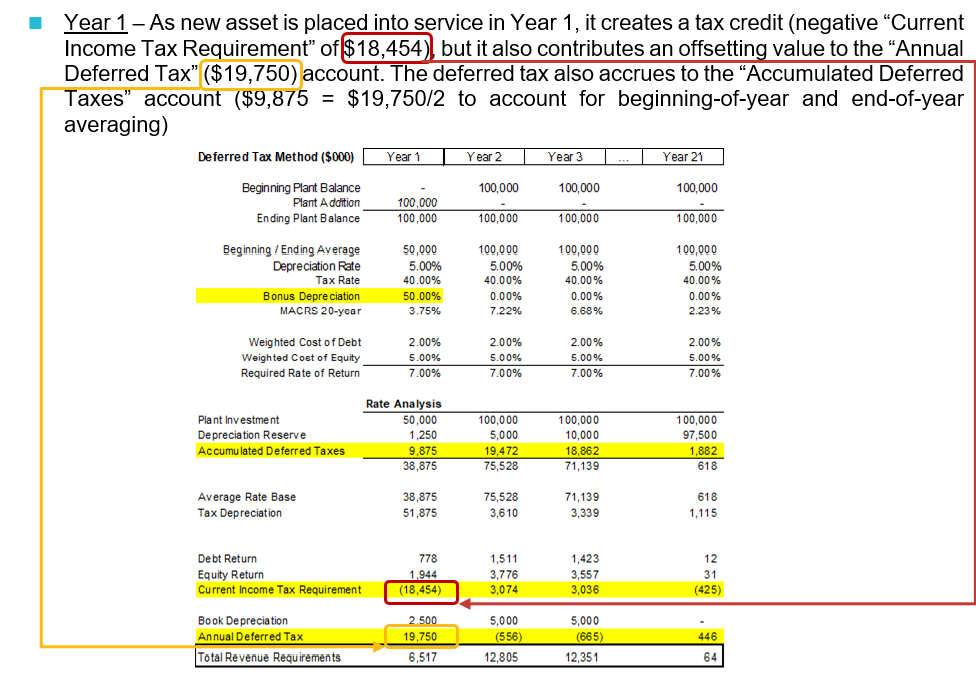

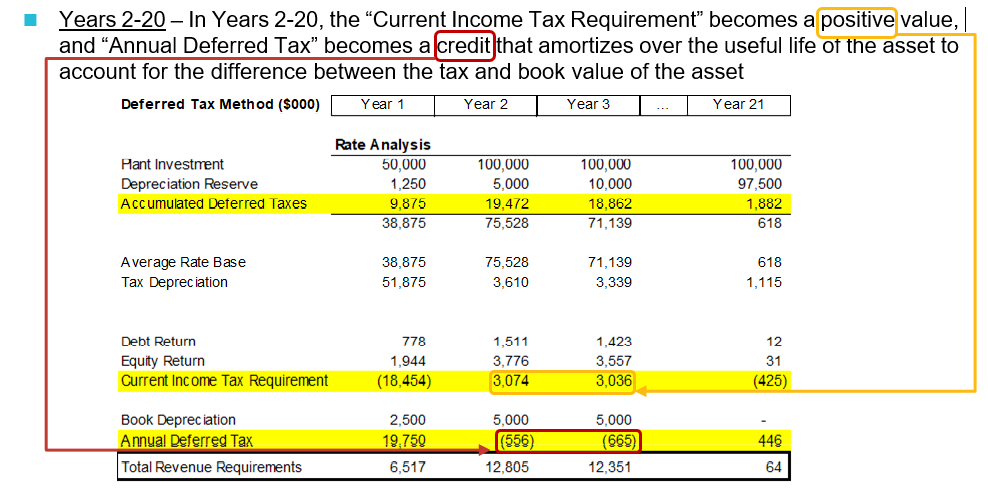

Example 2 – Purchase of a $100K Asset after Bonus Depreciation

Implications of adding a $100K asset (20-year life)

after bonus depreciation (with tax deferral) are outlined below:

- Bottom line – Bonus depreciation increases the amount of cash generated in the first year of an asset’s life (~$18K in this example), but it also reduces average rate base (~$8K per year on average over the 20-year life of the asset), pre-tax equity returns (total of ~$9K), and total revenue requirements (total of ~$19K * 7% required rate of return = ~$1.3K), relative to the scenario without bonus depreciation. Tax “normalization” requirements for regulatory accounting (vs. tax accounting) and rate-making require a deferral of tax liabilities to account for any differences between tax and book accounting

- Key Assumptions

- Regulatory timing – For the purpose of the illustrative analysis above, it is assumed that the incremental investment of $100K has an immediate impact on earnings. Actual timing will depend upon the utility's specific regulatory construct (i.e., rate case timing and structure), and companies utilizing rate riders for recovery of near-term investments will see a contemporaneous downward adjustment in rates

- Positive taxable income – This assumes that the utility is paying taxes and capable of capturing the tax benefit of bonus depreciation. If a utility has a net operating loss balance, the bonus depreciation can often be accrued as a regulatory asset to be carried forward and amortized over the remaining useful life of the underlying asset

Additional Considerations

The impact of bonus depreciation will be a function of multiple factors which are not exclusive to the tax paying position or equity needs of any specific utility.

- Utilities which recover costs through historical test-year rate case filings would not see an adjustment in their revenue requirement for rate-making until the next rate case

- Utilities which recover costs through traditional rate case filings could “recycle” excess cash flow into higher near-term capital spending by bringing forward necessary capital projects to mitigate the potential impact of bonus depreciations on earnings without necessarily requiring significant rate relief

Potential Options and Offsets for Addressing Adverse Impacts of Bonus Depreciation

- Elect not to use bonus depreciation (e.g., ITC Holdings has not historically elected to use bonus depreciation but has not made a determination about election going forward)

- Increase capital expenditures to make use of additional “headroom” in rates and additional operating cash flow. Moody’s estimates that “utilities poured the tax benefit [from bonus depreciation] back into their businesses, increasing capital spending to 28% of revenues in 2012 from 18% in 2007. This will protect their rate base and enable them to reduce capital spending to partially offset the higher future tax obligation”

- Continue to take advantage of incentives in place for investment in renewables (e.g., Southern Company and Dominion can move forward “placeholder” capital expenditures not specifically assigned as of Q4 2014)

- Reduce costs (e.g., next round of cost cuts coming, potentially including Ameren, Consumers Energy, Exelon, and WEC Energy), for companies with announced transactions, provide clarity on merger synergies and reflection in forward earnings estimate (e.g., Duke Energy and Southern Company)

Appendices

- Appendix A – MACRS Depreciation Schedules

- Appendix B – Depreciable Asset Lives for Electric and Gas Utility Services

- Appendix C – History of Bonus Depreciation Rates from 2001 through 2019

- Appendix D – Bonus Depreciation Comments from Recent Company Reports (Q1, 2016)

- Appendix E – S&P Global Market Intelligence Article: “S&P, Moody's Warn Utilities Must Plan for Bonus Depreciation Tax Break's Expiration” (S&P Global Market Intelligence, 4/12/2016)

Appendix A – MACRS Depreciation Schedules

Appendix B – Depreciable Asset Lives for Electric and Gas Utility Services

| Asset

Class |

Description of

Assets Included* |

Class Life (in Years) |

General

Depreciation

System |

Alternative

Depreciation

System |

| 49.11 |

Electric Utility Hydraulic Production Plant |

50 |

20 |

50 |

| 49.12 |

Electric Utility Nuclear Production Plant |

20 |

15 |

20 |

| 49.121 |

Electric Utility Nuclear Fuel Assemblies |

5 |

5 |

5 |

| 49.13 |

Electric Utility Steam Production Plant |

28 |

20 |

28 |

| 49.14 |

Electric Utility Transmission & Distribution Plant |

30 |

20 |

30 |

| 49.15 |

Electric Utility Combustion Turbine Production Plant |

20 |

15 |

20 |

| 49.21 |

Gas Utility Distribution Facilities |

35 |

20 |

35 |

*Note: Includes assets used in the production, transmission, and distribution of electricity and gas for sale (incl. related land improvements)

Appendix C – History of Bonus Depreciation Rates from 2001 through 2019

| Bonus Depreciation Rates |

| Start Date |

End Date |

Bonus Rate |

| September 11, 2001 |

May 5, 2003 |

30% |

| May 6, 2003 |

December 31, 2004 |

50% |

| January 1, 2008 |

September 8, 2010 |

50% |

| September 9, 2010 |

December 31, 2011 |

100% |

| January 1, 2012 |

December 31, 2017 |

50% |

| January 1, 2018 |

December 31, 2018 |

40% |

| January 1, 2019 |

December 31, 2019 |

30% |

Appendix D – Bonus Depreciation Comments from Recent Company Reports (Q1 2016)

| Company |

Impact |

Comments |

| AEP |

= |

Lower cash tax burden leads to $1B annual increase in capital spending in 2017 and 2018. No impact on earnings. |

| Ameren Corp. |

+ |

Brought forward $1.5B of additional CapEx in Illinois that offsets negative rate base impact. Reduced long-term adjusted EPS CAGR to 5-8% (2016 Adj.-2020) vs 7-10% (2013 Adj.-2018). |

| CenterPoint Energy |

- |

Decreases rate base by $1.6B for electric and $44.6M for gas through 2020 due to increase in deferred taxes. |

| CMS Energy Corp. |

+ |

Tax savings of $600M combined with leftover net operating losses avoids equity issuance for seven years. Ability to accelerate CapEx to offset earnings impact. |

| Dominion Resources |

= |

Anticipates $2.5B cash flow benefit over the intermediate term. Had already announced the cancellation of $500M-$1B of planned equity issuances through 2017 with the expectation of a two-year extension (accretive by $0.02/year at $250M/year). While utility rate base will experience some decline from accelerated depreciation and deferred taxes, the effect is expected to be immaterial. |

| DTE Energy |

= |

Expects $300M-$400M of cash flow benefit over the next five years, resulting in lower planned equity issuances. This is only modestly higher than the previously discussed $150M-$300M for a two-year extension. However, this negative impact on rate base is more than offset over time by $500M-$600M reduced equity issuances through 2018. |

| Duke Energy Corp. |

= |

After-tax deductions result in ~$1B in incremental cash flows in 2018–2020 timeframe. Earnings lower by $0.04-$0.05 per year through 2018. The company intends to file its larger rate cases in the 2018+ period, reflecting the impact of bonus on earnings as part of this updated tariff. This will moderate growth anticipated out of these cases rather than immediately impact rates. In contrast, cash flow benefits are also delayed seeing the company was not anticipated to be a cash tax payer for some time already (beginning in 2018-2020). ‘Additional regulatory discretionary spend' of $3B cumulatively offsets the $2.5B cumulative loss of rate base from bonus depreciation impact. |

| Edison International |

= |

Impact of additional deferred taxes on rate base ($700M from 2015 through 2017 from bonus depreciation) is offset by increased pole replacement CapEx. |

| Entergy Corp. |

= |

Minimal impact on rate base growth. |

| Eversource Energy |

- |

Extension lowers earnings growth expectation by 1%. EPS growth forecasted at 5%-7% annually over 2015-2019, versus 6%–8% previously. Decreases cash tax liability by $900M over 2015-2017, though management did not specify a use of this cash. |

| Exelon Corp. |

= |

$0.26 per share impact to EPS over 2016-2018. However, this does not include $1.9B of incremental cash flow benefit over this time period. |

| FirstEnergy Corp. |

= |

Modest rate base reduction extends outlook of no federal cash taxes until 2021. |

| NextEra Energy |

= |

Minimal impact on cash tax outlook and earnings expectations. |

| Otter Tail Corp. |

+ |

Extensions lower equity issuance needs by $25M-$35M over next five years. |

| PG&E Corp. |

- |

Expects $1B-$1.5B of rate-base reduction over next three years, but lower equity needs over the same time frame. Net EPS impact of $0.02 for every $500M of bonus depreciation. |

| Pinnacle West |

= |

Extension provides cash flow benefits around $550M through 2019 and reduces rate base by approximately $200M in 2018. |

| PPL Corp. |

= |

Reduces federal cash tax outlook by approximately $270M over the next five years. Reduction in equity needs to $100M per year from $200M per year over the next five years partially mitigates the negative earnings impact. |

| Public Service Enterprise Group |

- |

$1.7B of additional cash flow through 2019. Bonus depreciation is expected to have a ~$0.03 impact on transmission in 2016. |

| Southern Company |

- |

Expects $4B-$5B of cash flow benefit through 2020, reducing need for additional equity. Assuming a proportional reduction to capital requirements at 40% equity, this leaves only $1.2B remaining block equity for 2016 with none contemplated thereafter (vs. $2B more previously anticipated post-closing from 2017-2019). |

| WEC Energy Group |

= |

Approximately $1B in cash benefits from 2016-2017 has no material impact to earnings. Company has the flexibility to bring forward CapEx given a strong backlog of investments. |

| Westar Energy |

- |

Reduction in rate base of $150M-$200M over the next five years. The new five-year CAGR from 2015-2020 is 4.9% vs. 5.5% for the prior four-year 2015-2019 period, with -50 bps from bonus depreciation alone. |

| Xcel Energy |

- |

Reduces rate base growth by 70-80 bps to 3.7% (from 4.5%) CAGR over five years. |

Sources: “A Warm December Caps EPS Growth for U.S. Utilities,” Fitch Ratings (3/18/2016); “Power, Utilities, and Renewables: What We Learned with 4Q Results,” UBS (3/7/2016)

Appendix E – S&P Global Market Intelligence Article: “S&P, Moody’s Warn Utilities Must Plan for Bonus Depreciation Tax Break’s Expiration” (S&P Global Market Intelligence, 4/12/2016)

By: Daniel Testa

The recent extension in bonus depreciation is likely to boost utility cash flows in coming years, but in recent reports, rating agencies flag uncertainty about potential credit hazards down the road.

Standard & Poor's Ratings Services issued a report March 29 in which credit analyst Obie Ugboaja characterized the extension by Congress of bonus depreciation as broadly positive for utilities. "Utilities are going to receive this increased cash benefit that will allow them to support their increased capital spending," Ugboaja said. "We think that increased capital spending is likely to continue because of things like infrastructure replacement, new generation spending, and M&A activity that we've seen in the sector recently."

But regulators in different states and jurisdictions treat bonus depreciation differently, requiring utilities to plan carefully for the earnings impacts of the bonus depreciation extension beyond the near term. "Utilities have to somehow manage regulatory risk that is associated with the depreciation, because of the effect that it has on rate base," Ugboaja said. "So how they manage through that with their respective regulatory environment, in their respective regulatory jurisdictions, will play more of a factor in the long run."

A recent report by Moody's, issued March 17, echoed those concerns that the immediate benefit of bonus depreciation has the potential to increase long-term uncertainty when the current extension expires in 2020. When that occurs, utilities will have to fill the resulting cash-flow gap with a mix of new debt and equity. “To the extent that utilities take on more debt than equity, the credit impact could be negative,” Moody's Vice President and Senior Analyst Jeffrey Cassella wrote.

In December 2015 the U.S. Congress passed a $1.15 trillion spending bill that included five-year extensions of wind and solar investment tax credits, as well as an extension of bonus depreciation. The extension allows investor-owned utilities to depreciate 50% of capital investments in 2015, 2016 and 2017, then 40% of capital investments in 2018 and 30% in 2019. Bonus depreciation is a policy tool that allows companies to deduct depreciation more quickly, effectively accelerating depreciation expense, and thus lowering that company's tax obligation and increasing cash flows in the near term. Companies that use this deduction would owe fewer taxes in the year they make a capital investment, but more during remaining years of the asset's life.

While bonus depreciation benefits a utility's cash flows, because assets are depreciating more quickly, it generally reduces the rate base upon which regulated utilities earn a return.

With the release of 4Q 2015 earnings results, numerous large cap utilities adjusted their earnings outlook in light of the bonus depreciation extension. Southern Co. management projected the five-year extension of bonus depreciation would improve cash flows by roughly $4B through 2020, and potentially more depending on growth at its wholesale generation business, Southern Power Co. However, Southern anticipates a negative impact of $0.04 per share in 2016 due to bonus depreciation.

At Exelon Corp., management expects a negative EPS impact due to bonus depreciation of $0.09 in 2016, $0.11 in 2017 and $0.06 in 2018. But the company also emphasized the improved cash flow the company expects to enjoy as a result of the extension, estimating it at $625M in 2016, $675M in 2017 and $600M in 2018.

Among the 57 U.S. regulated utility holding companies Moody's rates, the agency calculated total tax benefit in 2015 associated with bonus depreciation of $8.6B. Over the period of 2011 to 2015, Moody's estimated a cash flow benefit through lower taxes tied to bonus depreciation of $54B for that utility group. During that four-year period, Moody's said the utility group used the increased cash flow to maintain a high dividend payout ratio of 60% to 70%, and increased its capital expenditures as a percentage of revenue to 29% in 2015, from 23% in 2011.

If the current bonus depreciation extension expires, as currently scheduled in 2019, utilities will experience a combined $7.7B in reduced cash flows in 2020, according to Moody's, resulting in a cash flow difference of $16B for the group comparing 2015 to 2020.

Most utilities have also used the increased incremental cash flow from bonus depreciation to increase the equity component of their target capital structure, Moody's noted, without having to issue equity. As cash flow declines with the step-down of bonus depreciation, utilities will likely compensate by issuing a mix of debt and equity. “To the extent that utilities take on more debt than equity, the credit impact will be negative,” Cassella wrote. “[G]iven the limitations on debt issuance from a regulatory standpoint, we expect that utilities will need to issue a higher proportion of new equity in order to meet any funding shortfalls.”

But when bonus depreciation recedes, many utilities will have tools at their disposal to manage the increased tax burden including: net operating losses, carry forwards and production and investment tax credits. Moody's noted TECO Energy Inc. had an NOL and alternative minimum tax credit of about $570M as of December 31, 2015. With its large renewable portfolio, NextEra Energy Inc. had $149M of production tax credits and $89M in investment tax credits and deferred income-tax benefits, according to Moody's and other utilities with substantial tax credit assets include CMS Energy Corp., Edison International, Entergy Corp., PG&E Corp. and Xcel Energy Inc.

Moody's and S&P both foresee robust and growing capital spending by utilities in coming years, with S&P expecting the utility industry's historical funds-from-operations improvement, due to lower taxes and interest rates, will more than offset increased capital spending. These conditions will also help utilities maintain their ratio of funds-from-operations to debt, despite growing CapEx requirements.

S&P also noted some regulators, as in Florida, treat bonus depreciation as a kind of “cost-free” permanent financing that benefits the utility, but its inclusion in the utility's regulated capital structure reduces the overall authorized rate of return. In other jurisdictions, bonus depreciation is accounted for as a build-up of deferred tax liability that offsets the rate base in future rate cases, and potentially impedes future rate base growth.

“There are regulatory implications and they vary by state and utilities will have to manage through that,” Ugboaja said. “We think that capital spending is likely to continue. And so as that continues we think that one way to mitigate the regulatory downward effect is to compensate by increasing capital spending, and as long as that occurs then utilities can sort of manage through any kind of potential regulatory risk that is tied to bonus depreciation.”

S&P Ratings and S&P Global Market Intelligence are divisions of McGraw Hill Financial Inc.

[1] http://heliopower.com/2016/01/06/bonus-depreciation-solar/

[2] “Depreciation: A Holiday Gift the Industry Didn’t Need,” Evercore ISI, 12/22/2015

[3] “US Electric Utilities & IPPs: Making Sense of the Bonus Depreciation Debate,” UBS, 1/26/2016